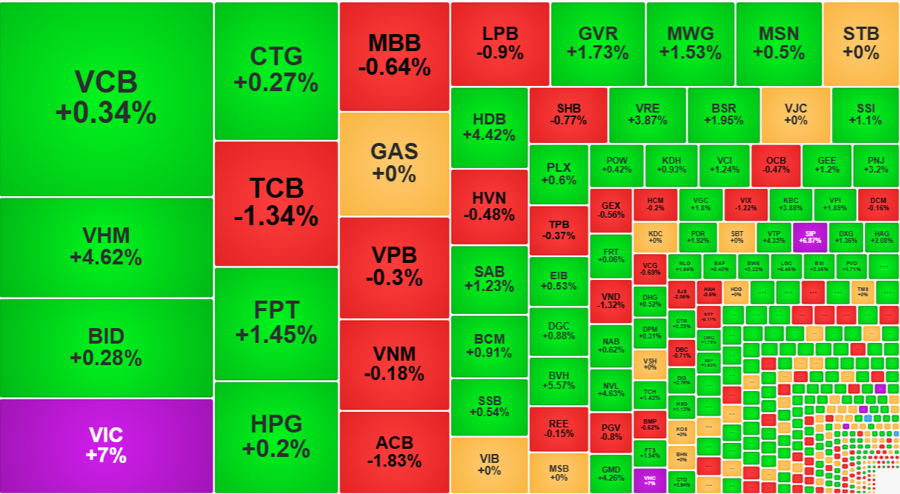

The afternoon session witnessed a continuation of the morning’s choppy trading state for a few more minutes, followed by a strong upward surge. VIC and VHM, the leading stocks, impressively led a host of other blue-chips higher. The VN-Index closed above the 1220-point mark, while foreign investors also made a strong showing with substantial net buying.

An impressive 19 stocks in the VN30 basket advanced in the afternoon session compared to their morning closing prices, with only 9 declining. The “trio” of VIC, VHM, and VRE led the charge. Notably, VIC started to shine brightly from around 1:45 pm onwards and closed at the daily limit-up price. After four consecutive sessions of losses totaling 17.5%, VIC rebounded with a 7% gain. The stock had already shown strength in the morning session (up 4.44%) and saw relatively modest trading volume in the afternoon, at around VND280 billion in matched orders. It appears that the selling pressure on VIC has eased.

VHM performed even better, starting from a less favorable position than VIC. At noon, VHM struggled to maintain its reference price, but in the afternoon, a flood of buying orders propelled it upward. VHM rose continuously until just before the closing bell and ended the day 4.62% above its reference price. VHM had the highest trading volume in the market, with VND585.2 billion worth of shares changing hands in the afternoon session.

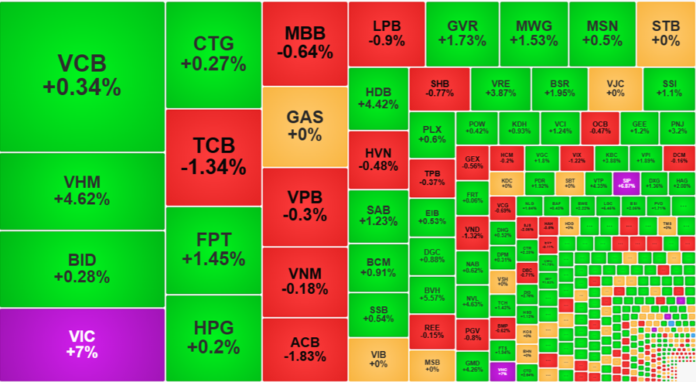

The impact of VIC and VHM was significant, contributing 6.4 points to the VN-Index’s total gain of 12.35 points. For the VN30-Index, these two pillars added 6.9 points to its 8.62-point increase. Additionally, several other blue-chip stocks also performed well in the afternoon session: VRE added 3.64% to its morning gain, closing up 3.87% above its reference price. MSN rose 2.04%, successfully reversing into positive territory to close 0.5% higher. BID increased by 1.14%, turning a morning loss into a 0.28% gain. MWG climbed 1.7%, ending the day 1.53% higher. CTG rose 1.36%, finishing 0.27% in the green. Even SHB, which had a poor morning session, narrowed its loss in the afternoon, closing down just 0.77%.

The combined effect of the leading stocks surging higher and other pillars reducing losses or reversing into positive territory resulted in a remarkable upward climb for the VN-Index towards the end of the day. The index not only surpassed the intraday high set in the morning session but also went a step further, closing just below its highest level, up 12.35 points or 1.02%. Thus, the volatility witnessed in the first two trading days of the week was fully recovered, and the VN-Index reclaimed the 1220-point level, closing at 1223.35.

In fact, the rally could have been even more explosive if the pillars had shown more unanimity. The standout performance was limited to VIC and VHM, while VCB remained unchanged. TCB and VPB even fell in the afternoon session, and GAS retreated to its reference price. The VN30 basket still had 8 stocks in the red, and the index rose by only 0.66%.

On a positive note, the broader market also strengthened, with good liquidity maintained among small and medium-cap stocks. Firstly, the market breadth improved: At noon, the VN-Index had 230 gainers and 226 losers, but by the closing bell, there were 289 gainers and 207 losers. The number of stocks rising by more than 1% increased from 102 in the morning to 128. In terms of capital distribution, out of the 41 stocks on the HoSE with liquidity exceeding VND100 billion – accounting for 75.5% of the total trading value on the exchange – only 12 stocks closed in the red, with the rest in the green.

Numerous stocks witnessed high trading volume and sharp price increases, even though they were not blue-chips. VHC hit the daily limit-up price with a volume of VND104.6 billion; VSC rose 5.84% with a volume of VND145.4 billion; NVL climbed 4.63% with a volume of VND355.6 billion; VTP advanced 4.35% with a volume of VND217.4 billion; GMD increased 4.26% with a volume of VND164.5 billion; KBC rose 3.88% with a volume of VND274.7 billion… Stocks with lower liquidity even witnessed more dramatic gains, such as DCL, SIP, and CSM, which also hit the daily limit-up price, while FMC, TLH, ASM, IDI, NTL, TCM, VDS, and ORS rose between 4% and 6%.

On the downside, the number of stocks falling by more than 1% decreased from 53 in the morning to 44 in the afternoon. Trading was concentrated in a few stocks: VIX fell 1.22%, TCB lost 1.34%, VND declined 1.32%, and ACB dropped 1.83%. In fact, out of these 44 stocks, only 7 had matched orders exceeding VND10 billion.

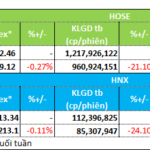

Foreign investors also surprised the market in the afternoon session, with a significant increase in net buying. Their net buying value in the afternoon session was 48% higher than in the morning session, reaching VND1,448 billion, while net selling was VND831 billion. This resulted in a net buying value of VND617 billion for the afternoon session, compared to a net selling value of VND38 billion in the morning. The stocks that attracted strong net buying were HPG (VND151.9 billion), MWG (VND138.1 billion), VHM (VND109.4 billion), STB (VND88.1 billion), NVL (VND46.9 billion), and SAB (VND42.6 billion). On the net selling side, GEX (-VND79 billion), SHB (-VND73.9 billion), VIC (-VND39.4 billion), and GVR (-VND35.9 billion) stood out.

The Red Hot Electric Board: VN-Index Plunges Below the 1200-Point Mark, Foreigners Sell Off in the Highest 7 Sessions

The significant weakening of pillars, coupled with unfavorable developments in the international market, sent Vietnamese stocks into a sharp decline this morning. Investors tried to offload their positions, and while it didn’t quite turn into a panic sell-off, it still resulted in hundreds of stocks plunging. The VN-Index tumbled to 1,189.07 points…

The Stock Market Slump: VN-Index Plunges Towards 1200 Points

Concerns about pressure from large-cap stocks, particularly VIC, are being realized. VCB is the sole pillar trying to swim against the tide, but it’s unable to counterbalance the decline of numerous other large-cap stocks. The VN-Index plummeted throughout the morning session, closing at its lowest point, down nearly 13 points, or -1.06%, at 1,206.15.

Bank Stocks Under Pressure, VN-Index Holds Firm Above 1,220 Points

The stellar performance of VIC and VHM was instrumental in keeping the VN-Index firmly above the 1,220-point mark and driving a strong finish to the session. The rebalancing activities of the VN30-tracking ETF funds put significant selling pressure on bank stocks, but the resilience of these two heavyweights helped offset this.