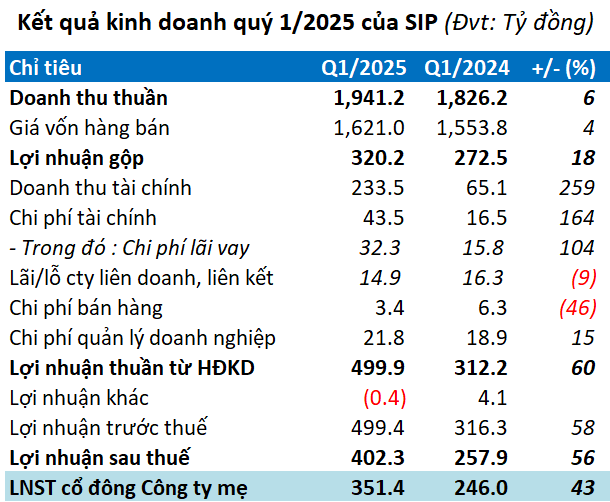

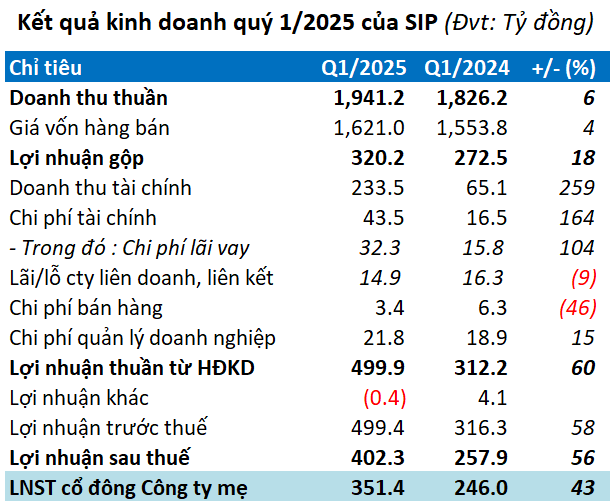

Consolidated revenue for the first three months reached over VND 1,941 billion, a 6% increase compared to the same period last year. The main driver continues to be the provision of electricity and water utility services to industrial parks, contributing nearly VND 1,590 billion, or over 80% of total revenue, and a 7% increase year-on-year.

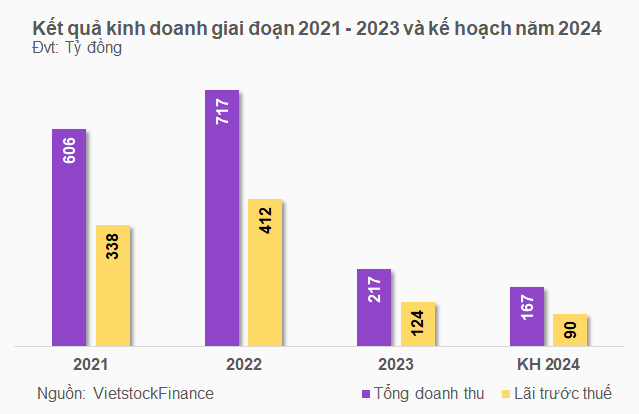

Source: VietstockFinance

|

Gross profit margin improved from 15% to nearly 17%, resulting in a gross profit of over VND 320 billion, an 18% increase. Additionally, financial revenue increased to nearly VND 234 billion, triple that of the previous year, due to the recognition of gains from divestment.

Despite a significant 65% increase in total expenses, mainly due to doubled interest expenses of over VND 32 billion, the impact was not substantial. Finally, the Company recorded a profit of over VND 351 billion, a 43% increase and the highest since the first quarter of 2021.

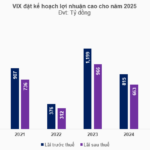

Looking ahead to 2025, SIP has set a cautious business plan with consolidated revenue of VND 5,657 billion and after-tax profit of nearly VND 833 billion, representing decreases of 33% and 35%, respectively, compared to 2024 performance.

With a conservative plan in place, SIP has already achieved nearly half of its profit target, and the remaining milestones may be more manageable.

This year, the Company plans to lease 45 hectares of industrial land, mainly focused on the Phuoc Dong Industrial Park with 30 hectares, while the remaining allocation is evenly distributed across the Dong Nam, Le Minh Xuan, and Loc An – Binh Son Industrial Parks. Regarding factory rentals, the Company expects to lease approximately 25,900 square meters.

As of the end of the first quarter, SIP’s total assets exceeded VND 26,300 billion (over $1 billion), a 5% increase from the beginning of the year. The enterprise currently holds over VND 6,000 billion in bank deposits, equivalent to 23% of total assets.

Inventory decreased to over VND 319 billion, with half comprising production and business costs for the Ben San resettlement area project (VND 84 billion) and the Thuan Loi residential area project (over VND 109 billion). Construction-in-progress costs decreased by 4%, standing at over VND 2,200 billion, with significant concentrations in the Le Minh Xuan 3 Industrial Park (nearly VND 708 billion), Loc An – Binh Son Industrial Park (nearly VND 238 billion), and Dong Nam Industrial Park (nearly VND 200 billion).

Total liabilities exceeded VND 21,000 billion, a 4% increase, but this does not raise significant concerns as advance payments from customers and unearned revenue (prepaid land and factory rentals) account for the majority of SIP’s liabilities, amounting to over VND 12,400 billion, a 3% increase, and comprising nearly 60% of total liabilities. In contrast, financial debt stands at over VND 4,100 billion, a 15% increase, contributing to 20% of total liabilities.

Amidst the dynamic landscape of international trade policies and the potential impact of US tariffs, Chairman of the Board of Directors, Tran Manh Hung, reassured that the risks to SIP are not significant. He elaborated, “SIP’s revenue structure is predominantly derived from utility services, accounting for 70%, while land leasing is recognized over 50 years. In contrast, companies engaged solely in land leasing and recognizing revenue once would undoubtedly face substantial challenges due to the changing trade environment,” as shared at the recent 2025 Annual General Meeting of Shareholders.

– 11:10 01/05/2025

The Ultimate Guide to VIX’s Ambitious Plans: Targeting Billion-Dollar Profits with a Massive Share Offering of 73 Million.

The upcoming 2025 Annual General Meeting of VIX Securities Joint Stock Company (HOSE: VIX) is set to take place on the morning of May 23, 2025, with a packed agenda. Notably, the company plans to present its ambitious pre-tax profit target of VND 1,500 billion and a post-tax profit of VND 1,200 billion. Additionally, they will propose the issuance of nearly 73 million shares as dividends for the year 2024 and seek approval for changes to the board of directors, including the exemption and election of a new member.

The Pen Is Mightier: Crafting a Compelling Headline

“DIG Uncovers a Hole in Q1”

After incurring a record loss of over VND 117 billion in Q1 2024, the Construction Development Investment Corporation (DIC Corp, HOSE: DIG) reported another quarterly loss in the first quarter of 2025, despite a significant improvement in revenue.