Asia Commercial Bank’s (ACB) 2025 Annual General Meeting: A Pivotal Year in ACB’s Growth Strategy

Asia Commercial Bank (ACB) convened its 2025 Annual General Meeting on April 8, during which shareholders endorsed the bank’s business plan and pivotal initiatives for the year ahead. This gathering holds significant importance as it marks a pivotal year in ACB’s five-year development strategy for 2025–2030.

For the upcoming year, ACB has set its sights on achieving a pre-tax profit of VND23,000 billion ($920 million), reflecting a 9.5% increase from the previous year. This ambitious goal is underpinned by a steadfast commitment to sustainable growth, meticulous risk management, and maintaining exceptional asset quality. Additionally, a 25% dividend payout was approved, consisting of a 10% cash dividend and a 15% share dividend. This continuation of high dividends, including three consecutive years of cash distributions, underscores ACB’s consistent business performance and unwavering dedication to rewarding its shareholders.

Mr. Tran Hung Huy, Chairman of the Board, remarked, “ACB has concluded its previous five-year strategy with notable achievements, including tripling our profits and delivering consistently high and balanced dividends. As we look ahead, Vietnam’s economy and financial market will face challenges such as increasing competition and stricter compliance requirements. To meet our strategic goals, ACB will persist in investing in infrastructure and new technology to enhance our efficiency and strengthen risk control, with an unwavering focus on safety and security.”

In the coming year, ACB remains committed to its aspiration of becoming a leading retail bank, not only in scale but also in profitability. This lays the foundation for the next five-year phase of its growth strategy. Key performance indicators include a targeted 14% growth in total assets and deposits (inclusive of valuable papers) and a credit growth rate of 16%. While retail banking remains at the core of ACB’s business, the bank also intends to place a stronger emphasis on corporate banking, particularly with leading enterprises and FDI clients.

Addressing concerns about potential economic impacts on 2025 targets, Mr. Tu Tien Phat, CEO of ACB, assured, “Despite economic challenges, including recent US tariff policies, ACB remains steadfast in our commitment to achieving our 2025 credit growth targets. Our preliminary estimates for Q1 2025 indicate credit growth exceeding 3%, deposit growth above 2%, and a slight decline in the non-performing loan ratio to 1.34%, demonstrating the effectiveness of our operational and risk management strategies.”

In alignment with these targets, ACB plans to expand credit and deposits while vigilantly monitoring asset quality. The bank will also focus on increasing fee-based income, especially in the realms of cards and international payments. Additionally, ACB will continue to invest in its subsidiaries to diversify financial products and bolster group performance. Investments in digital banking, modern technology, and secure operational solutions remain a top priority for the bank.

Looking back at 2024, ACB posted an impressive pre-tax profit of VND21,006 billion ($840.24 million), securing its position among the top seven banks with profits surpassing VND20,000 billion ($800 million). ACB also ranked among the top three most profitable private banks in Vietnam. During this period, the bank successfully accomplished its 2019–2024 goals and made significant strides toward its ambition of becoming Vietnam’s leading retail bank. This was evidenced by a tripling of profits and a return on equity (ROE) consistently above 20%. By the end of 2024, ACB’s total assets reached VND864 trillion ($34.56 billion), reflecting a remarkable year-on-year growth of over 20% and surpassing the planned target by 7%. Customer loans totaled VND581 trillion ($23.24 billion), resulting in a record credit growth of 19.1%, which not only exceeded the sector average but also marked the highest growth in a decade for ACB.

Beyond its financial achievements, ACB demonstrated its commitment to supporting government policies and State Bank of Vietnam initiatives. The bank offered competitive lending rates and preferential housing loans for young customers, simplified loan procedures, and provided online disbursement options to enhance accessibility to banking services.

ACB is one of only ten banks selected by the State Bank of Vietnam to pilot the Internal Ratings-Based (IRB) approach for credit risk and capital management. This selection signifies a significant step toward aligning with international Basel standards and enhancing risk control measures.

Recent credit rating updates further bolster ACB’s standing. Moody’s maintained a “Stable” outlook for ACB, while Fitch Ratings upgraded the outlook from “Stable” to “Positive” in 2024. On the domestic front, FiinRatings assigned ACB the highest long-term issuer rating of “AA+” with a “Stable” outlook. In recognition of its performance, ACB was named one of Vietnam’s Top 10 Best Banks by Decision Lab (partner of YouGov) in March 2025, and its brand health score also witnessed an improvement. As a testament to its commitment to sustainable finance, ACB introduced a Sustainable Finance Framework and disbursed VND4,000 billion ($160 million) in 2024 to support businesses that align with sustainability goals.

MSB’s General Meeting: Q1 Profit Reaches VND 1,630 Billion, 2-3 Potential Buyers for the Finance Company

On April 21, 2025, the Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) held its annual general meeting to discuss and approve key business strategies for the upcoming year. The agenda included proposals for dividend distribution, plans to increase charter capital, and decisions regarding the divestment from TNEX Finance and the potential acquisition of a securities company.

“LPBS Announces Impressive Q1 Results: Net Profit Surpasses VND 40 Billion, with an 81% Increase in Asset Size Since the Start of the Year”

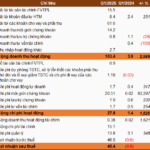

Joint Stock Commercial Bank for Foreign Trade of Vietnam, or LPBank, announced that its securities arm, LPBS, recorded a net profit of over VND 40 billion in the first quarter of 2025. This impressive performance was driven by robust earnings from proprietary trading and lending activities, which successfully offset losses incurred in the brokerage division. As a result, LPBS’ total assets surged to a remarkable VND 9,175 billion, largely attributed to increased borrowing from its parent company, LPBank.

DNSE Captures 33% of New Brokerage Accounts in Q1

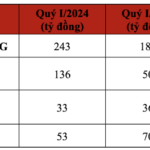

In Q1 of 2025, DNSE Securities witnessed a remarkable 34% surge in revenue compared to the same period last year. This impressive growth is further accentuated by a 10% increase in margin loan balances since the beginning of the year. DNSE Securities also maintained its dominant position in the market, capturing a substantial 33% of all new brokerage accounts opened, solidifying its leadership in the industry.