From a chilly relationship to a bank with two securities companies

The history of Vietnam’s stock market marks many powerful bank-securities couples: Techcombank with TCBS, MB with MBS, ACB with ACBS, Vietcombank with VCBS, BIDV with BSI, and Agribank with Agriseco. These relationships are considered the foundation for a robust financial ecosystem.

However, there were times when banks lost interest in the securities business, such as VPB‘s split from VPS in 2015 and MSB‘s sale of MSI (later renamed KBSV) in 2018 to focus on their core business.

The context has changed rapidly. The zero-fee trend, coupled with the booming demand for margin loans, has made securities firms increasingly resemble banks in terms of profit generation.

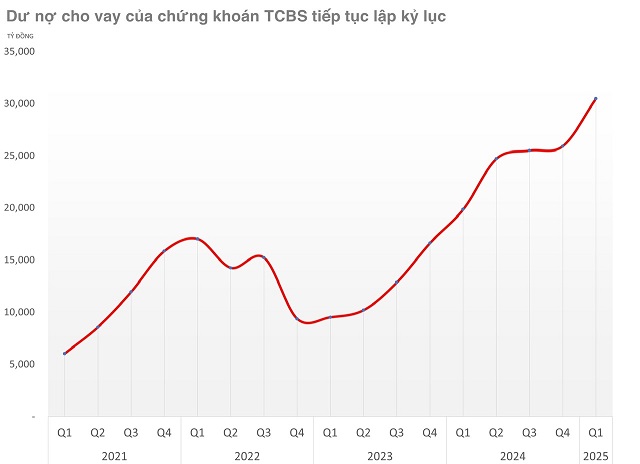

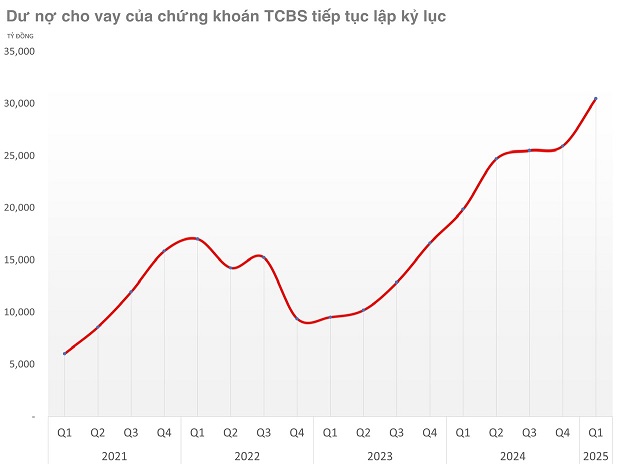

By the first quarter of 2025, TCBS, the securities arm of Techcombank, continued to dominate the lending market with outstanding loans exceeding VND 30,000 billion, consistently ranking as the most profitable securities firm in the industry.

The implementation of KRX and the opportunity to upgrade the market to “Emerging Market” further fueled the appeal of securities firms, prompting banks to rejoin the acquisition race.

VPBank made a remarkable comeback by acquiring ASC Securities in 2022, renaming it VPBank Securities (VPBankS), and injecting VND 15,000 billion in chartered capital.

Although VIB does not directly own a securities firm, it stands behind the rapid growth of KAFI. KAFI is expected to reach a chartered capital of VND 7,500 billion in 2025, thus increasing fivefold in four years.

OCB has also joined the race by acquiring and renaming VISecurities as OCBS, along with plans to increase its chartered capital to VND 1,200 billion. Meanwhile, MSB, after selling MSI in 2018, has included the acquisition of a securities firm in its agenda for the 2025 Annual General Meeting of Shareholders. Additionally, SeABank is publicly planning to transform ASEAN Securities into a subsidiary.

Notably, HDBank, through the acquisition of Dong A Bank, owns two securities firms: HDS and Dong A Securities (now VikkiBankS).

Historical lessons

The lows in the relationship between securities firms and banks are closely associated with economic crises and fluctuations.

Up to the present, the lessons from the past remain pertinent. Recently, ORS reminded investors that the securities industry entails risks. The company’s 2024 audit report included a qualified opinion regarding receivables related to bond lots worth nearly VND 9,000 billion, despite a fee receivable of only VND 28 billion.

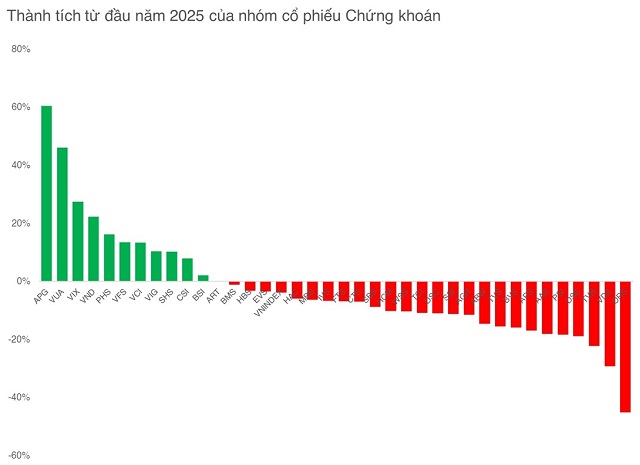

ORS experienced the most significant decline among securities stocks, dropping 45% year-to-date (as of April 17).

|

The substantial size of these bond holdings could threaten ORS‘s operations, causing its stock price to plunge. While there is potential for recovery, the timeline for ORS to get back on its feet remains uncertain and heavily dependent on support from its parent bank.

MBS and Agriseco offer contrasting perspectives. Following a challenging period in 2012, MBS merged with VIT Securities, accepting a reduction in chartered capital from VND 1,200 billion to VND 621 billion to facilitate restructuring. With MB’s resolute decision-making and resources, MBS swiftly regained its momentum, consistently maintaining its top 10 brokerage market share position and setting a new record in outstanding loans, surpassing VND 11,000 billion.

In contrast, Agriseco, once a giant in the securities industry, struggled with restructuring for over a decade. The company only cleared its accumulated losses and resumed dividend payments in 2023. From its top position in 2010, Agriseco now ranks within the top 30 and focuses on its core services with a cautious approach. Nearly 100% of Agriseco’s brokerage business comprises individual investors. The company sets achievable business targets, planning to maintain an average debt level of over VND 2,000 billion in 2025.

Agriseco’s consulting engagements primarily involve well-known enterprises, providing the company with opportunities to access attractive investment prospects. Notably, in 2024, the company was offered the opportunity to purchase GMD shares at a preferential price of VND 40,000 per share, a price unseen during the 2025 tariff shock.

– 13:23 18/04/2025

The CEO of BIDV Securities: Never has the prospect of an upgrade been so close and clear.

BSC targets a 2025 business goal of 560 billion VND in pre-tax profits, a 9% increase from the previous record.

Who is the Richest Real Estate Tycoon on the Stock Exchange?

In the real estate arena, VinGroup Joint Stock Company (HOSE: VIC) Chairman, billionaire Pham Nhat Vuong, reigns as Vietnam’s wealthiest stock market player.