Blue-chip stocks’ stability is boosting market confidence and enabling a more confident stock selection. The mid- and small-cap groups shone this morning due to their low liquidity and weak selling pressure.

After a highly volatile session that ended on a positive note yesterday, the market sentiment carried over significantly, especially with global stock markets also rallying and softer messages emerging on tariffs and trade conflicts. However, this is still a waiting period for more concrete results rather than just words.

Today’s trading session was not particularly strong and was somewhat cautious. The market opened with a significant gain of 18.5 points, equivalent to nearly 1.55%. This was also the highest intraday gain. Subsequently, the market slowed down, and many stocks retreated, but overall, it remained in positive territory. The VN-Index hit its deepest low around 10:10 am but still managed a gain of over 5 points, with 335 stocks advancing and 110 declining. The index eventually closed up 12.5 points (+1.04%) with 369 gainers and 114 losers.

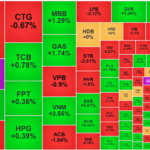

Most stocks experienced mild fluctuations this morning, but sellers did not exert significant pressure. In fact, it was the blue-chips that caused this volatility. The VN30-Index hit its low alongside the VN-Index and ended the morning session up 0.99%, still unable to surpass the intraday high. Meanwhile, the Midcap index rose 2.02%, and the Smallcap index climbed 1.56%, both reaching their highest levels.

Several pillars are experiencing notable declines, despite the VN30 basket having only 2 red stocks and 27 green ones. VIC reached a peak after 9:30 am, rising 2.2%, but then fell back to the reference price. VCB is up slightly by 0.34% after dropping 1.18% from its peak shortly after the opening. A host of other large-cap bank stocks, including BID, CTG, and TCB, followed a similar pattern, opening at their highest prices before sliding, with a decline of over 1%.

On the bright side, blue-chips continue to attract stable investment above the reference price. At its worst, the VN30 basket had 11 red stocks, but most have since recovered. FPT fell 0.63%, and SHB dropped 1.52%, making them the only two stocks yet to turn green. Nonetheless, FPT has rebounded 1.86% from its low, and SHB has climbed 1.56%. This morning, the VN30 basket’s trading volume rose nearly 39% from the previous morning, reaching approximately VND 5,340 billion, the highest in the last six morning sessions. Additionally, this basket accounted for 56.9% of the total matched orders on the HoSE, an exceptionally high proportion. This indicates a concentration of investment capital in maintaining stability among blue-chips.

Currently, 16 out of 30 stocks in the VN30 basket are up more than 1% compared to the reference price, with 7 stocks climbing over 2%. Leading the pack are VRE, up 5.1%; SAB, up 3.33%; VJC, up 2.87%; BVH, up 2.76%; SSI, up 2.7%; and MWG, up 2.62%. Notably, none of these stocks are among the top 10 in terms of market capitalization on the VN-Index. Even the largest stock by market cap, MWG, ranks only 16th. The underperformance of the leading stocks by market cap is restraining the VN-Index’s recovery, but this is not a significant concern as investment capital is flowing into specific opportunities.

On the HoSE, a substantial 120 stocks have climbed over 2%, and another 60 have gained more than 1%. This high-performing group accounts for 60.4% of the total trading volume, a positive sign as most investors will feel that their portfolios are growing strongly.

The mid- and small-cap groups have several standout performers: VTP, DCL, DXS, SGR, CTI, DXG, and APG hit the ceiling with relatively high trading volume. Notably, DXG matched orders worth VND 167.1 billion. Other stocks, such as CTR, BAF, YEG, NTL, TCH, HSG, and BMP, surged over 5%. Only VRE from the VN30 basket made it into this leading group.

In terms of liquidity, BAF, DIG, DBC, VIX, GEX, NVL, DGC, TCH, VCG, and HCM all matched orders worth hundreds of billions of VND. While this group also experienced price dips during the session, their ability to maintain high liquidity indicates that investment capital is ready to catch falling knives. This reflects a very open trading stance.

On the downside, there were no notable stocks today, as most had minimal trading volume or insignificant price movements. SHB and FPT were the two stocks with the largest trading volume among the decliners, with a few others, such as GEE falling 1.29% with VND 32.7 billion in trading volume; KDC dropping 2.09% with VND 23.4 billion; HAH slipping 0.66% with VND 31.2 billion; PVT declining 0.49% with VND 21.5 billion; and PHR decreasing 0.24% with VND 21.9 billion.

Foreign investors are net selling VND 286.8 billion on the HoSE, a significant decrease from the previous morning’s net selling of VND 523.1 billion. Their selling decreased by 12%, while their buying increased by 8%. FPT is facing the most significant net selling of VND 137.3 billion, followed by SHB with VND 60.2 billion and MBB with VND 38.4 billion. On the net buying side, BAF leads with VND 49.5 billion, followed by VNM with VND 41.5 billion, DXG with VND 28.5 billion, VRE with VND 24.6 billion, and TCH with VND 23.8 billion.

The Stock Market Slump: VN-Index Plunges Towards 1200 Points

Concerns about pressure from large-cap stocks, particularly VIC, are being realized. VCB is the sole pillar trying to swim against the tide, but it’s unable to counterbalance the decline of numerous other large-cap stocks. The VN-Index plummeted throughout the morning session, closing at its lowest point, down nearly 13 points, or -1.06%, at 1,206.15.

Bank Stocks Under Pressure, VN-Index Holds Firm Above 1,220 Points

The stellar performance of VIC and VHM was instrumental in keeping the VN-Index firmly above the 1,220-point mark and driving a strong finish to the session. The rebalancing activities of the VN30-tracking ETF funds put significant selling pressure on bank stocks, but the resilience of these two heavyweights helped offset this.

Market Beat: Running Out of Steam at the Close

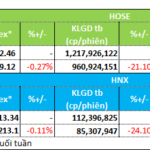

The market closed with positive gains, seeing the VN-Index rise by 1.87 points (+0.15%), reaching 1,219.12. Meanwhile, the HNX-Index climbed 3.52 points (+1.68%) to 213.1. The market breadth tilted in favor of bulls, with 571 advancing stocks against 229 declining ones. Within the VN30 basket, bulls dominated, recording 20 gainers, 6 losers, and 4 stocks closing flat.

The Tiring Index

The VN-Index kicked off the week on a strong note, surging by almost 19 points. However, this was short-lived as the market witnessed two consecutive days of sharp declines. Although the index rebounded in the last two sessions, it still ended the week 2 points lower than Monday’s open, closing at 1,219.12.