As of 8:15 am on April 21, 2025, the total number of shareholders attending the meeting (in person or by proxy) was 36, representing nearly 329.2 million shares, equivalent to 55% of the company’s total voting shares. This met the requirements to proceed according to the Enterprise Law and the company’s charter.

Vinaconex’s 2025 Annual General Meeting held in Hanoi on April 21 – Photo: The Manh

|

Discussion:

Vinaconex is currently developing several large real estate projects. Could the leaders update us on the progress of the Green Diamond and Cat Ba Amatina projects, as well as the expected profit contribution from the real estate segment in 2025?

General Director Nguyen Xuan Dong: The Green Diamond project at 93 Lang Ha is a renovation project for old apartments, consisting of a total of 324 apartments, including 100 apartments for relocation. The remaining 224 commercial apartments are for sale, along with 5 floors of commercial space.

Deputy General Director Duong Van Mau added: Up to the present time, about 80% of the profits from this project have been accounted for. The remaining 20% is expected to be recognized in 2025, mainly from the basic apartment part – most of which have been sold this year.

Regarding the Cat Ba Amatina project, General Director Nguyen Xuan Dong stated that Vinaconex ITC, a member company of Vinaconex, has not officially signed with any partners. However, the company affirmed that there is a partner and they are in the process of completing the necessary legal procedures.

As for the expected profit from this project, everyone wants it to be high, but it also depends on the price, market fluctuations, and the capacity of customers. So, the goal is to sell wholesale a part of it in 2025, which could be a relatively large quantity, to ensure cash flow and profit.

There is definitely an expectation of profit. In principle, there must be a profit, and it must be a substantial one. I can’t announce the figure now as we are still in negotiations. If I announce figure A today, it might change to figure B tomorrow, which would be very difficult.

How is Vinaconex’s real estate business doing? What is the sales progress of key projects such as Hai Yen, Cho Mo, and Capital One? What is the profit plan for this segment this year, and what is the dividend orientation?

General Director Nguyen Xuan Dong: First of all, as you are well aware, the Hai Yen project has been completely sold and accounted for. Secondly, regarding the Cho Mo – Bach Mai project, the total area there is 36,000 m2 of office space, equivalent to about 20 floors. We have opened the sale of 13 floors out of a total of 20, and have sold about three-quarters of those 13 floors, or about 9-10 floors. The expected profit there is quite good, and Mr. Mau (Deputy General Director Duong Van Mau – PV) can estimate it to be about VND hundreds of billions.

Deputy General Director Duong Van Mau: The Cho Mo project is expected to contribute about VND 200 billion in profit this year. If we sell out, it could be double that amount, or about VND 400 billion. As for Capital One – the project in Kim Van Kim Lu – we will officially start construction tomorrow. The product structure there is quite similar to Cho Mo, and we can separate the books by floor for sale like Cho Mo. Whether we sell quickly or not depends on the market situation, but in terms of products and legal procedures, we are completely proactive.

Mr. Dang Thanh Huan, Vinaconex’s Chief Accountant: If I add up the real estate segment from the companies and the parent company, and divide it by the total profit of VND 1,200 billion (tentatively according to the plan), it accounts for about 70-75%, maybe more. That is, real estate is still the largest contributor to the company’s profit this year.

The company’s business results for next year look very good. Do the leaders plan to increase the cash dividend ratio back to the range of 15-17% as in the previous period?

General Director Nguyen Xuan Dong: We acknowledge the expectations of shareholders and are also calculating how to balance the interests between investment expansion and dividends. If the business results are as expected, we can definitely consider a similar dividend rate as before.

Why is the gross profit margin in the construction segment so low?

How does Vinaconex explain the low gross profit margin in the construction segment, and how will the company take advantage of the opportunity from the wave of public investment in the context of cash flow pressure?

Mr. Nguyen Xuan Dong – Vinaconex’s General Director: First of all, I would like to affirm that Vinaconex is currently a joint-stock company with no state capital since the end of December 2018. That means we operate entirely according to market mechanisms, with the interests of the enterprise and shareholders as the focus. There is no such thing as the company working for some “community benefit” as some shareholders mistakenly believe.

Regarding the issue of gross profit margin in the construction segment, I would like to clarify: At present, if we do our job right, and after the final settlement, we still maintain a gross profit margin of 3-5%, that is extremely good. I emphasize that this is a “fantastic” profit margin in the current context. Shareholders can ask anyone in the industry, and they will find this view to be realistic.

The construction industry is currently facing many difficulties. From weather factors, input material prices, labor, equipment, to schedule pressure – especially for public investment projects. While raw material prices are rising, payments are still made according to unit prices and estimated norms approved in advance, with limited adjustments based on CPI. That means we have to manage the difference ourselves, which makes it very difficult to maintain profits.

We will continue to accept projects, but our approach is to tightly manage risks. We can’t just see a large package and accept it at all costs, and then not be able to collect the money while having to pay bank interest. If the legal documents are not complete, the procedures are not certain, and the schedule is not guaranteed, not only will there be no profit, but there may also be losses. We prioritize projects that are certain, where we can collect money, control the schedule and legal aspects.

Regarding the question related to the opportunity of public investment and the possibility of improving cash flow, I would like to share that although the government is strongly promoting the disbursement of public investment, Vinaconex will approach it cautiously. The most important thing is efficiency and the ability to recover capital, not chasing sudden revenue without accompanying profits. In the current conditions, doing this is what constitutes real success.

There was a significant difference between the gross profit margin of the construction segment in Q4/2024 before the audit (nearly 10%) and after the audit (resulting in only over 3% for the whole year). Could the leaders provide an expectation for the gross profit margin of the construction segment in 2025?

Mr. Dang Thanh Huan, Vinaconex’s Chief Accountant: I am currently referring to the report before the audit. But when the auditors come in, I think it won’t change that much. There is very little change between the figures before and after the audit. We will check and inform you later.

General Director Nguyen Xuan Dong further clarified: Now, we have to calculate for the whole year. Auditors currently do not report by quarter, so we have to monitor the annual data. I affirm that the profit margin did not change as significantly as reflected by the shareholders: The Board of Directors will officially send a document to the shareholders later.

Three main growth drivers for 2025

What is the business orientation of the Hai Yen urban area project near the Dai Lo Hoa Binh extension project in Mong Cai city (Quang Ninh province)? Is it to sell land plots after completing the infrastructure or to build houses first and then sell them?

Mr. Duong Van Mau – Member of the Board of Directors and Standing Deputy General Director of Vinaconex: The Hai Yen urban area and the Dai Lo Hoa Binh extension project in Mong Cai city, Quang Ninh province, both have two types of products. One is land plots, which will be sold after the infrastructure is completed and meets the conditions. The second type is shophouses, which must be built.

Currently, the project has completed the investment of phase 1, including synchronous infrastructure, and has legal documents sufficient for sale. However, the timing of bringing the product to the market is still being considered.

What is Vinaconex’s strategic orientation for new projects such as the Dong Anh Industrial Park, high-speed railway investment, and nuclear power, while at the same time, what are the main growth drivers in 2025?

General Director Nguyen Xuan Dong: Vinaconex has been assigned by the government to be the investor of the Dong Anh Industrial Park project in Hanoi. This area has a very strategic location, between Nhat Tan Bridge and Noi Bai Airport – where there is a high demand for renting industrial parks, while neighboring industrial parks such as Thang Long 1 and 2 are almost full. This project is oriented by Vinaconex to develop into a “green, clean, and logistics-serving” industrial park.

Regarding the FDI trend, Mr. Duong Van Mau – Member of the Board of Directors and Deputy General Director: We also analyzed and assessed that in the near future, as you mentioned, FDI may decrease. But our target audience is selected high-tech and logistics industries, so basically, there is no significant impact on the project.

However, the progress of the project implementation will not be immediate. The fastest procedure will probably take about two more years to complete compensation. And it may take about three years to implement the infrastructure, so it will be balanced according to the progress of FDI and domestic investment attraction.

In the 2025 plan, Vinaconex is also proactively researching the expansion into new fields. General Director Nguyen Xuan Dong stated that for high-speed railways, Vinaconex – one of the two large construction contractors in the country – has proactively coordinated with the University of Construction to open a training course for human resources. As for nuclear power, we are also in contact, but it is not very clear at the moment. However, there is an orientation to participate in this field.

Regarding the growth drivers for the coming year, Vinaconex identified three main segments: construction, real estate, and financial investment. The construction segment is expected to contribute to growth in revenue and scale. However, it does not bring much profit.

On the other hand, investment is identified as the main driver of profit growth and dividends for shareholders. Investments in water distribution (VIWACO), third companies, the Ly Thai To education system, Bach Thien Loc, etc., are bringing stable cash flow.

Especially, real estate (including residential, resort, and industrial real estate) along with financial investment are the two pillars that play a role in profit creation for the enterprise. We also affirm to our esteemed shareholders that the profit will come from real estate investment and financial investment.

Consolidated profit in Q1 estimated at VND 150 billion

Vinaconex sets a target revenue of VND 15,500 billion and profit after tax of VND 1,200 billion in 2025. What is the basis for the Management Board’s confidence in the ability to achieve this plan? At the same time, could you update us on the business results of Q1/2025 and share more about the development orientation of Vinaconex in the context of the increasingly fierce competition in the construction industry?

Mr. Nguyen Xuan Dong – Vinaconex’s General Director: Regarding the 2025 plan, I affirm that this plan is built quite carefully, based on what Vinaconex is doing and will implement in the future. I personally commit, as in the 2024 plan, that in 2025, the company can completely achieve the target revenue of VND 15,500 billion and profit after tax of VND 1,200 billion. The possibility of completing this plan is about 90 to 95%.

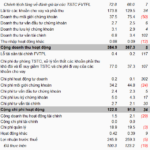

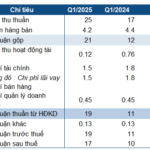

Regarding the results of Q1/2025, the consolidated revenue is estimated at nearly VND 2,600 billion, equivalent to 17% of the plan. Consolidated profit after tax is about VND 150 billion, reaching 13% of the plan. For the parent company, revenue is estimated at about VND 2,062 billion, or 18% of the plan, and profit after tax reaches more than VND 250 billion, or 25% of the plan. So, the parent company is doing quite well in terms of profit.

In the current context, the construction industry, especially the infrastructure segment and public investment projects, is highly competitive. We do not have high expectations for profit from construction projects. The main goal is to contribute to the country’s economic development according to the Party and State’s guidelines. It is important that Vinaconex always prioritizes quality and construction progress. At the same time, the Management Board clearly defines the goal of economic efficiency, not allowing losses on projects – except for special cases. 2023 was a very difficult year for the construction industry, but Vinaconex did not suffer losses on any projects.

We have strengthened governance, maximized the capacity of the corporation, and paid special attention to debt collection – an extremely challenging issue in the construction segment. Therefore, the Management Board has a policy of not accepting too many projects, especially those with unclear capital sources in the context of the current real estate difficulties. Doing a lot but not being able to collect money is very dangerous. “The bosses are dying, let alone us as contractors.” Currently, the projects that Vinaconex is implementing basically have good cash collection.

At the same time, we have also tried to finalize the settlement of old projects with difficulties in payment such as the Lang – Hoa Lac route. For new projects, the company sets clear criteria from the beginning: specific responsibilities must be assigned, there must be a transparent settlement and payment schedule, and we must be able to collect the money.

In summary, the revenue target of VND 15,500 billion for 2025 is a very careful figure. It may even be exceeded, but we do not put heavy pressure on hot development, always prioritizing ensuring cash flow, financial balance, and stable jobs for employees.

In 2025, Vinaconex will focus its resources on which projects after selling the remaining part of Green Diamond 93 Lang Ha? How is the progress of the Dong Anh Industrial Park project going?

Mr. Nguyen Xuan Dong – Member of the Board of Directors and General Director of Vinaconex: In 2025, the remaining part of the Green Diamond 93 Lang Ha apartment project will basically be accounted for, contributing to the company’s business results.

Currently, the sale of offices at the Cho Mo – Bach Mai project is showing positive signals, with good absorption and expected to bring profit to Vinaconex. Another large project is Amatina in Hai Phong. As this is a resort real estate project, even though the market has some bright spots, it is still not really favorable. Vinaconex has invested a large amount of capital in this project, so in 2025, the Board of Directors and the Management Board will try to coordinate to find some wholesale customers to recover capital and profit.

In addition, some other projects will also continue to contribute revenue, such as Cho Mo – Bach Mai office, Dai Lo Hoa Binh project – which has met the conditions for sale, and possibly a part from the ITC project in Hai Phong.

Regarding the subsidiary companies, two urban areas developed by Vinaconex in Quang Nam and Da Nang (Ngan Cau and Thien An) are in the process of completing legal procedures. When the procedures are smooth, these will be significant sources of revenue and profit for VCG. As for the Dong Anh Industrial Park project, with a total investment of over VND 6,000 billion, the project has just been assigned to Vinaconex as the investor and started the task of planning. The next steps, such as compensation, site clearance, and construction implementation, will take a lot of time, so it cannot contribute profit in the short term.

At the end of the meeting, all the proposals were passed.

Target profit – the highest in 5 years

Vinaconex identified 2025 as a pivotal year to consolidate its position as a leading construction contractor. The company prioritizes projects with high economic efficiency, invests in new construction technologies, and trains high-quality human resources. At the same time, the company aims to expand into the field of urban real estate, industrial infrastructure, and sustainable development of invested projects.

Based on this, Vinaconex submitted a consolidated revenue and income plan of VND 15,500 billion and profit after tax of VND 1,200 billion in

The Brokerage Segment’s Thin Margins and Surging Provision Costs: A Look at FPTS’ 8% Drop in Q1 Net Profit

In Q1 2025, FPT Securities Joint Stock Company (FPTS, HOSE: FTS) recorded revenue and pre-tax profit of nearly VND 314 billion and over VND 100 billion, respectively, equivalent to 31% and 20% of the yearly plan. The profit showed a slight decrease compared to the same period last year due to modest profits in the brokerage segment and a significant increase in provision expenses.

The Power of Words: Crafting a Compelling Title

“The SC5 Shareholder’s Meeting: Vice-Chairman’s Ambition to Increase Ownership and Cancel 2024 Dividends”

Mr. Nguyen Dinh Dung, Vice Chairman of the Board of Directors and CEO of Construction Joint Stock Company No. 5 (HOSE: SC5), shared that the construction industry continues to face challenges due to volatile and unstable material prices, which drive up costs. Despite these difficulties, the Company ensures a sufficient backlog of work to cushion its plans for the coming years.

“Patience is Key: ADTD Shareholders Refrain from Dividends, Awaiting Project Permits”

The sluggish market conditions in the real estate sector prompted HAR to focus on financial cost-cutting measures and refrain from paying dividends. While a significant portion of the company’s capital is tied up in uninitiated projects, the leadership assures that the permitting process is currently delayed and advises shareholders to “exercise patience.”