A significant weakening of the pillars, combined with unfavorable developments in the international market, pushed Vietnamese stocks into a fierce downward spiral this morning. Investors tried to get out, not quite at a selling-off level, but still pushing hundreds of stocks down sharply. The VN-Index fell to 1189.07.

This index is evaporating 1.49%, equivalent to an 18-point drop, with a breadth of only 79 gainers/395 losers. Among these, 122 stocks fell by more than 2%, and if calculated from the -1% margin, there were 200. It’s clear that the index does not yet reflect the full extent of the damage to investors’ portfolios.

The market is currently in a quiet news phase, and a few disappointing Q1/2025 earnings reports have emerged. There is nothing new about the external developments regarding tariff conflicts, but the US stock market’s overnight evaporation of more than 2% shows that the troubles are still haunting. For the domestic market, the recovery rhythm has not shown any signs of ending, so a defensive mindset prevails.

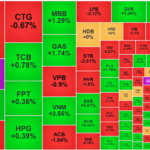

The group of blue-chip stocks remains the primary pressure on the overall market and causes the VN-Index to lose the most points. Quite surprisingly, VIC is not the “culprit.” This stock only plummeted drastically within the first 40 minutes, with a bottom price evaporating 5.53% in value. However, after that, VIC recovered gradually and closed the session with a slight loss of 0.16%. On the contrary, the VN-Index’s most precipitous plunge occurred from around 10:40 onwards. In other words, VIC played a role in propping up the index.

The pressure comes from numerous other blue-chip stocks. GVR had a dizzying nosedive in the last 15 minutes of the morning session. Its value plummeted by 4.54% in this very short period, and GVR closed 6.75% lower. FPT initially resembled VIC, falling rapidly and deeply within the first 45 minutes, losing 3.13%, before rebounding. However, from 10:30 onwards, it plunged again and ended the morning session 2.95% lower. Among the ten largest stocks by market capitalization in the VN-Index, there were also declines in VCB by 1.03%, VHM by 1.64%, CTG by 1.74%, TCB by 2.14%, and GAS by 1.55%.

The VN30-Index is down 1.22%, with only MWG up 1.26% and VIB up 0.28%; the remaining 28 stocks are in the red, 18 of which have lost over 1%.

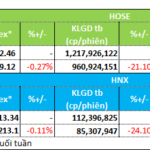

The downward pressure on prices is controlling almost the entire market, as evidenced by 200 stocks on the HoSE evaporating by more than 1%. The matched order liquidity decreased slightly by 1.7% compared to yesterday morning, and given the price decline, this is still a high liquidity threshold. This floor currently has 27 stocks with transactions above 100 billion VND, accounting for 63% of the total volume, with only four in the green and the rest in the red. Among these, 15 declined by more than 1%.

The group swimming against the tide today is insignificant due to their small number and concentration in stocks with low liquidity. MWG rose 1.26% with a match of 212.1 billion, NVL increased by 1.94% with 200 billion, FRT climbed 2.45% with 60.4 billion, GEG advanced 1.06% with 26 billion, and VOS surged 3.52% with 22.5 billion—these are the only notable stocks.

Bottom-fishing demand this morning was very passive, mainly waiting for sellers to match orders. This type of buying is almost “letting go,” and liquidity depends entirely on the sellers. Of course, a few stocks were supported and pulled up, but this was primarily based on minimal liquidity. Overall, only 89 stocks recovered by more than 1% compared to their lowest prices, equivalent to about 25% of the total number of stocks traded in the VN-Index.

Foreign investors are also significantly increasing their selling scale. Specifically, this group dumped VND 1,403.7 billion worth of stocks on the HoSE, up 41% from yesterday morning. The buying value reached VND 880.6 billion, a slight increase of 10%, resulting in a net sell-off of VND 523.1 billion, the highest in seven sessions. The expansion of their net selling scale indicates a change after a few days of small transactions, even switching to net buying on some occasions.

On the bright side, the scale of capital withdrawal by foreign investors is spread out rather than concentrated in a few stocks. KBC suffered the most significant net selling, at VND 81.7 billion, followed by FPT at VND 55.8 billion, VHM at VND 50.3 billion, VND at VND 33.5 billion, and DIG at VND 32.1 billion. On the buying side, HPG led with a net purchase of VND 77.5 billion, followed by MWG with VND 35.8 billion and ACB with VND 24.5 billion.

The Stock Market Slump: VN-Index Plunges Towards 1200 Points

Concerns about pressure from large-cap stocks, particularly VIC, are being realized. VCB is the sole pillar trying to swim against the tide, but it’s unable to counterbalance the decline of numerous other large-cap stocks. The VN-Index plummeted throughout the morning session, closing at its lowest point, down nearly 13 points, or -1.06%, at 1,206.15.

Bank Stocks Under Pressure, VN-Index Holds Firm Above 1,220 Points

The stellar performance of VIC and VHM was instrumental in keeping the VN-Index firmly above the 1,220-point mark and driving a strong finish to the session. The rebalancing activities of the VN30-tracking ETF funds put significant selling pressure on bank stocks, but the resilience of these two heavyweights helped offset this.

Market Beat: Running Out of Steam at the Close

The market closed with positive gains, seeing the VN-Index rise by 1.87 points (+0.15%), reaching 1,219.12. Meanwhile, the HNX-Index climbed 3.52 points (+1.68%) to 213.1. The market breadth tilted in favor of bulls, with 571 advancing stocks against 229 declining ones. Within the VN30 basket, bulls dominated, recording 20 gainers, 6 losers, and 4 stocks closing flat.