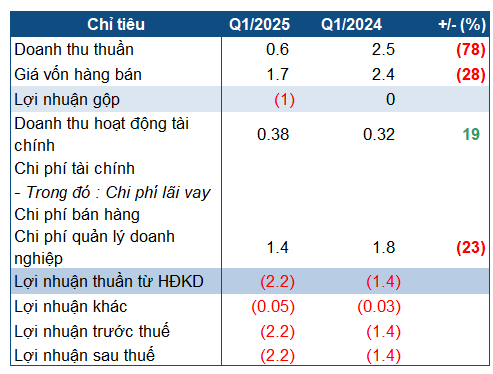

The company’s Q1 financial picture remains bleak. PVH incurred a gross loss of over 1.1 billion VND, operating at a cost below prime, with only 565 million VND in revenue, a 78% decrease year-over-year. After deducting expenses, the company posted a post-tax loss of 2.2 billion VND, higher than the 1.4 billion VND loss in Q1/2024.

The company attributed the decline in revenue, which came solely from leasing the Petroleum Building at 38A Le Loi Avenue, to unfinished projects that had not yet reached the acceptance stage. This significant drop in revenue led to increased losses compared to the previous year.

|

PVH’s business indicators in Q1/2025

Source: VietstockFinance

|

This is the fifth consecutive quarter of losses for PVH, and the streak would have been longer if not for small profits in Q4/2022 and Q4/2023. As of Q1, the accumulated loss reached 164 billion VND.

| PVH’s business situation |

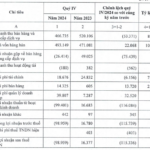

Currently, PVH’s total assets are nearly 555 billion VND, a slight decrease from the beginning of the year, with almost 182 billion VND in short-term assets. Cash and deposits have slightly increased to over 30 billion VND. Inventory remains unchanged at over 68 billion VND.

On the other hand, payables climbed to 501 billion VND (also a slight decrease from the start of the year), but only about 107 billion VND are short-term (with no loan debt). Compared to equity, PVH’s debt is 9.3 times higher (leaving just over 58 billion VND).

Fortunately, the current and quick payment ratios are both greater than 1, indicating that the company can meet its short-term debt obligations. Long-term loan debt remained stable at nearly 310 billion VND.

A series of reasons led to PVH’s restricted trading status.

PVH’s shares have been under trading restrictions since October 4, 2024, and HNX decided to maintain this status on April 10, 2025, due to delayed submission of the 2024 semi-annual reviewed financial statements and the auditor’s refusal to provide an opinion on the 2023 financial statements. While PVH has released the 2024 semi-annual reviewed financial statements, the issues raised by the auditors seem unresolved.

Specifically, the company’s auditor, AASC, raised several concerns, leading to their refusal to provide an opinion. PVH has recently published an explanatory document with a roadmap to address these issues.

Firstly, AASC stated that they lacked sufficient information to assess the appropriateness of accounts receivable and payable as of the beginning and end of 2024. PVH explained that these were outstanding balances from previous projects. The company established a debt collection team and even sought legal intervention to recover these debts.

Secondly, AASC did not have enough information to evaluate the proper classification of long-term accounts receivable and payable, amounting to hundreds of billions of VND. According to PVH, these are long-term accounts related to ongoing projects and contracts. Due to various complications, the final settlement of these projects and contracts has not been completed.

Thirdly, AASC noted that as of December 31, 2024, PVH had not conducted an assessment of bad debt provisions for accounts receivable and lacked the necessary information to assess the appropriateness of short-term and long-term bad debt provisions. In response, PVH considered setting aside nearly 27 billion VND in bad debt provisions and is taking all measures, including legal intervention, to recover the remaining amounts.

Regarding inventory and long-term construction-in-progress expenses, AASC observed that as of December 31, 2024, these items included costs for several projects that had been halted before 2020, and PVH had not assessed the recoverable values of these projects, totaling nearly 263 billion VND. PVH clarified that these are construction-in-progress expenses for a group of completed projects awaiting final settlement. The company is actively working with relevant parties to finalize the settlement, recognize revenue, and simultaneously reduce construction-in-progress expenses.

Fifthly, AASC pointed out that PVH recorded depreciation expenses for the Petroleum Building at 38A Le Loi Avenue and expenses related to leasing offices in this building under the inventory item, totaling approximately 4.2 billion VND. PVH explained that these are residual expenses from the past. The building has recently undergone repairs and resumed operations, but the number of tenants is still low, and the rentable area is limited. Therefore, only a portion of the expenses has been allocated to construction-in-progress expenses, and the rest will be allocated once the building stabilizes and attracts more tenants.

Sixthly, AASC noted that the construction-in-progress expenses item included 19.4 billion VND in expenses for the “Construction of Infrastructure for Industrial Park I and the Assembly Area for Materials and Construction Equipment for the Nghi Son Petrochemical Complex in Thanh Hoa Province” project, which was terminated on August 1, 2013. PVH explained that they had agreed to reimburse the investment costs for this project, totaling over 26.4 billion VND. The company is actively negotiating with the partner to reach a consensus on the remaining cost.

Seventhly, the company temporarily recorded unearned revenue and accounts receivable related to the National Highway 217 Cam Thuy project, amounting to 16.4 billion VND. While the completed work volumes have been inspected, accepted, and put into use since December 22, 2020, PVH has not yet finalized the settlement of these items with the general contractor, affecting the comparative figures.

Regarding these amounts, PVH explained that due to disagreements between the parties on the final settlement value and ongoing disputes in court, they have not directly recognized the revenue. In 2024, the company issued invoices and recognized revenue according to the judgment of the Provincial Court of Ninh Binh Province.

Eighthly, AASC stated that PVH had not recorded expenses payable to PVcomBank, related to two projects, the Lam Kinh Hotel and the Petroleum Building at 38A, from 2015 to December 31, 2024, totaling nearly 601 billion VND. PVH clarified that the borrowing costs for the “Commercial Service and Housing Area” project from 2015 to 2024 have not been recognized in the financial statements due to disagreements between the two parties regarding the applicable interest rate. Moreover, for the Lam Kinh Hotel project, PVH is neither the owner nor the beneficiary of the operating revenue. Therefore, they believe that the obligation to repay this debt rests with the Lam Kinh Hotel Joint Stock Company. Currently, this interest expense is still under negotiation, and PVH will comply with the court’s final decision.

Additionally, AASC observed that in 2023, the company recorded other income as late payment interest from Hung Son Construction JSC according to a court-approved settlement, but the amount had not been received. PVH explained that per the court’s decision, Hung Son agreed to pay the company 3.2 billion VND. To ensure the recovery of this debt, PVH recorded the receivable from Hung Son for the late payment interest of 1.1 billion VND and corresponding other income.

Lastly, AASC noted that at the beginning and end of 2024, the company monitored the repair expenses for the Petroleum Building under the long-term prepaid expenses item. However, PVH has not provided completion acceptance for these repairs.

PVH explained that as of December 25, 2023, the repairs to the Petroleum Building at 38A Le Loi Avenue were completed. However, one contractor has not finalized the settlement documents, preventing PVH from providing completion acceptance.

– 11:16 21/04/2025

The Debt Burden’s Drag on Economic Growth

Debt is a pivotal tool in the modern financial system, stimulating consumption and investment while contributing to economic growth. When managed prudently, credit enables businesses to expand their production, enhance operational efficiency, and improve labor income, thereby creating a positive ripple effect on the economy. However, debt growth is not a panacea for perpetual expansion, as the burden of interest payments can become onerous.

The Ultimate Guide to Saigontel’s Ambitous Endeavor: Unlocking the $1.6 Billion Loan for Vietnam’s Industrial Revolution

On December 12th, the Board of Directors of Saigon Telecommunication Technology Corporation (Saigontel, HOSE: SGT) approved a resolution to accept a credit facility of up to VND 1,635 billion from VPBank. This financing will be utilized to invest in the second phase of the Dai Dong – Hoan Son Industrial Park project.