|

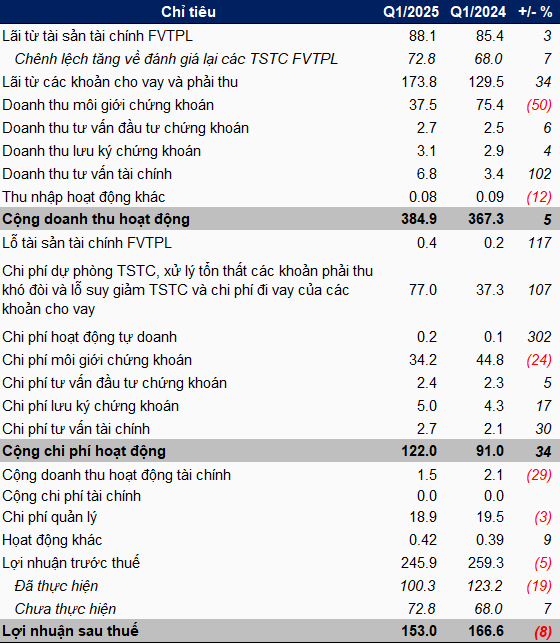

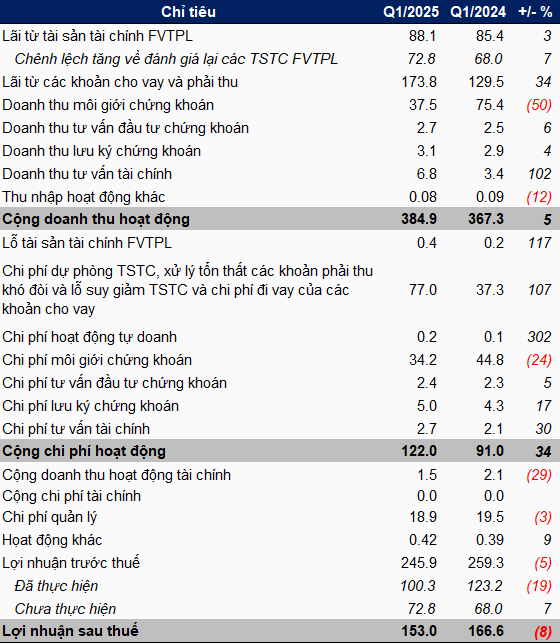

FPTS’ Q1 2025 Business Results

Unit: Billion VND

Source: VietstockFinance

|

FPTS reported total revenue from business and financial activities (realized) of nearly VND 314 billion, up 4% compared to the same period last year and achieving 31% of the yearly plan of VND 1,000 billion. However, the realized pre-tax profit was just over VND 100 billion, down 19% and meeting 20% of the target of VND 500 billion for the whole year.

It can be seen that despite a 34% growth in profit from loans, reaching nearly VND 174 billion, the company also recorded VND 77 billion in financial asset impairment provisions, handling bad debt losses, and financial asset depreciation and borrowing costs for loans, double that of the same period. In addition, brokerage activities also showed a decline with a meager profit of over VND 3 billion, equivalent to 10% compared to the previous year.

Finally, the company’s net profit was nearly VND 153 billion, down 8%.

As of March 31, 2025, FPTS’ total assets exceeded VND 10,706 billion, up 10% from the beginning of the year. The largest item was loan balance of nearly VND 7,612 billion, up 8%, of which more than VND 7,000 billion was for margin lending.

Another item with a size of over VND 1,000 billion is the fair value of financial assets FVTPL of nearly VND 2,065 billion, up 8%, mainly invested in fixed-term deposits, deposit certificates of over VND 839 billion; government bonds and bonds of credit institutions nearly VND 651 billion; listed and traded stocks nearly VND 573 billion, with the investment value in MSH shares of May Song Hong Joint Stock Company reaching nearly VND 572 billion, 42 times the purchase price.

At the Annual General Meeting of Shareholders held on the afternoon of April 1, 2025, CEO Nguyen Diep Tung stated that the company has no intention of taking profits on the textile and garment industry stock.

“FPTS does not focus on proprietary trading on the exchange, as this would conflict with the interests of our clients. FPTS only invests directly in unlisted companies and accompanies them, as in the case of MSH. FPTS has been with MSH for over a decade and we have not discussed exiting, as long as the collaboration remains beneficial for shareholders.”

“However, I cannot confirm that we will not take profits in 2025 because if anything changes, we must adapt and take action, not stand still. Therefore, I can only say that FPTS has no plan to exit at this time” – FPTS’ CEO shared.

In terms of capital sources, FPTS’ debt was nearly VND 6,088 billion, up 11% from the beginning of the year and accounting for 57%. The company’s major lending partners include VIB, MSB, VPBank, Vietcombank, and VietinBank.

– 10:41 19/04/2025

The Power of Words: Crafting a Compelling Title

“The SC5 Shareholder’s Meeting: Vice-Chairman’s Ambition to Increase Ownership and Cancel 2024 Dividends”

Mr. Nguyen Dinh Dung, Vice Chairman of the Board of Directors and CEO of Construction Joint Stock Company No. 5 (HOSE: SC5), shared that the construction industry continues to face challenges due to volatile and unstable material prices, which drive up costs. Despite these difficulties, the Company ensures a sufficient backlog of work to cushion its plans for the coming years.

“Patience is Key: ADTD Shareholders Refrain from Dividends, Awaiting Project Permits”

The sluggish market conditions in the real estate sector prompted HAR to focus on financial cost-cutting measures and refrain from paying dividends. While a significant portion of the company’s capital is tied up in uninitiated projects, the leadership assures that the permitting process is currently delayed and advises shareholders to “exercise patience.”

MSB’s General Meeting: Q1 Profit Reaches VND 1,630 Billion, 2-3 Potential Buyers for the Finance Company

On April 21, 2025, the Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) held its annual general meeting to discuss and approve key business strategies for the upcoming year. The agenda included proposals for dividend distribution, plans to increase charter capital, and decisions regarding the divestment from TNEX Finance and the potential acquisition of a securities company.

“LPBS Announces Impressive Q1 Results: Net Profit Surpasses VND 40 Billion, with an 81% Increase in Asset Size Since the Start of the Year”

Joint Stock Commercial Bank for Foreign Trade of Vietnam, or LPBank, announced that its securities arm, LPBS, recorded a net profit of over VND 40 billion in the first quarter of 2025. This impressive performance was driven by robust earnings from proprietary trading and lending activities, which successfully offset losses incurred in the brokerage division. As a result, LPBS’ total assets surged to a remarkable VND 9,175 billion, largely attributed to increased borrowing from its parent company, LPBank.