TPBank, or Tien Phong Commercial Joint Stock Bank, has recently released an updated list of shareholders owning 1% or more of its charter capital as of April 17.

Notably, the non-UCITS PYN Elite Fund is no longer among the shareholders with a stake of 1% or more in the bank.

Previously, on August 30, 2024, TPBank disclosed a list of shareholders owning over 1% of its capital, which included PYN Elite Fund holding nearly 79 million TPB shares, equivalent to a 3.59% stake. By September 30, 2024, the Fund had increased its holdings to over 104 million shares, representing a 4.7% stake in TPB.

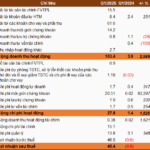

According to the 2025 Annual General Meeting documents, TPB set ambitious targets for the year, including total assets of VND 459 trillion, a 7.6% increase year-over-year. The bank also aims to raise total capital mobilization to VND 420 trillion, a 12.3% jump from the previous year, while growing loans and bonds issued to economic organizations to VND 313.75 trillion, a substantial 20% increase. Additionally, TPB targets a pre-tax profit of VND 9 trillion, an impressive 18.4% rise compared to the previous year.

In terms of dividend distribution, TPB proposed a 10% cash dividend payout ratio to the Annual General Meeting, along with a plan to increase its charter capital to over VND 27.74 trillion by issuing bonus shares to existing shareholders.

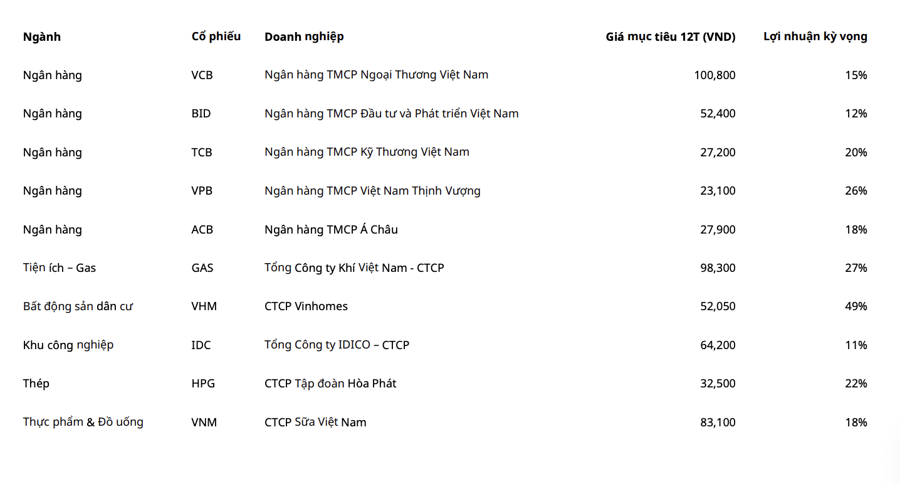

Unlocking Steady Growth and Unlocking Strong Returns: ACB’s 2025 Vision

Asia Commercial Bank has unveiled ambitious plans for the next five years, targeting VND23,000 billion in pre-tax profits and an impressive 16% credit growth by 2025. With a sharp focus on sustainable expansion and digital innovation, the bank aims to deliver consistent returns to its shareholders. This new strategy underscores the bank’s commitment to dynamic growth and positions it for a promising future in Vietnam’s evolving financial landscape.

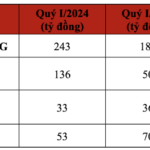

MSB’s General Meeting: Q1 Profit Reaches VND 1,630 Billion, 2-3 Potential Buyers for the Finance Company

On April 21, 2025, the Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) held its annual general meeting to discuss and approve key business strategies for the upcoming year. The agenda included proposals for dividend distribution, plans to increase charter capital, and decisions regarding the divestment from TNEX Finance and the potential acquisition of a securities company.

“LPBS Announces Impressive Q1 Results: Net Profit Surpasses VND 40 Billion, with an 81% Increase in Asset Size Since the Start of the Year”

Joint Stock Commercial Bank for Foreign Trade of Vietnam, or LPBank, announced that its securities arm, LPBS, recorded a net profit of over VND 40 billion in the first quarter of 2025. This impressive performance was driven by robust earnings from proprietary trading and lending activities, which successfully offset losses incurred in the brokerage division. As a result, LPBS’ total assets surged to a remarkable VND 9,175 billion, largely attributed to increased borrowing from its parent company, LPBank.

DNSE Captures 33% of New Brokerage Accounts in Q1

In Q1 of 2025, DNSE Securities witnessed a remarkable 34% surge in revenue compared to the same period last year. This impressive growth is further accentuated by a 10% increase in margin loan balances since the beginning of the year. DNSE Securities also maintained its dominant position in the market, capturing a substantial 33% of all new brokerage accounts opened, solidifying its leadership in the industry.