In a low-interest-rate environment, many investors are prioritizing defensive investment strategies, particularly those offering high and stable annual cash dividends. These stocks not only optimize investment cash flow but also help mitigate market volatility risks.

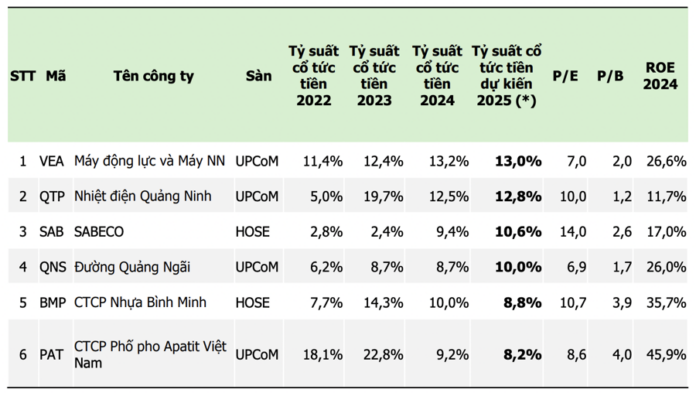

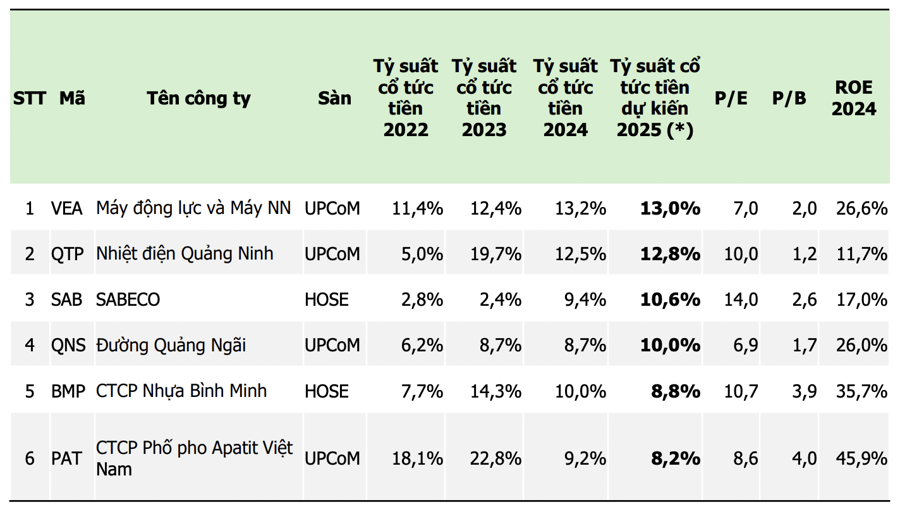

Agriseco Research has identified six stocks with attractive dividend yields. These companies were selected not only for their generous dividends but also for their strong financial foundations, stable business operations, and promising mid- to long-term growth prospects. This makes them attractive for both regular income and sustainable portfolio value appreciation.

VEA stands out for its high dividend yield. The company consistently pays high cash dividends, with a projected dividend yield of 11.4% in 2022, 12.4% in 2023, and 13.2% in 2024. Given the current stock price and the expected dividend payout for 2025, VEA’s dividend yield is an impressive 13%.

VEA boasts stable and consistent financial performance, maintaining a high ROE of nearly 30% for the last four quarters. Its financial structure is robust, with cash, cash equivalents, and short-term financial investments totaling approximately VND 13,500 billion, representing 50% of the company’s total assets.

VEA’s valuation is attractive, with a P/E ratio of ~7.0 and a P/B ratio of ~2.0, given its high ROE and cash dividend yield.

QTP is another company known for its high and consistent cash dividend payouts. Its dividend yield for 2022, 2023, and 2024 is projected to be 5.0%, 19.7%, and 12.5%, respectively. Considering the current stock price and the expected dividend payout for 2025, QTP’s dividend yield stands at an attractive 12.8%.

QTP has demonstrated stable financial performance year after year, thanks to the operations of its thermal power plants in northern Vietnam. The total electricity production and import for 2025 is forecasted to reach approximately 347.5 billion kWh, representing a 12.2% increase compared to 2024. As hydroelectric power needs to store water for the dry season and renewable energy sources remain unstable, thermal power will continue to be prioritized, benefiting QTP.

QTP maintains a healthy financial structure, with a continuous reduction in debt in 2024 and positive cash flow from operations for many years. Its valuation is reasonable, with a P/E ratio of ~10.0 and a P/B ratio of ~1.2, given its high dividend yield.

SAB offers a cash dividend yield of 10.6%. Notably, in 2024, SAB achieved a cash dividend yield of 9.4%. With a plan to pay a 50% cash dividend (equivalent to VND 5,000 per share) in 2025, SAB’s cash dividend yield is expected to reach an impressive 10.6%.

However, it’s important to consider the challenges faced by the beer industry due to Decree 100 and the trend among young people to consume less alcohol. SAB’s stock price has been on a downward trend for several years, resulting in a P/E ratio of ~14 and a P/B ratio of ~2.6, significantly lower than its historical valuations.

QNS has delivered consistent dividend yields over the years, with 6.2% in 2022, 8.7% in 2023, and an expected 8.7% in 2024. Based on the current stock price and the anticipated dividend payout for 2025, QNS’s dividend yield stands at an attractive 10%.

QNS has maintained profit growth for several years through its core business of sugar production and trading. The outlook for 2025 remains positive due to sustained high sugar prices, which are predicted to continue rising as the global balance sheet deficit worsens in the 2024-25 crop year, reaching ~3.58 million tons due to forest fires in Brazil. Additionally, the industry benefits from Vietnam’s anti-dumping tax on sugar from Thailand and other regional countries.

BMP has delivered impressive dividend yields of 7.7% in 2022, 14.3% in 2023, and an expected 10.0% in 2024. Considering the current stock price and the projected dividend payout for 2025, BMP’s dividend yield is an attractive 8.8%.

BMP’s business prospects for 2025 are positive due to a significant drop in the cost of PVC resin, a key raw material. Specifically, PVC prices are currently 20% lower than the same period last year and are expected to continue declining due to pressure from US tariffs on PVC imports from China. Additionally, the demand for plastic pipes in Vietnam is experiencing strong growth, driven by the recovery of the real estate sector and policies promoting public investment disbursement.

BMP maintains a healthy financial position with minimal debt and a substantial cash balance, cash equivalents, and short-term financial investments of nearly VND 2,000 billion, representing 60% of its total assets. The company’s positive cash flow from operations over the years ensures its ability to maintain high cash dividend payouts in the coming years.

PAT has consistently delivered high dividend yields of 18.1% in 2022, 22.8% in 2023, and an expected 9.2% in 2024. Based on the current stock price and the anticipated dividend payout for 2025, PAT’s dividend yield is an impressive 8.2%.

PAT specializes in the production, processing, and trading of yellow phosphorus and phosphorus-derived products, such as phosphoric acid. The company has maintained stable operations over the years, demonstrated by its high ROE of 46% in 2024. PAT boasts a robust financial structure with minimal debt and a substantial cash, cash equivalents, and short-term financial investments balance, accounting for approximately 46% of its total assets.

A Shareholder Accumulated Over 4 Million TVS Shares in 10 Days

In just 10 days, Dinh Thi Hoa, a major shareholder, purchased shares of TVS four times on the Ho Chi Minh Stock Exchange (HOSE). Her transactions included 1.44 million shares on March 7th, followed by 950,000 on the 11th, an additional 945,000 on March 13th, and finally, 700,000 shares on March 17th, totaling over 4 million shares.

“Cash Flow Woes: The Ongoing Challenge for Real Estate Investors in 2024”

Operating cash flow remains negative for most developers in 2024, as many have increased disbursements to expedite project development. VIS Ratings anticipates an improvement in this metric in 2025, as cash inflows from sales, led by prominent developers, are expected to surge.