Following the transaction, Ms. Nguyen Thi Hong Ly, Ms. Vu Thi Lan, and Mr. Nguyen Dac Long increased their ownership in UNI to 23.46%, 21.12%, and 18.77% of the capital, respectively, totaling 63.35% of the capital. This is a significant increase from their previous holding of zero shares.

This change in ownership resulted from the recent private placement of 27 million shares of UNI, which were sold at a price of 10,000 VND per share, raising a total of 270 billion VND for the company. These newly issued shares are subject to a one-year lock-up period. With this capital increase, the company’s chartered capital has grown from over 156 billion VND to over 426 billion VND.

According to UNI, the primary purpose of this capital raise is to invest in the Phu Quoc – Vien Lien High-end Beach Villa Residential Area project, located in Rach Ham hamlet, Ham Ninh commune, Phu Quoc city, Kien Giang province. A total of 156 billion VND will be allocated to this project, with the remaining 114 billion VND used to restructure the company’s debt associated with the same project.

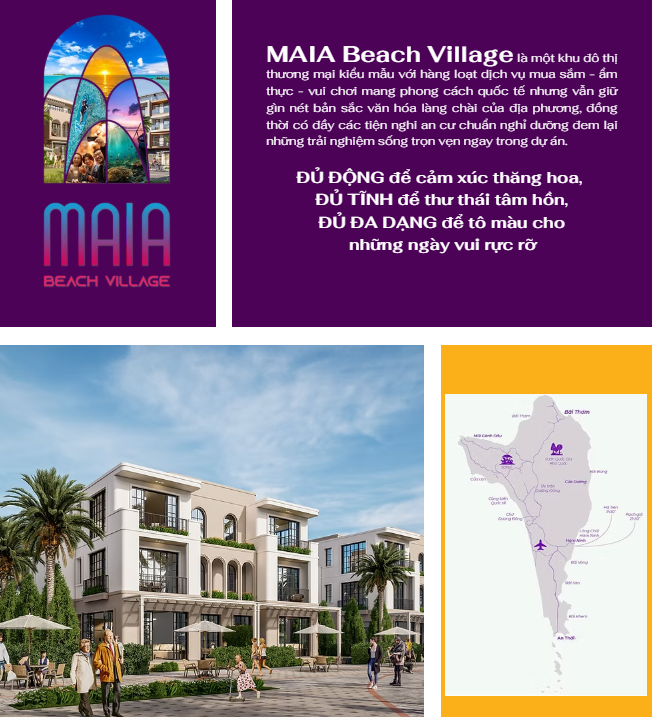

The Phu Quoc – Vien Lien High-end Beach Villa Residential Area project, also known as MAIA Beach Village, spans approximately 11.3 hectares and has a project duration of 70 years. The project aims to develop a high-end residential area that showcases a unique and dominant character while respecting the natural conditions and protecting the ecological environment. It aligns with the central government and Kien Giang province’s vision to develop the tourism, service, and urbanization sectors in Phu Quoc Island.

Notably, the offering price of 10,000 VND per share was significantly higher than the market price of 6,500 VND per share on April 1, 2023, indicating that these three professional investors were willing to pay a premium of 1.5 times the market price to acquire UNI shares. However, subsequent to this transaction, the share price of UNI experienced several sharp declines, falling to 5,900 VND per share as of April 18, 2023.

| Sharp declines in UNI share price since April 1, 2023 |

On UNI‘s website, the company presents the project as MAIA Beach Village, featuring South European and Mediterranean-style twin villas, shophouses, and garden houses.

Source: UNI Website

|

Source: UNI Website

|

As per the Q1/2025 financial statements, as of March 31, 2025, UNI had nearly 120 billion VND in prepayments to vendors, a 55% increase from the beginning of the year. This increase was mainly due to a new prepayment of nearly 43 billion VND to Milan Real Estate Investment and Consulting JSC. The company’s other notable prepayments remained unchanged from the beginning of the year, including those to Sao Mai Real Estate Investment and Development JSC (nearly 45 billion VND), Shearman and Capital Financial Consulting Co., Ltd. (20 billion VND), and Asean House Trading Services Co., Ltd. (11.4 billion VND), all of which are partners in the Phu Quoc project.

UNI also recorded over 507 billion VND in production and business expenses, mainly consisting of compensation, support, and resettlement costs for the Phu Quoc project, as well as interest expenses, investment expenses, and construction expenses related to the same project.

The company’s short-term borrowings totaled nearly 294 billion VND, mostly from a loan from VPBank used to pay for investment costs in the Phu Quoc project. Additionally, the company recorded nearly 59 billion VND in short-term advance payments from customers, mainly from six customers who made advance payments for land purchases, and over 84 billion VND payable to the General Director, Ms. Vu Thi Nhu Mai.

In terms of business performance, UNI generated 300 million VND in revenue and nearly 20 million VND in net profit in Q1, representing an 8% decrease in revenue and an 86% decrease in net profit compared to the same period last year. During this quarter, the company incurred 110 million VND in new consulting costs and a 15% increase in management expenses.

– 10:45 21/04/2025

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)