I. MARKET ANALYSIS OF STOCK MARKET BASICS ON 04/21/2025

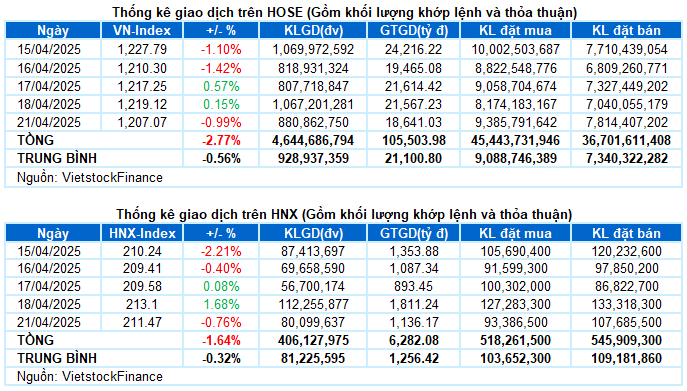

– The main indices adjusted in the trading session on April 21. VN-Index decreased by 0.99%, to 1,207.07 points; HNX-Index also lost 0.76%, falling to 211.47 points.

– The matching volume on HOSE reached more than 819 million units, a decrease of 21.2% compared to the previous session. The matching volume on the HNX floor decreased by 32.2%, reaching more than 62 million units.

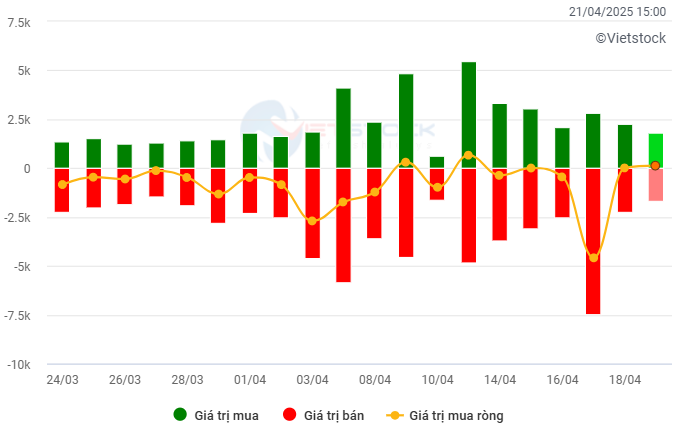

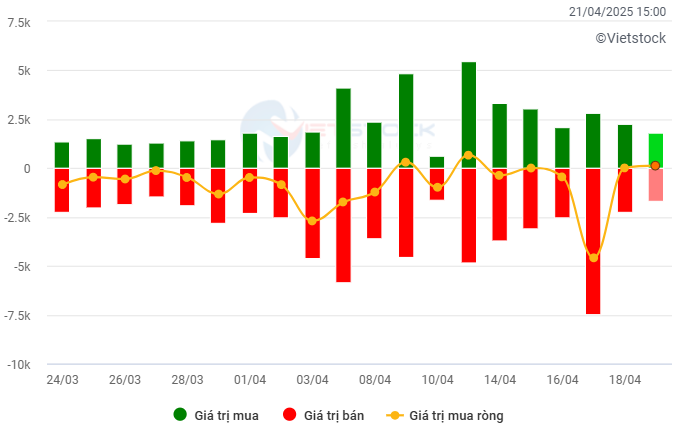

– Foreign investors net bought with a value of more than VND 126 billion on the HOSE and nearly VND 18 billion on the HNX.

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: VND billion

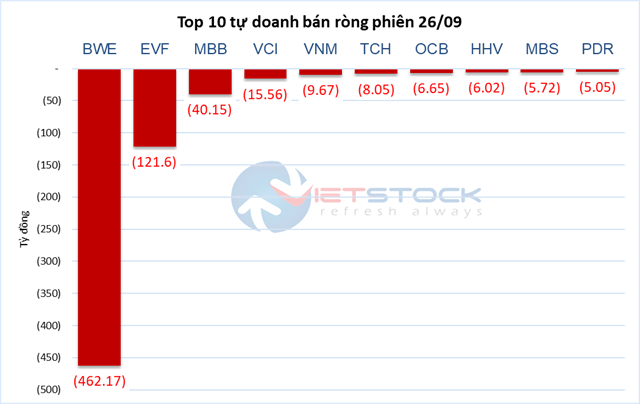

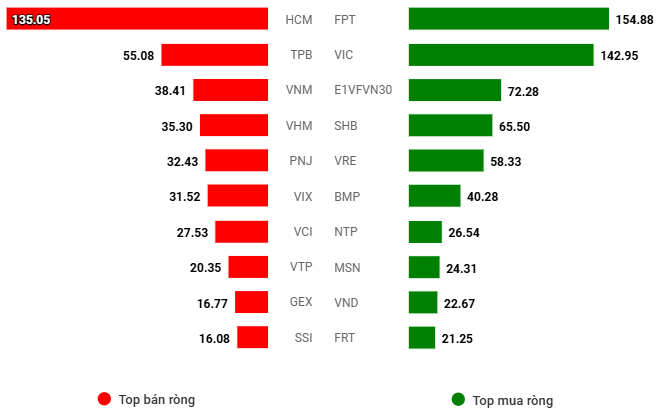

Net trading value by stock code. Unit: VND billion

– The first trading session of the week was not very positive. After more than an hour of fluctuating around the reference mark at the beginning of the session, selling pressure increased, pushing the index down gradually. The pillar stocks weakened noticeably, with the VN-Index losing nearly 13 points by the end of the morning session. In the afternoon session, the downward trend continued and pulled the index down towards the 1,200-point mark. However, this was also the price region that triggered the return of buying demand, helping the market narrow its losses. The VN-Index closed the trading session on April 21 at 1,207.07 points, down 0.99% from the previous week.

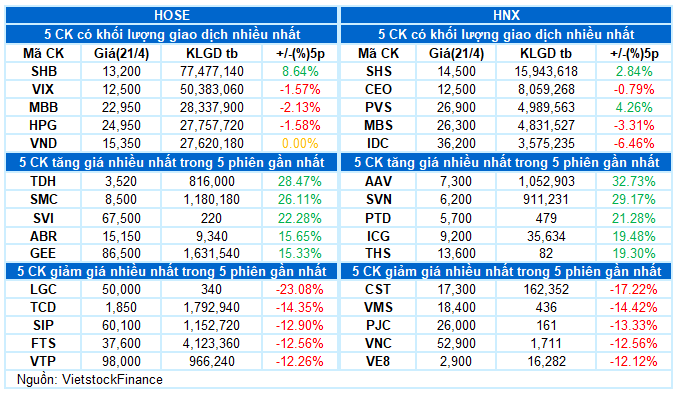

– In terms of impact, VIC continued to be the negative focus, falling to the floor for the second consecutive session, taking away nearly 4 points from the VN-Index. Following were BID, HPG, and GVR, which also caused the index to lose more than 2.5 points. On the other hand, STB made the most significant contribution in narrowing the decline at the end of the session, helping the VN-Index regain nearly 1 point.

– VN30-Index decreased by 0.91%, to 1,294.29 points. The breadth was negative with 19 declining stocks, 9 advancing stocks, and 2 stocks unchanged. In addition to VIC, stocks such as GVR, VJC, LPB, and BVH also plunged by more than 2%. Meanwhile, STB went against the market with a gain of 4.9%, along with SHB, TPB, and BCM, which also attracted positive buying demand, surging by more than 2%.

Most sectors were immersed in red. The real estate group was at the bottom of the market, continuing to fall by nearly 2% under significant pressure from VIC, NLG, DIG, SIP, HDG, CEO, and SZC,… Nevertheless, a few bright spots emerged in this group, such as NVL, which hit the ceiling price, BCM (+2.22%), TCH (+1.5%), and QCG (+2.88%).

The materials and telecommunications groups also adjusted by more than 1% as sellers dominated in many large-cap stocks such as HPG (-1.96%), GVR (-3.27%), DGC (-1.58%), VGC (-4.76%), HSG (-2.92%), KSV (-2.22%); VGI (-1.52%), CTR (-3.84%), and FOX (-0.85%).

In contrast, healthcare was the only sector that managed to stay in the green during the first trading day of the week, mainly thanks to positive trading in DHG (+1.56%), DMC (+3.27%), PBC (+7.35%), and DVM (+1.45%).

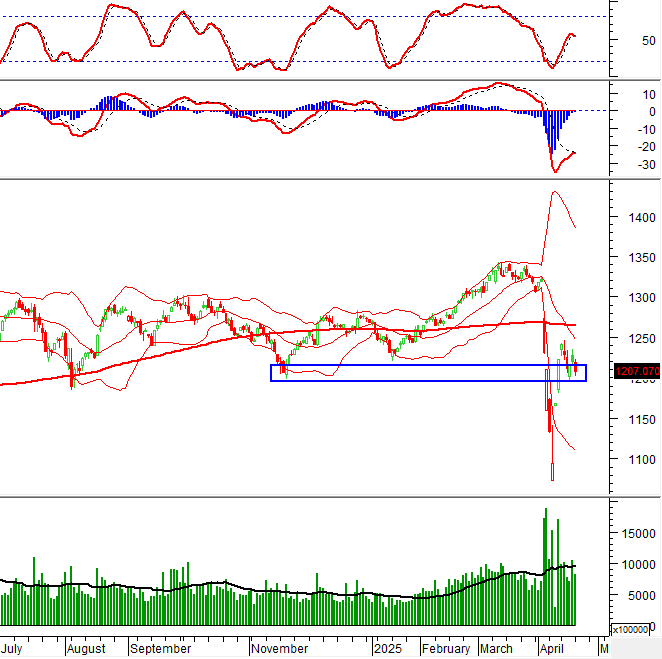

The VN-Index fell sharply as the trading volume dropped below the 20-day average, reflecting investors’ extremely cautious sentiment. Currently, the index is retesting the old peak of November 2024 (equivalent to the 1,195-1,215 range). At the same time, this is also the bottom region established at the beginning of 2025. If the index continues to hold at this level, the situation will not be too pessimistic. On the other hand, the MACD indicator is likely to give a buy signal again after the distance with the Signal Line is narrowed. If the buy signal is confirmed, the risk of short-term adjustments will be reduced.

II. TREND AND PRICE FLUCTUATION ANALYSIS

VN-Index – MACD indicator is likely to give a buy signal

The VN-Index fell sharply as the trading volume dropped below the 20-day average, reflecting investors’ extremely cautious sentiment. Currently, the index is retesting the old peak of November 2024 (equivalent to the 1,195-1,215 range). This range also coincides with the bottom established at the beginning of 2025. If the index continues to hold at these levels, the situation may not be too pessimistic.

Additionally, the MACD indicator is likely to give a buy signal as the distance with the Signal Line narrows. If this buy signal is confirmed, it will reduce the risk of short-term adjustments.

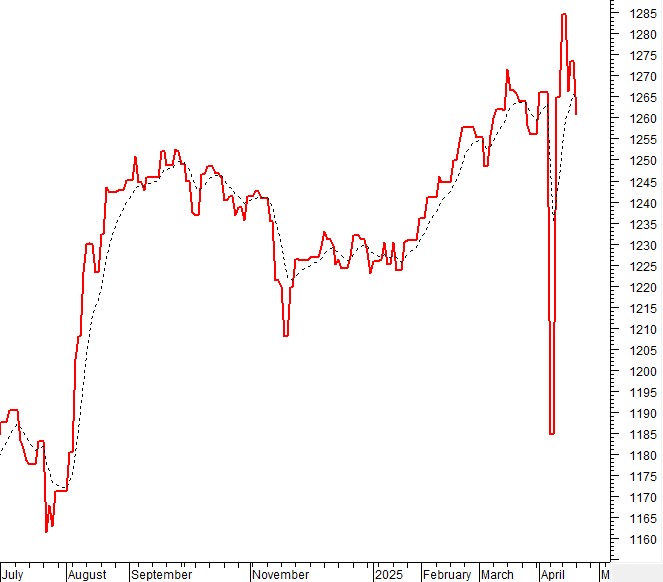

HNX-Index – Trading volume remains below the 20-day average

The HNX-Index recorded a slight decrease in the session, along with a trading volume that remained below the 20-day average, indicating investors’ cautious sentiment. Currently, the old bottom of October 2023 (equivalent to the 204-208 range) will act as an important support level for the index in the near future.

At the moment, the MACD indicator is likely to give a buy signal again as the distance with the Signal Line narrows. If this state occurs in the next sessions, the risk of short-term adjustments will be reduced.

Analysis of Capital Flows

Fluctuation of smart money flow: The Negative Volume Index of the VN-Index cut down below the 20-day EMA. If this state continues in the next session, the risk of an unexpected drop (thrust down) will increase.

Fluctuation of foreign capital flow: Foreign investors returned to net buying in the trading session on April 21, 2025. If foreign investors maintain this action in the coming sessions, the situation will be less pessimistic.

III. MARKET STATISTICS ON 04/21/2025

Economic Analysis and Market Strategy Department, Vietstock Consulting

– 17:22 04/21/2025

Market Beat: Running Out of Steam at the Close

The market closed with positive gains, seeing the VN-Index rise by 1.87 points (+0.15%), reaching 1,219.12. Meanwhile, the HNX-Index climbed 3.52 points (+1.68%) to 213.1. The market breadth tilted in favor of bulls, with 571 advancing stocks against 229 declining ones. Within the VN30 basket, bulls dominated, recording 20 gainers, 6 losers, and 4 stocks closing flat.

The Stock Market Week of April 14-18, 2025: Wide-Ranging Sell-Off Pressure

The VN-Index concluded the session with a surprisingly narrowed advance, while the trading volume surpassed the 20-day average. This development underscores the persistent selling pressure that emerged as the index approached the January 2025 resistance zone (equivalent to 1,220-1,235 points). If the VN-Index fails to successfully breach this threshold in the upcoming period, the risk of a correction will become more apparent as profit-taking selling pressure tends to expand.