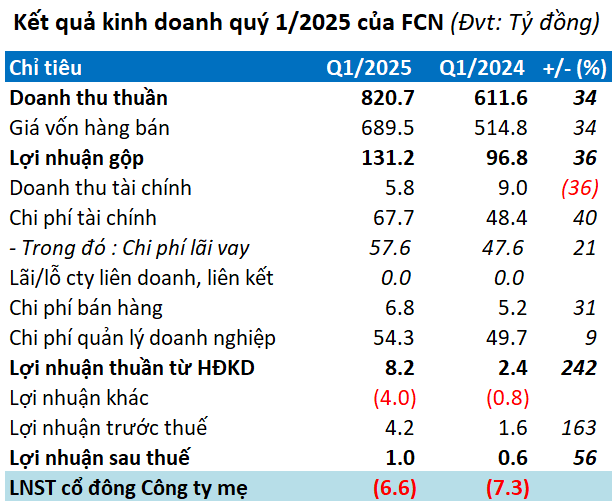

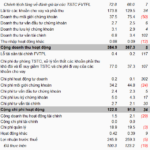

Closing the first quarter, FECON recorded net revenue of nearly VND 821 billion, up 34% over the same period. However, the company still incurred a net loss of nearly VND 7 billion, showing no improvement from the loss of over VND 7 billion in the previous year.

| FCN’s net profit from Q1/2020 to Q1/2025 |

The main reason for this was a significant increase in operating and financial expenses. Specifically, total expenses for the period reached nearly VND 129 billion, up 25% year-on-year; with interest expenses accounting for nearly half at VND 58 billion, a 21% increase. FCN attributed this to receiving large advance payments for construction in Q1/2024, which reduced bank borrowings significantly, while no similar factors supported this year.

Financial revenue also decreased by 36%, reaching only VND 6 billion, further challenging the business results.

For 2025, FCN has set ambitious business plans with a consolidated revenue target of VND 5,000 billion, a 48% increase compared to 2024’s performance; while net profit is targeted at VND 200 billion, 6.6 times higher than the previous year and the highest since 2020.

With the results of the first quarter, the company has only achieved 16% of its revenue plan and is far from its profit target.

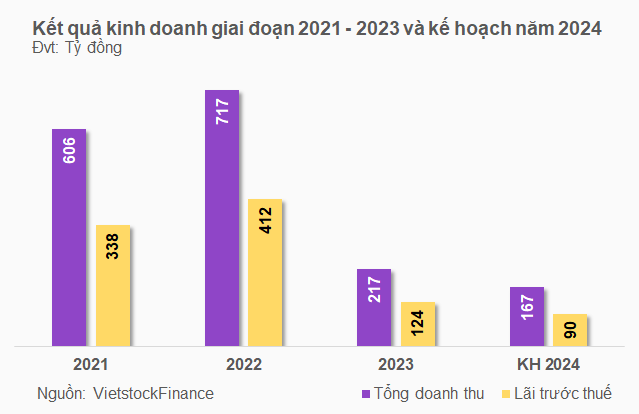

Source: VietstockFinance

|

At the recent 2025 Annual General Meeting of Shareholders, Mr. Nguyen Van Thanh, Member of the Board of Directors, stated that the value of backlog contracts carried over to 2025 was approximately VND 2,500 billion. By the end of Q1/2025, the company had signed new contracts worth about VND 1,300 billion, thus providing a basis for the ambitious business plan for this year.

Ms. Nguyen Thi Nghien, Chief Financial Officer, added that in the net profit plan of VND 200 billion for 2025, the construction segment is expected to contribute VND 55 billion, while the investment segment is projected to contribute VND 145 billion from the implementation and sales of projects such as the Pho Yen (Thai Nguyen) and Danh Thang – Doan Bai industrial clusters.

Turning to the balance sheet, FCN’s total assets at the end of Q1 increased slightly by 2% from the beginning of the year to nearly VND 9,905 billion; with a significant portion being short-term assets of over VND 6,411 billion, up 1% and accounting for 65% of capital sources. This includes nearly VND 279 billion in cash, a 41% decrease, and over VND 1,900 billion in inventory, a 13% increase.

The company still has nearly VND 6,547 billion in payables, a 3% increase from the beginning of the year, with the majority being financial borrowings of VND 4,021 billion, up 3% and accounting for 61% of total debt.

– 11:12 03/05/2025

“DXS Acquires Dat Xanh Mekong From Cara Group Subsidiary”

On April 29, 2025, the Board of Directors of Dat Xanh Real Estate Service Joint Stock Company (HOSE: DXS) approved the acquisition of nearly 2.3 million shares of Cara Group Joint Stock Company in Dat Xanh Tay Nam Service Joint Stock Company (DXMT).

The Brokerage Segment’s Thin Margins and Surging Provision Costs: A Look at FPTS’ 8% Drop in Q1 Net Profit

In Q1 2025, FPT Securities Joint Stock Company (FPTS, HOSE: FTS) recorded revenue and pre-tax profit of nearly VND 314 billion and over VND 100 billion, respectively, equivalent to 31% and 20% of the yearly plan. The profit showed a slight decrease compared to the same period last year due to modest profits in the brokerage segment and a significant increase in provision expenses.

The Power of Persuasive Writing: Crafting a Compelling Headline

Unveiling the Secrets of a Profitable Quarter: VGC’s Impressive 56% Growth

Thanks to its robust land leasing segment and strong infrastructure development, Viglacera reported impressive earnings for the first quarter of 2025, with a profit of nearly VND 321 billion, a 56% increase compared to the same period last year. The company has successfully achieved 24% of its annual profit target.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)