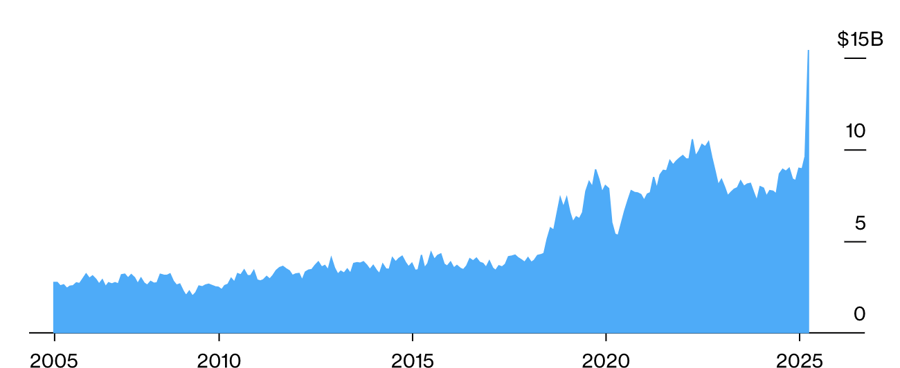

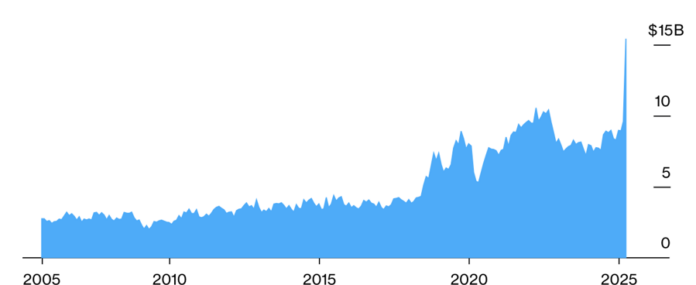

US tariff revenue soared more than 60% in April, reaching at least $15 billion, as the first tariffs of President Donald Trump’s second term took effect, according to data released by the US Department of the Treasury a few days ago.

Bloomberg reported that the data was derived from the daily report of the US Department of the Treasury, reflecting the tariff payments made by the country’s large importers and import brokers in April for shipments arriving at US ports in March. About two-thirds of US importers pay tariffs monthly, on the 15th working day of the following month.

Daily tariff collections—for those who pay as soon as goods are imported into the US—also increased by around 40% in April compared to the previous month.

The tariff revenue collected by US authorities in April included the 25% tariff on steel and aluminum imports that took effect on March 12. However, this amount did not include the 10% retaliatory tariff announced by Trump on April 2, implying that tariff revenue in May could be even higher.

With the monthly tariff payments for March imports completed, the US Department of the Treasury will collect at least $15.4 billion in tariffs for April, according to the published data. According to Bloomberg, in absolute value terms, rather than as a percentage of gross domestic product (GDP), this is a record high for US tariff revenue in a single month.

Trump considers tariffs an effective tool to reduce or even eliminate the US trade deficit with its trading partners. However, he also sees tariff revenue—the primary source of revenue for the US federal government before Congress passed the income tax in 1913—as an important source of revenue to be able to cut domestic taxes.

The US Department of the Treasury reported collecting $9 billion in tariff revenue in March, a $2 billion increase compared to the same period in 2024.

But despite the significant increase, the amount the US government collects from tariffs is minuscule compared to the federal budget deficit. In the first six months of this fiscal year, the US government posted a budget deficit of $1.31 trillion, a 15% increase from the same period last year. Interest payments on the national debt, along with expensive federal programs such as Medicare and Social Security, continue to account for a large portion of America’s growing debt.

In his second term, Trump has imposed retaliatory tariffs of up to 145% on Chinese goods. He has also imposed retaliatory tariffs ranging from 10% to 50% on approximately 180 other countries and territories but reduced them all to the base rate of 10% for 90 days on April 9, subsequently waiving retaliatory tariffs on technology goods. In addition, he imposed a 25% tariff on goods from Canada and Mexico but later exempted those that met the standards of the USMCA free trade agreement; a 25% tariff on imported cars and car parts; and a 25% tariff on steel and aluminum imports.

Before Trump announced the retaliatory tariff plan on April 2, senior White House adviser on manufacturing and trade, Peter Navarro, said in an interview with Fox News that the tariff plans, excluding auto tariffs, would bring in $600 billion in revenue to the US over the next 10 years, equivalent to an average of $60 billion per year. Auto tariffs could bring in an additional $100 billion per year.

“The Risk of Trump Imposing Tariffs on All Vietnamese Exports Is Minimal”

“There are no fundamental issues between Vietnam and the United States, be it in the economic, trade, or technological domains,” remarked Mr. Pham Quang Vinh, former Deputy Minister of Foreign Affairs and ex-Ambassador of Vietnam to the United States.

The Soaring US Trade Deficit

The surge in the trade deficit in December could bolster the case for Trump 2.0’s protectionist policies. With a widening gap between imports and exports, the data highlights a potential vulnerability in the nation’s economic health, providing ammunition to those advocating for a more guarded approach to international trade.

The Vietnamese Economy to Embrace New Opportunities Post-Trump Policies

According to experts, the upcoming policies of the Trump administration could have a significant positive impact on Vietnam’s economic growth. The country’s economy is poised to flourish under the new policies, with potential benefits across various sectors.

“Donald Trump’s Election Victory: Currency Manipulation and Exchange Rates”

In the recent US presidential election, Donald Trump’s victory was not just a win, but a Republican sweep of both houses of Congress. This outcome has profound implications, not just for the United States but for the entire world. Among the many consequences is the impact on exchange rates, particularly for countries with significant trade surpluses with the US, and Vietnam presents a rather unique case in this regard.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)