The 2025 Annual General Meeting of SC5 was held on the morning of April 21st. Photo: Thanh Tú

|

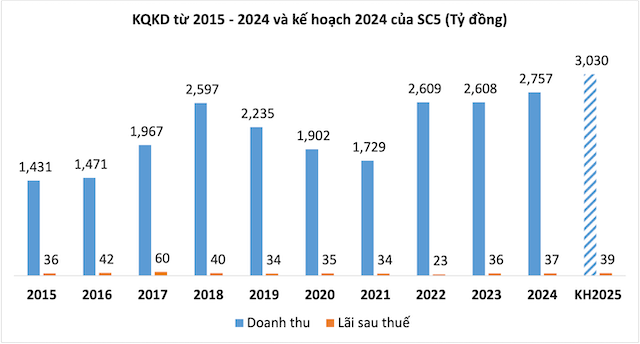

In 2025, SC5 set a record-high business plan with a total revenue of 3,030 billion VND, a 10% increase from the 2024 performance, and a profit after tax of nearly 39 billion VND, a 5% increase, the highest in the past six years. Most of the revenue came from construction activities valued at 3,000 billion VND. The company plans to pay a 3% dividend for 2025.

Previously, the 2024 Annual General Meeting approved a dividend payment of 3%. However, to strengthen capital sources for production and business activities, expand investment, maintain competitiveness, and ensure the sustainable development of the company in the coming years, at this year’s meeting, SC5 shareholders approved a plan to not pay dividends for 2024.

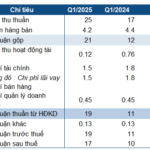

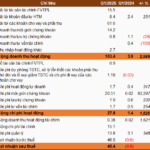

Source: VietstockFinance

|

Won bids worth over 2.4 trillion VND in the past year, optimistic 2025 plan

Mr. Nguyen Dinh Dung – Vice Chairman of the Board of Directors and General Director of SC5 shared that the construction industry still faces challenges due to volatile material prices, difficult access to capital, and intense competition from domestic and foreign companies in the Vietnamese market.

In addition, delayed payments and debts from investors have impacted the company’s cash flow and business operations. Despite these challenges, SC5 remains optimistic about its 2025 business plan. To achieve its goals, SC5 will continue to finalize the legal procedures for the second phase of the Phuoc Long B Ward housing project in Thu Duc City, Ho Chi Minh City. The company expects to complete the approval of the 1/2000 scale planning project by the end of 2025.

Furthermore, SC5 will enhance its marketing efforts and actively participate in bidding for projects within its areas of expertise. The company will also expand its scope to include transportation projects and other high-potential areas. In 2024, SC5 won bids for eight projects, with a total value of over 2,439 billion VND. Mr. Dung affirmed that the company will ensure sufficient work for its employees and a smooth transition into the following years’ plans.

The meeting approved the transfer of shares to Mr. Nguyen Dinh Dung and Mr. Pham Van Tu – Member of the Board of Directors and Deputy General Director, without the need for a public offering. Mr. Dung will acquire over 396,000 shares, and Mr. Tu will acquire nearly 104,000 shares from Ms. Nguyen Thi Huyen. As a result, Mr. Dung’s ownership will increase to 57.97%, and Mr. Tu’s ownership will exceed 20%. Including their related parties, Mr. Nguyen Dinh Dung and his related parties are expected to own over 58% of SC5, while Mr. Tu and his related parties will hold 26.69%.

In late November 2024, Mr. Nguyen Dinh Dung purchased 4.66 million shares in a session on November 22, increasing his ownership in SC5 from 24.23% (3.63 million shares) to 55.53% (8.3 million shares). On the same day, Mr. Pham Van Tu also acquired 1.4 million shares, increasing his stake from 10.17% (1.5 million shares) to 19.33% (2.9 million shares), as of now.

Election of a new Board Member

The meeting also elected Mr. Nguyen Kha Tuan (born in 1981) as a Member of the Board of Directors for the term 2024-2029, replacing Mr. Pham Gia Phu, who resigned as Chairman of the Board of Directors of SC5 in December 2024. Before resigning, Mr. Phu and his related group divested their entire 28% stake (approximately 4.2 million shares) in two sessions on October 4 and 7, 2024.

Mr. Pham Gia Phu (born in 1996) holds a Master of Investment Analysis and was appointed as a Member of the Board of Directors of SC5 on June 7, 2023. He is the son of Mr. Pham Van Tu (born in 1968, deceased) – former Vice Chairman of the Board of Directors and General Director of SC5. During his tenure, Mr. Tu was the largest shareholder of SC5, owning 48.96%, equivalent to over 7.3 million shares. At the 2024 Annual General Meeting on April 20, Mr. Phu was elected as the Chairman of the Board of Directors of SC5.

SC5 Chairman and Related Group Divest Entire 28% Stake in Two Sessions

Mr. Nguyen Kha Tuan (holding flowers) was elected as a Member of the Board of Directors of SC5. Photo: Thanh Tú

|

At the same time, Mr. Hoang Xuan Hung was elected as a Member of the Supervisory Board of SC5 for the term 2024-2029, replacing Mr. Nguyen Kha Tuan, who resigned in mid-March. Mr. Hung, born in 1976, holds a Master of Business Administration and a Bachelor of Engineering in Construction. He joined SC5 in June 2023 as a technical officer.

– 14:16 21/04/2025

Hydropower Plant Song Vang Records 67% Profit Increase in Q1 Thanks to “Extremely Favorable” Weather Conditions

The Golden River Hydropower JSC (UPCoM: SVH) reported a significant increase in power generation compared to the previous year due to favorable weather conditions in the first quarter. This surge in power production has positively impacted the company’s profits.

“Patience is Key: ADTD Shareholders Refrain from Dividends, Awaiting Project Permits”

The sluggish market conditions in the real estate sector prompted HAR to focus on financial cost-cutting measures and refrain from paying dividends. While a significant portion of the company’s capital is tied up in uninitiated projects, the leadership assures that the permitting process is currently delayed and advises shareholders to “exercise patience.”

MSB’s General Meeting: Q1 Profit Reaches VND 1,630 Billion, 2-3 Potential Buyers for the Finance Company

On April 21, 2025, the Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) held its annual general meeting to discuss and approve key business strategies for the upcoming year. The agenda included proposals for dividend distribution, plans to increase charter capital, and decisions regarding the divestment from TNEX Finance and the potential acquisition of a securities company.

“LPBS Announces Impressive Q1 Results: Net Profit Surpasses VND 40 Billion, with an 81% Increase in Asset Size Since the Start of the Year”

Joint Stock Commercial Bank for Foreign Trade of Vietnam, or LPBank, announced that its securities arm, LPBS, recorded a net profit of over VND 40 billion in the first quarter of 2025. This impressive performance was driven by robust earnings from proprietary trading and lending activities, which successfully offset losses incurred in the brokerage division. As a result, LPBS’ total assets surged to a remarkable VND 9,175 billion, largely attributed to increased borrowing from its parent company, LPBank.