|

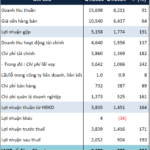

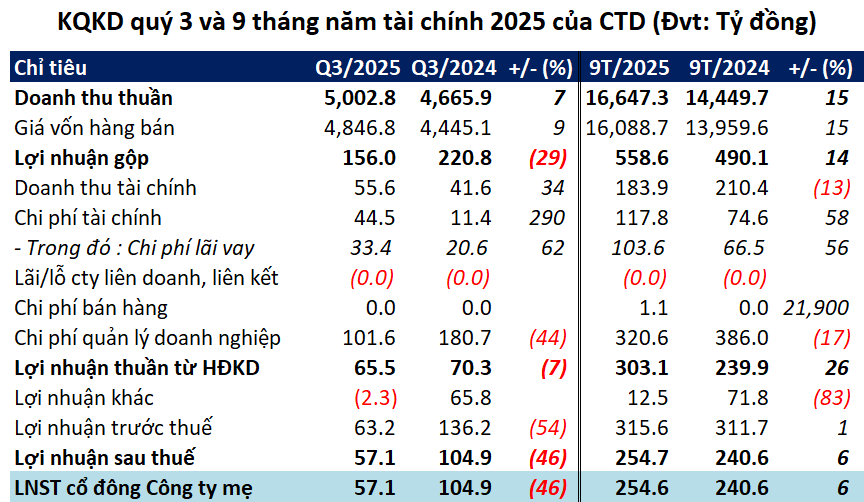

For the third quarter of the 2025 financial year (from 01/01-31/03/2025), Coteccons reported consolidated revenue of nearly VND 5,003 billion, a 7% increase compared to the same period last year. The main contributor remains the construction contracts, amounting to over VND 4,909 billion, a 6% increase. After deducting the cost of goods sold, the company’s gross profit stood at VND 156 billion.

A highlight of this period was the reduction in total expenses by 24% to VND 146 billion, largely due to lower enterprise management costs. Ultimately, CTD posted a net profit of over VND 57 billion, a 46% decrease compared to the previous year.

Coteccons attributed this to fluctuations in input costs influenced by macroeconomic factors and global uncertainties, which impacted their profit margins.

However, for the nine months ended March 31, 2025, of the 2025 financial year (from 01/07/2024-31/03/2025), Coteccons recorded revenue of over VND 16,647 billion and a net profit of nearly VND 255 billion, representing a 15% and 6% increase, respectively, compared to the same period last year.

Source: VietstockFinance

|

With targets set for the 2025 financial year (from 01/07/2024-30/06/2025) to achieve VND 25,000 billion in revenue and VND 430 billion in after-tax profit, Coteccons has accomplished 67% and 59% of these goals, respectively, in the first nine months.

CTD also disclosed that their contract wins for the nine months ended March 31, 2025, totaled approximately VND 23,000 billion, boosting their backlog to VND 37,000 billion. This provides a solid workload for the upcoming quarters, with about 69% of the contract wins originating from “repeat sales” projects.

Additionally, Coteccons has been expanding its presence in the infrastructure and public investment sectors, including projects such as the Long Thanh Airport and the University of Ho Chi Minh City sub-project, which demand high technical capabilities and stringent progress requirements.

Recently, CTD shares were included in the VNDiamond index for the first time, a group of stocks attractive to foreign investors and ETF funds.

As part of their mid-term strategy, Coteccons is venturing into the industrial, MEP, and sustainable urban development sectors for the 2025–2029 period.

– 15:17 30/04/2025

Is FECON’s 200 Billion Profit Goal at Risk Due to Consecutive Losses in the First Quarter?

FECON Corporation (HOSE: FCN) reported a 34% increase in revenue for the first quarter of 2025, however, the company still incurred a loss of VND 7 billion, marking the second consecutive quarter of losses as financial expenses continue to weigh heavily. This puts the company’s target of VND 200 billion in profits for the year at a more challenging position.

Unveiling Vinhomes Wonder City: Vinhomes’ Q1 Net Profit Triples Year-on-Year

The launch of Vinhomes Wonder City in Hanoi’s west has seen Vinhomes Joint Stock Company (HOSE: VHM) kick off 2025 with a bang, posting a impressive net profit of nearly VND 2.7 trillion.