The concern about the pressure from large-cap stocks, especially VIC, is being validated. VCB is the only pillar trying to buck the trend, but it’s unable to balance out the decline of many other large-cap stocks. VN-Index plummeted throughout the morning session and closed at its lowest level, down nearly 13 points, or -1.06%, to 1206.15.

VIC declined as soon as the market opened, but it still made an upward effort in the first half of the session. Around 9:49 AM, VIC reached a peak of 1.97% above the reference price, but then it faced significant pressure and started tumbling down. By the end of the morning session, VIC had dropped by 3.33% compared to the reference price, equivalent to a 5.19% decrease from its peak. Its trading volume ranked 5th in the market, with 380.2 billion VND. VIC alone took away approximately 2 points from the VN-Index and 2.3 points from the VN30-Index.

VHM fared better than VIC, exhibiting narrower fluctuations, and ended the morning session with a slight decline of 0.73%. Similarly, VRE managed to maintain its price and closed at the reference price with a substantial buying surplus.

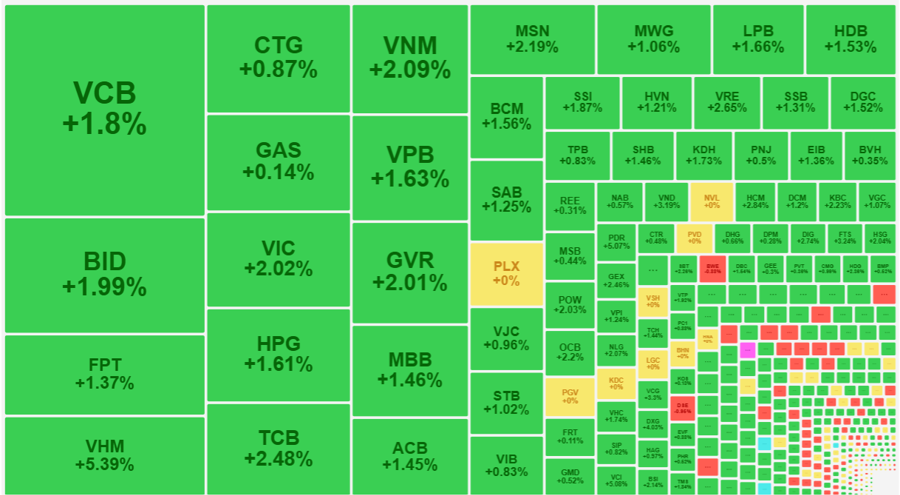

The impact of VIC was amplified by numerous other blue-chips. In the VN30 basket, only 5 codes increased, while 24 decreased, with 17 of them falling by more than 1%. The representative index of this basket is also at -1.11%. Among the top 10 market caps of the VN-Index, BID decreased by 1.81%, CTG by 1.74%, TCB by 1.35%, FPT by 1.16%, HPG by 1.38%, and MBB by 1.51%. Additionally, LPB, GVR, and BVH were other codes that declined by more than 2% in value.

The five codes that went against the downward trend in the VN30 group included TPB, up 2.27%; SHB, up 0.78%; VIB, up 0.55%; VNM, up 0.35%; and VCB, up 0.17%. Regarding the pillars, only VCB was notable, while VNM has not yet made it into the top 10 market caps.

The imbalance in the group of stocks leading the point scores significantly influenced the overall market. Midcap decreased by 1.24%, and Smallcap fell by 0.82%. The breadth of the HoSE floor at the end of the morning session showed only 125 codes increasing against 343 codes decreasing. The selling pressure was quite strong, mainly in the red price range. When the VN-Index rose to its highest level above the reference price at 9:50 AM, the breadth was 185 codes increasing versus 205 codes decreasing.

Numerous stocks are currently plunging. The HoSE floor recorded 163 stocks falling by 1% or more, including 74 codes decreasing by more than 2%. This group accounts for approximately 66% of the total matched orders value on the HoSE floor, confirming that deep selling pressure below the reference price is dominating most stocks.

Financial stocks are under immense pressure. Securities companies are witnessing high trading volumes and weak prices. HCM decreased by 5.76% with nearly 437 billion VND in matched orders; VCI fell by 3.91% with 423.9 billion; VIX dropped by 1.97% with 318.4 billion; SSI declined by 1.93% with 277 billion; and VND decreased by 3.51% with 233.4 billion. More than 20 stocks in this group fell by over 2%. In the banking sector, MBB, STB, CTG, and TCB had substantial trading volumes. Fourteen out of 27 banking codes across the exchanges are currently down by more than 1%.

On the upside, although 125 codes remained in positive territory, only a few stocks significantly went against the general trend. VCG rose by 1.37% with a trading volume of 192.7 billion; NVL increased by 4.96% with 173.8 billion; TPB climbed by 2.27% with 133.1 billion; CTD went up by 1.31% with 58.9 billion; EVF advanced by 2.72% with 52.6 billion; and VCS rose by 1.7% with 44.9 billion, being the only stocks that stood out from the general landscape.

Foreign investors maintained net selling on the HoSE, totaling approximately 195.5 billion VND, but there weren’t many codes with sudden selling. The leading codes were HCM -81.2 billion, GEX -44 billion, TPB -41.6 billion, VIX -34 billion, VHM -23.6 billion, and SSI -23.5 billion. On the net buying side, SHB +62.3 billion, VIC +59.4 billion, FPT +40.6 billion, VRE +34.8 billion, and BMP +22.2 billion.

The VN-Index closed the morning session at 1206.15 points. HoSE’s trading volume slightly decreased by 4% compared to the previous morning session, and many stocks closed at or near their lowest prices, indicating that sellers still dominated the fluctuations. The 120-point threshold has appeared once before on April 17, and now it has another chance to be tested.

Bank Stocks Under Pressure, VN-Index Holds Firm Above 1,220 Points

The stellar performance of VIC and VHM was instrumental in keeping the VN-Index firmly above the 1,220-point mark and driving a strong finish to the session. The rebalancing activities of the VN30-tracking ETF funds put significant selling pressure on bank stocks, but the resilience of these two heavyweights helped offset this.

Market Beat: Running Out of Steam at the Close

The market closed with positive gains, seeing the VN-Index rise by 1.87 points (+0.15%), reaching 1,219.12. Meanwhile, the HNX-Index climbed 3.52 points (+1.68%) to 213.1. The market breadth tilted in favor of bulls, with 571 advancing stocks against 229 declining ones. Within the VN30 basket, bulls dominated, recording 20 gainers, 6 losers, and 4 stocks closing flat.

The Stock Market Week of April 14-18, 2025: Wide-Ranging Sell-Off Pressure

The VN-Index concluded the session with a surprisingly narrowed advance, while the trading volume surpassed the 20-day average. This development underscores the persistent selling pressure that emerged as the index approached the January 2025 resistance zone (equivalent to 1,220-1,235 points). If the VN-Index fails to successfully breach this threshold in the upcoming period, the risk of a correction will become more apparent as profit-taking selling pressure tends to expand.

The Tiring Index

The VN-Index kicked off the week on a strong note, surging by almost 19 points. However, this was short-lived as the market witnessed two consecutive days of sharp declines. Although the index rebounded in the last two sessions, it still ended the week 2 points lower than Monday’s open, closing at 1,219.12.