ABBank’s 2025 Annual General Meeting of Shareholders was held in Hanoi on the morning of April 18, 2025.

|

2025 Pre-tax Profit Target is 2.3 Times Higher

According to ABBank, 2025 presents abundant opportunities for the banking industry, with significant growth prospects fueled by economic stability and supportive macroeconomic policies.

The primary driver stems from credit growth, especially as the economy enters the post-pandemic recovery phase. International capital is another notable highlight. With Vietnam expanding its role in the regional financial market, international investors have been channeling more capital into the banking sector through bonds and stocks.

FDI and FII capital not only fortifies the financial resources of Vietnamese banks but also enhances their competitiveness. Digital transformation will continue to bring about profound changes. Technologies such as eKYC (electronic know-your-customer), contactless payments, and artificial intelligence (AI) have aided banks in boosting operational efficiency and enhancing customer experience.

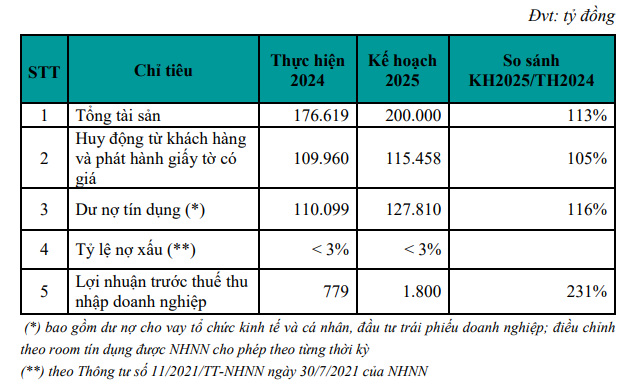

Consequently, ABBank aims to attain a total asset value of VND 200,000 billion by the end of 2025, marking a 13% increase compared to the beginning of the year. Customer deposits and bond issuances are targeted to reach VND 115,458 billion (+5%), while credit outstanding is expected to hit VND 127,810 billion (+16%). The bank intends to maintain its non-performing loan ratio below 3%.

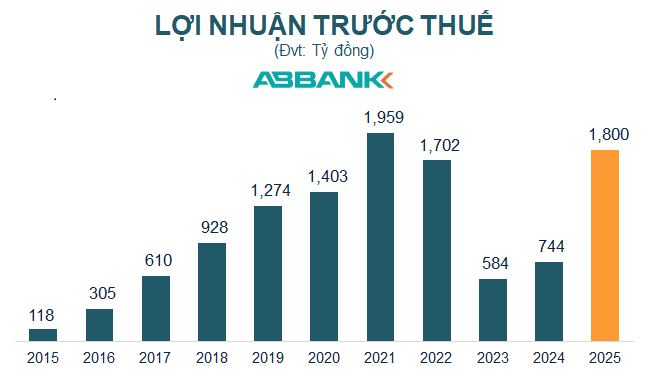

Notably, ABBank has set an ambitious pre-tax profit target of VND 1,800 billion for 2025, representing a 2.3-fold increase from 2024.

Source: VietstockFinance

|

Non-Performing Loan Management Emerges as a Bright Spot, with First-Quarter Profit Reaching VND 400 Billion

In response to shareholders’ concerns about the relatively high non-performing loan ratio of 2.48%, Mr. Dao Manh Khang, Chairman of the Board of Directors of ABBank, reassured that the bank’s non-performing loan management has been a strong suit, with dedicated teams consistently delivering positive results. ABBank has devised comprehensive plans to bring the non-performing loan ratio below 3%. The bank has weathered the most challenging period in 2024 and is poised to move forward from this trying time.

Currently, ABBank has implemented a strategy to centralize the handling of non-performing loans at the head office, relieving business units of this burden. This approach enables business units to focus on market development while leveraging the expertise of specialized personnel at the head office for effective loan management.

For loans with adequate provisions, the bank has a concrete recovery plan, assigning specific responsibilities to individuals. ABBank is investing in human resources, operational mechanisms, and legal tools to maximize the efficiency of the loan management process.

However, the current context presents challenges, particularly in the legal proceedings for debt recovery at the local level, which tend to slow down the process. ABBank’s loan management team is committed to overcoming these hurdles. The bank’s goal is not merely to reduce the non-performing loan ratio below 3% but also to establish a more professional and efficient loan management system in the long term.

The Chairman also shared that the bank’s first-quarter profit reached nearly VND 400 billion, a figure that underpins the feasibility and boldness of the plan presented to shareholders for the year.

Retaining VND 2,311 Billion in Undistributed Profit

In 2024, ABBank recorded a post-tax profit of over VND 627 billion. After allocating funds to various reserves and taking into account the undistributed profit from previous years, the bank has VND 2,311 billion in retained earnings.

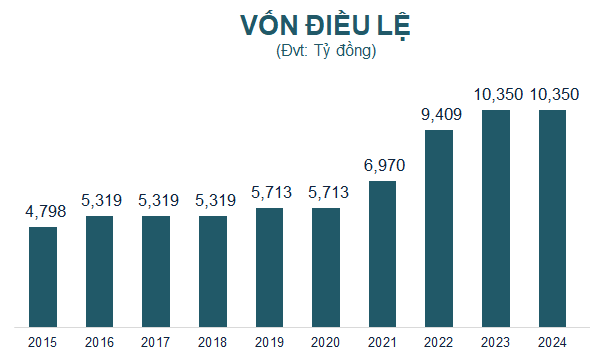

The Board of Directors proposes to retain the entire amount of undistributed profit to bolster the implementation of strategic plans and build internal capital for future increases in charter capital.

Previously, during the 2021-2023 period, ABBank consistently increased its charter capital. Specifically, in 2023, the bank raised its charter capital from VND 9,409 billion to VND 10,530 billion.

Source: VietstockFinance

|

Responding to a shareholder’s inquiry about capital increase plans and attracting foreign investors, Chairman Dao Manh Khang explained that in the context of technology application, the opening of new geographical branches requires permission from the State Bank of Vietnam and careful cost considerations. Meanwhile, technology enables faster customer reach, broader market coverage, and enhanced efficiency.

Regarding foreign strategic shareholders, ABBank already has a long-standing partnership with Maybank, a leading Malaysian bank. The bank intends to explore opportunities from Japanese and Korean markets, as suggested by shareholders, given the strong interest from financial institutions in these countries.

Additionally, Mr. Pham Duy Hieu, CEO of ABBank, shared that the bank has been collaborating with fintech companies, leveraging digital transformation in the first quarter of 2025 to expand its customer base. By embracing automation and technology, ABBank aims to achieve a 131% increase in profit for the year 2025.

Resignation and Election of Board Members

At the 2023 Annual General Meeting of Shareholders, ABBank approved a seven-member Board of Directors for the 2023-2027 term. The following individuals were elected: Mr. Dao Manh Khang, Mr. Vu Van Tien, Mr. John Chong Eng Chuan, Mr. Foong Seong Yew, Mr. Nguyen Danh Luong, Ms. Do Thi Nhung, and Mr. Tran Ba Vinh.

On January 5, 2025, Malayan Banking Berhad (Maybank), a foreign shareholder owning 16.394% of ABBank’s capital, submitted a nomination for Mr. Syed Ahmad Taufik Albar to serve as a member of ABBank’s Board of Directors for the 2023-2027 term and act as Maybank’s representative for 50% of its capital in ABBank, replacing Mr. John Chong Eng Chuan. This change will take effect upon completion of relevant legal procedures.

On January 16, 2025, Mr. Tran Ba Vinh, an independent member of the Board of Directors, submitted his resignation due to personal reasons, effective from the time the Annual General Meeting of Shareholders approves his resignation.

Mr. Trinh Thanh Hai, the nominee for the position of independent member of the Board of Directors, currently serves as an independent member of the Board of Directors and Chairman of the Inspection Committee of Van Phu – Invest Investment Joint Stock Company. He is also a member of the Board of Directors and non-executive director of Vinacapital Vietnam Opportunity Fund (VOF).

Subsequently, the Annual General Meeting of Shareholders approved the election of two new members to the Board of Directors: Mr. Syed Ahmad Taufik Albar and Mr. Trinh Thanh Hai.

All other proposals were passed at the Annual General Meeting of Shareholders.

– 13:46 18/04/2025

Unlocking Steady Growth and Unlocking Strong Returns: ACB’s 2025 Vision

Asia Commercial Bank has unveiled ambitious plans for the next five years, targeting VND23,000 billion in pre-tax profits and an impressive 16% credit growth by 2025. With a sharp focus on sustainable expansion and digital innovation, the bank aims to deliver consistent returns to its shareholders. This new strategy underscores the bank’s commitment to dynamic growth and positions it for a promising future in Vietnam’s evolving financial landscape.

MSB’s General Meeting: Q1 Profit Reaches VND 1,630 Billion, 2-3 Potential Buyers for the Finance Company

On April 21, 2025, the Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) held its annual general meeting to discuss and approve key business strategies for the upcoming year. The agenda included proposals for dividend distribution, plans to increase charter capital, and decisions regarding the divestment from TNEX Finance and the potential acquisition of a securities company.

“LPBS Announces Impressive Q1 Results: Net Profit Surpasses VND 40 Billion, with an 81% Increase in Asset Size Since the Start of the Year”

Joint Stock Commercial Bank for Foreign Trade of Vietnam, or LPBank, announced that its securities arm, LPBS, recorded a net profit of over VND 40 billion in the first quarter of 2025. This impressive performance was driven by robust earnings from proprietary trading and lending activities, which successfully offset losses incurred in the brokerage division. As a result, LPBS’ total assets surged to a remarkable VND 9,175 billion, largely attributed to increased borrowing from its parent company, LPBank.

DNSE Captures 33% of New Brokerage Accounts in Q1

In Q1 of 2025, DNSE Securities witnessed a remarkable 34% surge in revenue compared to the same period last year. This impressive growth is further accentuated by a 10% increase in margin loan balances since the beginning of the year. DNSE Securities also maintained its dominant position in the market, capturing a substantial 33% of all new brokerage accounts opened, solidifying its leadership in the industry.