The Ministry of Finance is seeking feedback on a draft circular that regulates the fees for exploiting and utilizing water resources and the central agency’s collection, regime, management, and usage.

According to the Ministry of Finance, they have received Correspondence No. 7577/BTNMT-KHTC, dated October 30, 2024, and Correspondence No. 232/BTNMT-TNN, dated January 9, 2025, from the Ministry of Agriculture and Environment (Ministry of Agriculture and Rural Development) regarding amendments to Circular No. 01/2022/TT-BTC.

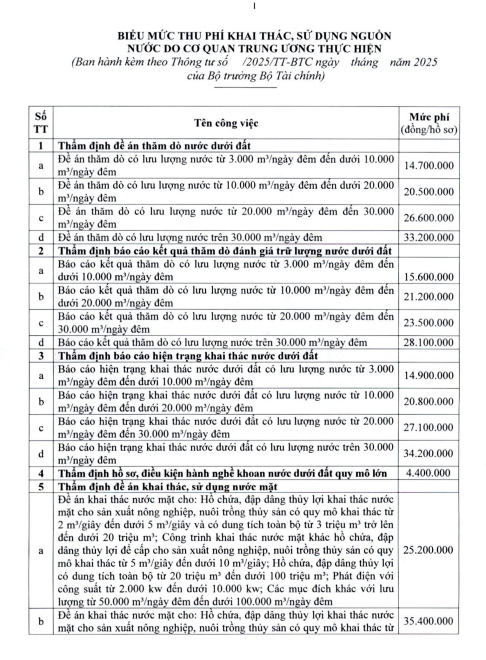

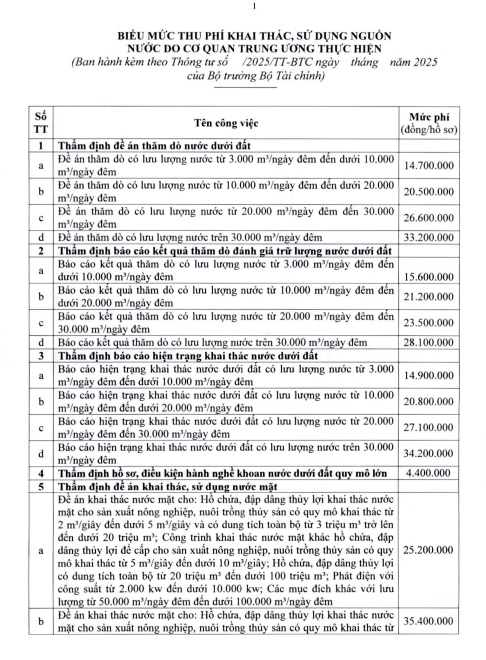

The proposed amendments aim to ensure alignment with water resource laws and reflect the current reality. The fee schedule has been adjusted, with increases ranging from 40% to 102% for six tasks: evaluating groundwater exploration proposals, assessing reports on groundwater exploration and reserve estimation, analyzing groundwater exploitation status reports, evaluating large-scale groundwater drilling practices, assessing proposals for surface water utilization, and evaluating proposals for seawater utilization.

The Ministry of Agriculture and Environment has assessed the potential impact of the proposed fee adjustments. Regarding businesses, the organization or individual submitting the evaluation is inevitable when the government provides public services to these entities and has an obligation to compensate for the costs incurred in providing those services. Evaluation fees account for a small fraction of the expenses incurred by organizations or individuals engaged in water resource exploitation and utilization.

For instance, consider a business investing in the construction of a 2MW hydroelectric plant with average total investment costs ranging between VND 50-60 billion (typically, a small-to-medium-sized hydroelectric project has an investment rate of approximately VND 25-30 billion/1MW). The fee for evaluating and granting a water resource permit, if adjusted, would be around VND 25 million (the current rate is VND 12.8 million).

Compliance costs, which businesses must incur to ensure adherence to legal requirements, are estimated by the World Bank to account for 20-30% of profits for companies in Vietnam. In related fields, the fees for evaluating and issuing new environmental permits range from VND 45-50 million (according to Circular No. 02/2022/TT-BTC dated January 10, 2022) and VND 1-100 million for mining permits (as per Circular No. 10/2024/TT-BTC dated February 5, 2024).

The proposed new fee for water resource permits ranges from VND 15-58 million, which is in line with similar evaluation and licensing processes in other sectors. Moreover, as the permit (including groundwater exploration, water resource exploitation, and groundwater drilling licenses) is typically valid for an extended period (ranging from 5 to 15 years), the associated cost is negligible compared to the investment and profits generated from water resource exploitation.

With the proposed adjustments, resulting in a fee increase of 40-102% and a corresponding fee of VND 15-58 million, businesses can afford and are willing to pay to ensure legal compliance. Regarding the state budget, the suggested fee adjustments, with a 40-102% increase over the rates specified in Circular No. 01/2022/TT-BTC and a 30% contribution to the state budget, are expected to have a positive impact on state budget revenues.

“Looking Back and Leaving a Legacy: A Journey Through TA’s Emotional Storytelling”

“TA nhìn lại & để lại” offers a glimpse into the life and legacy of Trần Mộng Hùng, the founder of ACB Bank. This exhibition is not just a showcase of artifacts and memories; it is an emotional journey that brings to life the stories, priceless possessions, and enduring legacies that shaped the bank’s growth and development.

The Art of Negotiation: Gemadept, CII, BAF, and the Impact of US Tax Policies – Insights from the Timber, Textile, and Seafood Industries.

Large corporations on the stock market, along with their leaders, are now able to provide swift feedback to their partners, investors, and shareholders.