According to the resolution approved by bondholders on January 13, 2025, the maturity of two bond codes, TTDCH2122001 (VND 300 billion with outstanding debt of VND 225 billion) and TTDCH2122002 (VND 500 billion), has been extended to December 2027. Repayment will be made in 36 installments from January 2025, with payments made once a month as agreed with bondholders.

The applicable interest rate from October 12, 2022, to November 30, 2024, is 11% per annum. From December 1, 2024, onwards, the interest rate will be calculated based on the average deposit interest rate of four banks: BIDV, Vietcombank, MB, and VietinBank, plus a margin of 2% per annum. Interest for each month will be accrued based on the remaining principal balance and paid in full at the end of 2027.

|

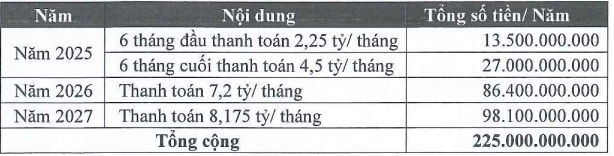

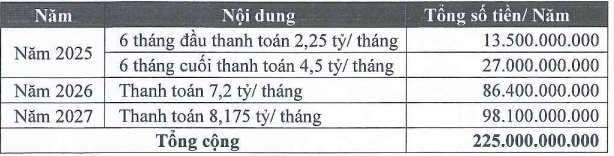

Details of the repayment plan for TTDCH2122001 bond principal

Source: HNX

|

|

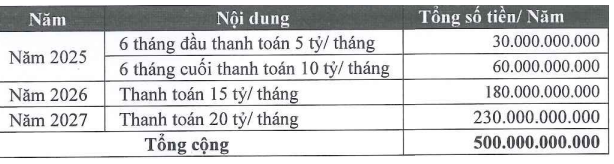

Details of the repayment plan for TTDCH2122002 bond principal

Source: HNX

|

In the event that the company’s business performance improves or other sources of funding become available, Thai Tuan commits to repaying bondholders earlier than the above schedule, as stated in the minutes of the Board of Directors’ meeting signed by Mr. Tran Hoai Nam – Chairman, Mr. Le Dinh Phap – Member, and Mr. Nguyen Thanh Danh – Member of the Board of Directors.

The TTDCH2122001 bond was issued on April 12, 2021, with a value of VND 300 billion and was originally scheduled to mature on October 12, 2022. However, in mid-2023, after repurchasing VND 75 billion of the principal, the company received approval from bondholders to extend the maturity of the remaining amount to July 27, 2024, and subsequently to 2027 as mentioned above. The bond is secured by 20 million shares of the Thai Tuan Group (with a total par value of VND 200 billion), as well as residential properties and land use rights at 07, 08, 09 Trang Tu, Ward 4, District 5, Ho Chi Minh City, and 2.6 hectares of land in the CND-D4 lot, Road No. 1, Duc Hoa III – Anh Hong Industrial Park, Duc Lap Ha Commune, Duc Hoa District, Long An Province (with a total value of VND 210 billion, as appraised by Vietnam Valuation and Appraisal Joint Stock Company).

On the other hand, the TTDCH2122002 bond, with a value of VND 500 billion, was issued on May 20, 2021, and was initially set to mature on November 20, 2022. Similar to the first bond, this bond also experienced a delay in repayment. With the agreement of 59 bondholders holding more than VND 349 billion (accounting for 74%) of the bonds in mid-2023, the maturity was extended to November 20, 2024, and the interest rate was increased to 16.5% per annum from November 20, 2022, to November 20, 2024. Additionally, seven villas in the Cross Long Hai project were added as collateral, along with the original 16.05 million shares of the Thai Tuan Group.

It is worth noting that the bond issuance of the Thai Tuan Group is under the registration and custody of Bao Viet Securities Joint Stock Company (BVSC).

Thai Tuan Group Records a Profit of VND 449 Million in the First Half of the Year

– 12:32 19/04/2025

The Rising Interest Rates on Social Housing Loans: A Growing Concern for the Financially Disadvantaged

The social housing loan interest rate has surged by 1.8% annually, causing concern among homebuyers who now face increased financial burden, especially those with low incomes.