The de-escalation of US-China tensions has somewhat dampened gold’s appeal, but the need for risk hedging remains high as investors believe the trade war will not end overnight.

Just before 9 am Vietnam time, the spot gold price in the Asian market surged by $69.9/oz compared to the New York session close, equivalent to a 2.13% increase, trading at $3,359.9/oz, according to Kitco trading floor data. This price translates to nearly VND 106 million/troy ounce when converted using Vietcombank’s USD selling rate, a decrease of VND 300,000/troy ounce compared to the beginning of the previous day.

At the same time, Vietcombank quoted the USD at VND 25,784 (buying) and VND 26,174 (selling), an increase of VND 33 at each price point compared to the previous day.

On the night of April 23 in the US, the spot gold price closed at $3,290/oz, a decrease of $93.7/oz compared to the previous session’s close, equivalent to a 2.8% drop. In the previous session, the spot gold price had briefly surpassed $3,500/oz for the first time in history.

On the COMEX, gold futures fell by 3.7%, closing the session on April 23 at $3,294.1/oz. Gold futures also hit an all-time high above $3,500/oz in the previous session.

“The financial market is recovering from the tariff shock. Some investors are shifting capital away from safe-haven assets to buy stocks that have been sold off heavily in the past, such as Apple and Tesla,” said Phillip Streible, chief strategist at Blue Line Futures.

On April 22, US President Donald Trump stated that he would take a less confrontational approach to trade negotiations with China. On April 23, US Treasury Secretary Scott Bessent declared that the US and China had an opportunity to reach “a big deal” on trade. On the same day, The Wall Street Journal reported, citing a White House official, that the Trump administration was considering reducing tariffs on Chinese goods to 50-65%. Subsequently, a White House official told CNBC that such a move would have to come from both sides, meaning China would also have to reduce tariffs on US goods.

The risk appetite also increased after Trump stated on April 22 that he had “no intention” of firing Federal Reserve Chairman Jerome Powell before his term officially ends in 2026. Previously, risky assets had been sold off, and gold was strongly bought as investors feared the Fed’s independence was being threatened.

Despite the positive news causing the gold price to drop, the strong rebound in the morning showed that the demand for risk hedging remains high, and bottom-fishing forces are always ready. Caution persists as investors await further developments in trade negotiations between the US and its partners, while Washington and Beijing have yet to make any official moves to advance the talks.

Analysts believe that the long-term outlook remains positive, but gold prices are still subject to fluctuations and adjustments in the short term.

“From a technical perspective, the flash surge above $3,500/oz and subsequent sharp decline indicate the risk of a deeper correction,” said Ole Hansen, head of strategy at Saxo Bank.

Bark Melek, a strategist at TD Securities, said that in the event of further gold price adjustments, the $3,100/oz level is a critical point to watch.

The US dollar rebounded strongly in the April 23 session, with the Dollar Index closing at 99.84 points, up more than 0.9% from the previous session’s close. In the morning, the index headed lower, falling below 99.6 points at times.

The world’s largest gold ETF, SPDR Gold Trust, bought a net 1.4 tons of gold in the April 23 session, raising its holdings to 949.1 tons.

“Stocks at Their Peak, but I’m Averaging Down: A Tale of Contrarian Investing”

“Watching the gold price rise daily filled me with a sense of despair. I thought I had made the right decision to sell my gold and invest in stocks, but now I feel utterly deflated,” Minh Hang confided, expressing her dismay at the recent turn of events.

A Nuanced Look at Tariff Policies and Their Market Impact

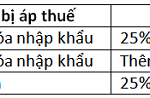

The US trade policies and their tariffs could have a significant impact on global commerce. This move will undoubtedly affect Vietnam’s exports, a key driver of its economy. While the stock market may experience indirect and limited effects, it is not a primary driver of market trends and thus will not be significantly influenced.