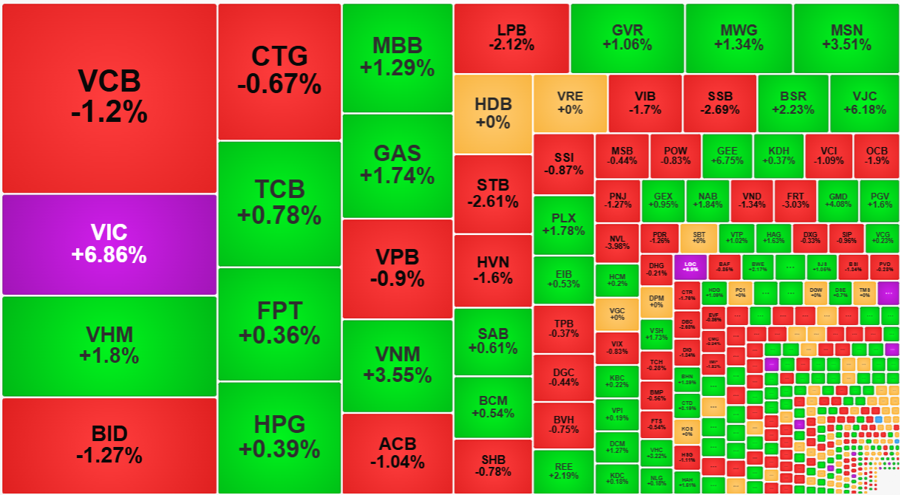

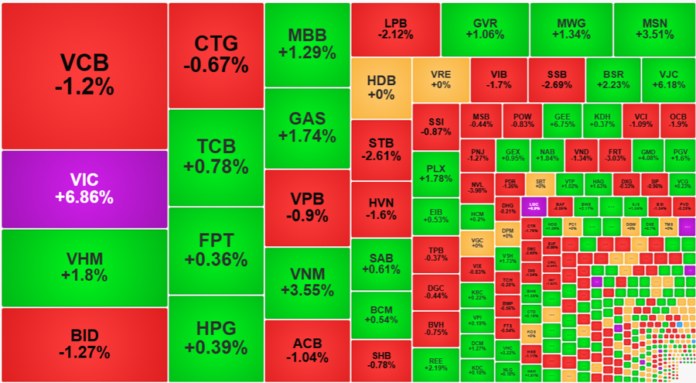

The stellar performance of VIC and VHM was instrumental in keeping the VN-Index firmly above the 1220 mark and posting solid gains towards the end of the session. The rebalancing activities of the VN30-linked ETFs put significant selling pressure on bank stocks.

The selling pressure from funds such as VNFinlead and Diamond was anticipated beforehand. Changes in the VN30 index’s weightings prompted a slew of bank stocks, including ACB, VIB, and VPB, to top the list of stocks to be sold. Naturally, not all bank stocks that underwent rebalancing fell during this session, but the sector as a whole undeniably faced heightened pressure.

Out of the 14 bank stocks in the VN30 basket, only MBB, which rose by 1.29%, TCB, up by 0.78%, and HDB, which closed unchanged, managed to stay in the green. The remaining bank stocks closed in the red, with ACB falling by 1.04%, BID by 1.27%, VCB by 1.2%, VPB by 0.9%, and LPB by 2.12%. These declines significantly weighed on the VN-Index. Among the top ten stocks dragging the index down, nine were from the banking sector. Furthermore, out of the 27 stocks in this sector across all exchanges, only nine finished in positive territory.

Fortunately, the market’s pillars extended beyond the banking sector. VIC, which hit the daily limit-up for the second consecutive session, contributed approximately 3.9 points to the VN-Index, almost offsetting the losses incurred by half of the declining bank stocks. The gains in VHM, VNM, MSN, VJC, and GAS also provided a substantial boost to the market. Many of these stocks benefited from increased capital allocation by ETFs as they reduced their exposure to bank stocks. VIC, VHM, MSN, VNM, and MWG were among the top stocks purchased by these funds.

Nonetheless, the overall picture among blue chips was one of tug-of-war, resulting in a balanced outcome. The VN30-Index closed up 0.42%, with 15 gainers and 13 losers. The VN-Index rose 0.48%, with 256 advancing stocks and 220 decliners. The Midcap index edged up 0.02%, while the Smallcap index climbed 0.5%. This equilibrium was pervasive, and there weren’t many stocks that exhibited significant outperformance in either direction.

Among the 256 stocks that closed in the green, only 87 rose more than 1%, accounting for 36.4% of the total trading value on the HoSE. Conversely, out of the 220 declining stocks, 67 fell by more than 1%, representing 20.3% of the total trading value. Thus, the vast majority of the market was confined to a narrow trading range, contributing to nearly half of the total trading value on the exchange.

Aside from the blue chips that benefited from ETF buying and posted substantial gains, a few mid-cap stocks also stood out, albeit with relatively limited liquidity. CII hit the daily limit-up with 322 billion VND in trading value, while GMD rose 4.08% on a turnover of 219 billion VND. GEE, VSC, CTD, and ORS also recorded impressive gains, with respective trading values of 158.9 billion, 145.2 billion, 126.6 billion, and 89.3 billion VND.

On the downside, the prominent losers were predominantly blue-chip bank stocks. Additionally, VCI, NVL, DBC, DIG, VND, and PNJ witnessed declines, each with trading values exceeding 100 billion VND.

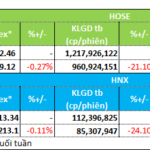

The tug-of-war among large-cap stocks helped maintain the VN-Index’s balance during a session marked by considerable volatility. The index briefly dipped below the reference level, hitting a low of 1220.67. However, the resilience of VIC, VHM, and other blue chips propelled the market higher. At the intraday low, there were 164 gainers and 296 losers, but by the closing bell, this ratio improved to 256 gainers and 220 losers. Nearly a hundred stocks managed to rebound, which is a positive development, although the associated trading volume was relatively modest. Today’s ETF-driven activities boosted the total trading value on the HoSE by approximately 13% compared to the previous session, reaching 18,375 billion VND.

Foreign investors were net sellers for the day on the HoSE, offloading a net value of 591.1 billion VND. However, their selling activities were concentrated in the morning session, and the afternoon session witnessed a more balanced dynamic, resulting in a net buying value of 7.4 billion VND. The stocks that witnessed the most substantial selling pressure from foreign investors were FPT, VIC, STB, VCI, and SHB, while HPG, MSN, and HDB were among the top buys.

The Cash Flow Conundrum: Unraveling the Capital Retreat in Real Estate Stocks

Last week saw a notable decline in transactions, with a significant outflow of funds from the real estate sector. Smaller and mid-cap stocks also suffered a similar fate, experiencing a withdrawal of investment funds.

Market Beat: Running Out of Steam at the Close

The market closed with positive gains, seeing the VN-Index rise by 1.87 points (+0.15%), reaching 1,219.12. Meanwhile, the HNX-Index climbed 3.52 points (+1.68%) to 213.1. The market breadth tilted in favor of bulls, with 571 advancing stocks against 229 declining ones. Within the VN30 basket, bulls dominated, recording 20 gainers, 6 losers, and 4 stocks closing flat.

The Stock Market Week of April 14-18, 2025: Wide-Ranging Sell-Off Pressure

The VN-Index concluded the session with a surprisingly narrowed advance, while the trading volume surpassed the 20-day average. This development underscores the persistent selling pressure that emerged as the index approached the January 2025 resistance zone (equivalent to 1,220-1,235 points). If the VN-Index fails to successfully breach this threshold in the upcoming period, the risk of a correction will become more apparent as profit-taking selling pressure tends to expand.

The Tiring Index

The VN-Index kicked off the week on a strong note, surging by almost 19 points. However, this was short-lived as the market witnessed two consecutive days of sharp declines. Although the index rebounded in the last two sessions, it still ended the week 2 points lower than Monday’s open, closing at 1,219.12.

![[IR Awards] Important Disclosure Dates for July 2025](https://xe.today/wp-content/uploads/2025/07/T7_V1-100x70.png)