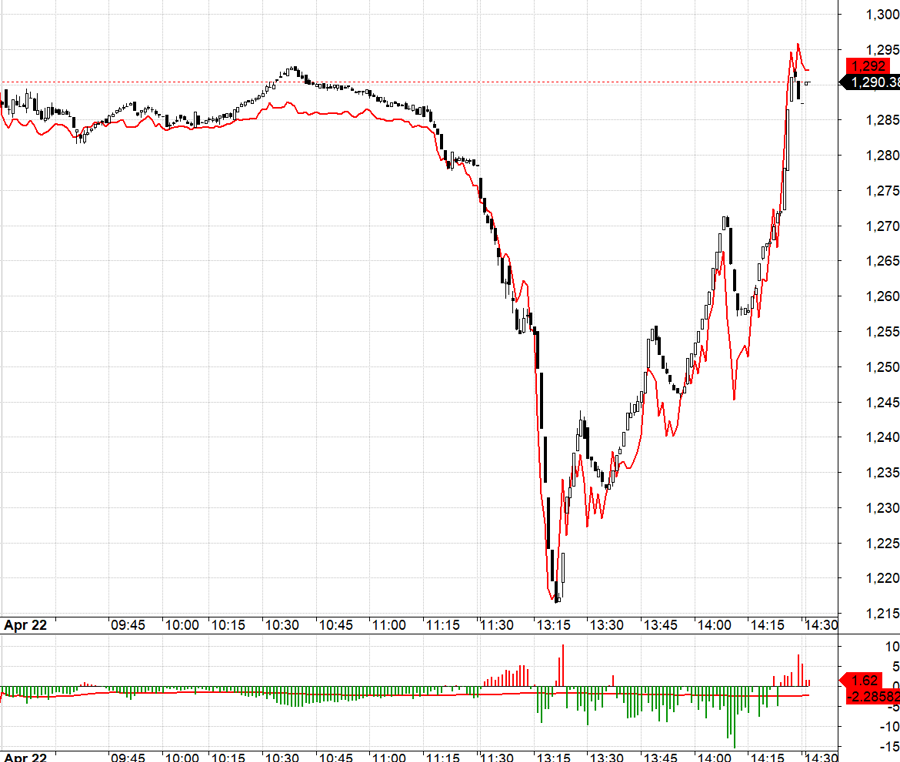

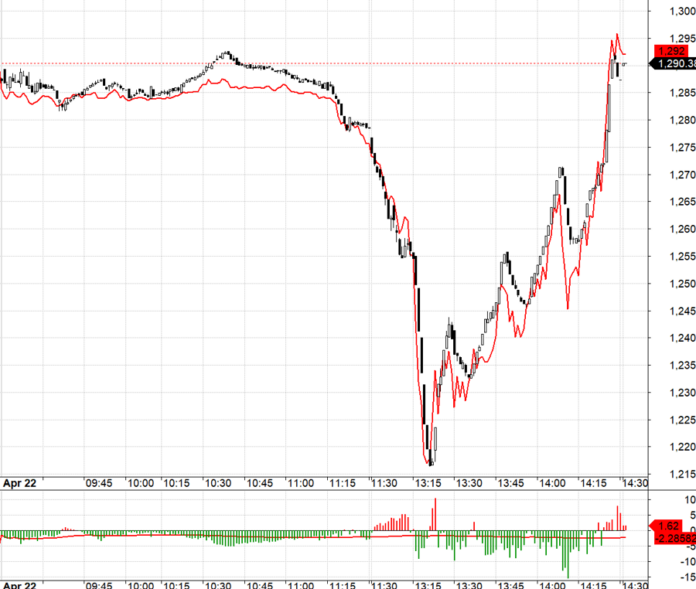

The market suddenly witnessed a sharp sell-off at the beginning of this afternoon’s session, pushing VNI down by 5.81%, reminiscent of the volatile sessions during the tariff panic. This presents a great opportunity to enter the market.

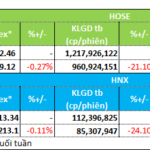

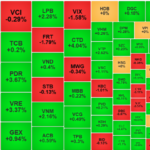

The trading pressure in the first 30 minutes was extremely high, with over 170 stocks on HSX falling to their daily limit losses, and 12 stocks in the VN30 group experiencing the same fate. This select group of stocks traded over 6,100 billion VND in just 30 minutes, accounting for 52% of the total matched orders for the afternoon session.

The extremely high liquidity indicates a notable concentration of trading activity. VNI also decreased rapidly by 4.33% in a very short period. It is likely that this proactive sell-off caught buyers off guard, resulting in many pending orders being filled without the opportunity to cancel. Sellers disregarded prices and even hit buy orders at very low prices, as evidenced by the fact that in addition to the 170 stocks that fell to their daily limit losses, nearly 150 other stocks experienced declines ranging from 3% to over 6%.

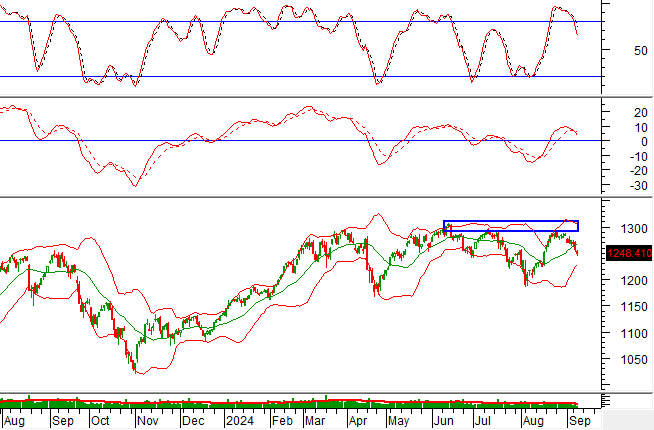

It is unclear what caused this volatility, whether it was due to undisclosed information, forced liquidation, or any other reason. What matters is that a massive volume of stocks changed hands. Today’s volume was equivalent to the session on April 11th, which saw a massive buying response (1.83 billion shares traded on the two exchanges), and most of this volume resulted in losses. From a positive perspective, this extreme volatility has shaken loose a significant amount of weak hands. However, a skeptical perspective would suggest that there must have been a very negative reason for such a sudden sell-off in the market.

Investors will have time to investigate and discuss the cause of this volatility. What’s important is how the market will react going forward. Many stocks were affected simultaneously, similar to what occurred during the initial tariff panic. This volatility presents an opportunity to select targeted stocks, and even some good stocks are now trading at attractive prices, nearing their lows from three weeks ago.

Today’s bottom-fishing money was also impressive, with the two exchanges’ liquidity soaring to 33.6 trillion VND, excluding matched orders. Foreign investors also bought significantly in the afternoon session. The strength of stocks, as well as the bottom-fishing demand during such sessions, is reflected in the recovery margin. The stronger the recovery, the better. If the recovery surpasses the reference price, it indicates a robust market. If the liquidity is small, it suggests that sellers are not offloading enough. Conversely, if the liquidity is substantial, it means that buyers are aggressively scooping up stocks.

Buying during panic sessions offers the advantage of a lower cost basis, and there is no need to compete with other buyers. While the market is not yet risk-free, the maximum level of panic and forced liquidation has certainly passed. A low cost basis provides a good risk buffer in this situation.

The volatility on the futures market today was also exceptionally large, mirroring the underlying market and exceeding expectations. As soon as the afternoon session began, a significant downward push emerged with great intensity and speed. Even those monitoring the futures market would have been unable to react and go short in such a scenario, unless they were “involved” in the price suppression. Therefore, one could only go long and bet on a temporary scenario for this price suppression.

With strong bottom-fishing money and resilient stocks quickly recovering and even reversing their losses, the market is likely to stabilize in the coming sessions. Currently, the scenario for a market increase is still unlikely, as there is no strong catalyst, but there is also nothing shockingly negative to trigger another sell-off. The strategy is to temporarily pause stock purchases and happily go long or short with futures.

VN30 closed today at 1290.38. Tomorrow’s nearest resistances are 1292; 1303; 1315; 1322; 1327. Supports are 1279; 1272; 1263; 1260; 1255.

“Blog Chứng Khoán” reflects the personal perspective of the investor and does not represent the views of VnEconomy. The opinions and assessments expressed are solely those of the author, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the published opinions and investment perspectives.

The Market Beat, February 18th: A Sea of Green, With a Hint of Differentiation

The VN-Index managed to stay in the green at the end of a volatile and tug-of-war afternoon session. While the market opened with a broad rally, it turned slightly “redder” as the session drew to a close.

The Stock Market Breakthrough: Scaling New Heights in 2025

The upgrade of the stock market from frontier to emerging status is a significant and correct government initiative, closely monitored and directed by the Prime Minister in the past term. The goal is to have the Vietnamese stock market upgraded to emerging status by 2025, as outlined in the approved Strategy for the Development of the Stock Market until 2030.

The Cash Flows into Mid and Small-Cap Stocks

Although the VN-Index closed today with a modest gain of 0.39%, nearly a hundred stocks outperformed, rising over 1% compared to their reference prices. Notably, only six of these were from the VN30 basket, with the majority being small- and mid-cap stocks. Among these, several high-liquidity stocks stood out, leading the market’s gains.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)