Dinh Quang Hinh, Head of Macroeconomic and Securities Market Analysis at VnDirect, has shared his insights on the economic outlook for Vietnam in 2025.

The US’ imposition of a 46% retaliatory tariff on imports from Vietnam presents significant challenges for an export-dependent economy like Vietnam. While the US’ temporary 90-day suspension of tariffs may boost Vietnam’s exports and GDP growth in Q2/25 due to increased inventory stockpiling by US retailers, the economy’s growth in the second half could face difficulties if trade negotiations between Vietnam and the US are unsuccessful and the new retaliatory tariff rate does not decrease significantly from 46%.

Even if the tariff is reduced, prolonged negative impacts may persist. US consumers may face rising inflation and slower income growth due to tariffs, potentially reducing demand for imported goods. As a result, Vietnam’s GDP growth prospects for 2025 are faced with risks stemming from US trade protectionism.

However, the Vietnamese government remains steadfast in its 8% GDP growth target for this year and is prepared to implement more aggressive economic stimulus policies if trade negotiations with the US encounter obstacles or if significant risks emerge, such as supply chain disruptions or a global recession.

Adjusting Vietnam’s GDP forecast at this point is premature due to insufficient information and data to make an accurate assessment, as there is still a low possibility of a significant shift in trade negotiations favoring Vietnam. Therefore, VnDirect has decided to maintain its GDP growth forecast for 2025 while awaiting clearer trade negotiation outcomes and closely monitoring FDI trends and government economic stimulus policies for a comprehensive evaluation.

Consequently, VnDirect upholds its projection of Vietnam’s GDP growth for 2025 at 7.3% year-on-year.

The US’ announcement of a 46% retaliatory tariff on Vietnamese imports triggered a significant sell-off in industrial real estate stocks, reflecting investors’ growing concerns about the short-term FDI outlook.

Although the 46% tariff rate is currently suspended for 90 days, new FDI registrations are expected to be significantly impacted and may even freeze in the short term. While additional FDI and realized FDI may be less severely affected than new FDI registrations, delays in disbursements and land rental payments until there is clearer information about the final retaliatory tariff rate post-negotiation pose risks of disruptions to investment flows in the near future.

Investors fear the worst-case scenario of a mass exodus of existing FDI projects from Vietnam, but this risk is low in the short to medium term as other countries in the region also face significant tariff rates, high relocation costs, policy uncertainties within the four-year term of the current US presidency, and Vietnam’s strong competitive advantages.

In a positive sign, Japanese electronics manufacturer Sourcenext plans to establish a new production base in Vietnam to proactively mitigate the impact of retaliatory tariffs between the US and China, demonstrating foreign investors’ confidence in Vietnam’s fundamentals amidst evolving trade dynamics.

On the currency front, pressures will intensify following the announcement of US retaliatory tariffs. In the short term, the VND will continue to face depreciation pressures. The weakening of the DXY will strengthen other currencies, notably the Euro, as investors seek safe havens amid volatile global trade conditions. A stronger Euro will exert additional pressure on the VND.

Moreover, the 46% retaliatory tariff could lead to a slowdown in both FDI and FII inflows into Vietnam. This is on top of Vietnam’s ongoing negotiations with the US to secure potential trade agreements, which would entail increased imports of American goods in the near future, further pressuring the exchange rate.

Given these circumstances, VnDirect believes that the State Bank of Vietnam needs to adopt a more flexible exchange rate management approach to support the export sector, which is already burdened by tariffs. This includes accepting a wider exchange rate fluctuation band, especially considering that Vietnam’s foreign reserve levels are currently below the IMF’s recommended threshold.

VnDirect also anticipates stability in deposit interest rates and maintains its forecast of a 12-month average deposit interest rate of 4.8-5.0% for 2025, reflecting the view that the State Bank of Vietnam will continue its accommodative monetary policy stance, actively support system liquidity, and maintain a low-interest-rate environment to bolster the economy.

Looking ahead, if the Fed proceeds with the expected rate cut cycle, the State Bank of Vietnam will have more room to loosen monetary policy. Should the Fed cut rates two to three times this year, the State Bank of Vietnam may consider reducing the OMO interest rate from its current level of 4%/year. In a more aggressive easing move, the State Bank of Vietnam could lower its operating interest rate by 25 basis points in Q3/2025 to stimulate credit growth and support the GDP growth target.

The Greenback’s Allure: Why Many are Hoarding USD

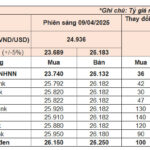

Today (April 10th), the USD exchange rate on the black market soared past 26,200 VND per USD. This surge has prompted a rush among individuals to stockpile USD, anticipating further significant increases in value by the year’s end.

The Greenback and the Yuan: A Dynamic Duo on the Rise

The State Bank of Vietnam has set the reference exchange rate at 24,831 VND per USD, an increase of 18 VND from the previous day’s morning session. With a allowed band of +/- 5%, the ceiling and floor rates for the day are 26,073 VND and 23,589 VND per USD, respectively.