Despite acknowledging that the cement industry remains mired in challenges due to oversupply, high production costs, and intense price competition from cheap imported products, BTS remains optimistic about its prospects for 2025, following two years of losses.

According to this year’s plan, the company aims for a total revenue of over 2,794 billion VND, a 5% increase from the previous year, and a profit after tax of more than 29 billion VND. In the previous year, the company incurred a loss of nearly 202 billion VND, the heaviest loss in over a decade. In 2023, the loss amounted to over 96 billion VND.

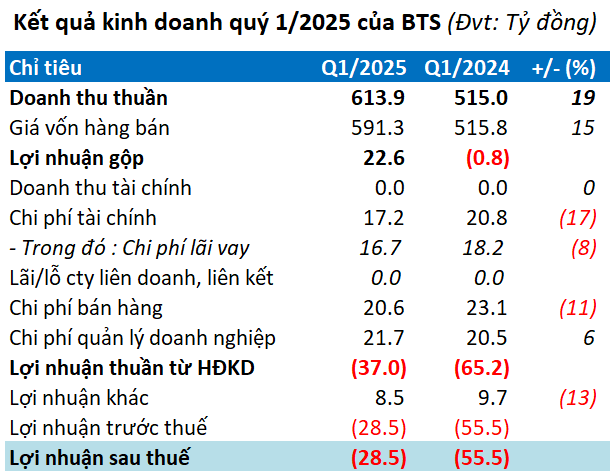

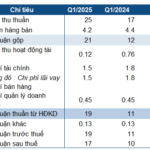

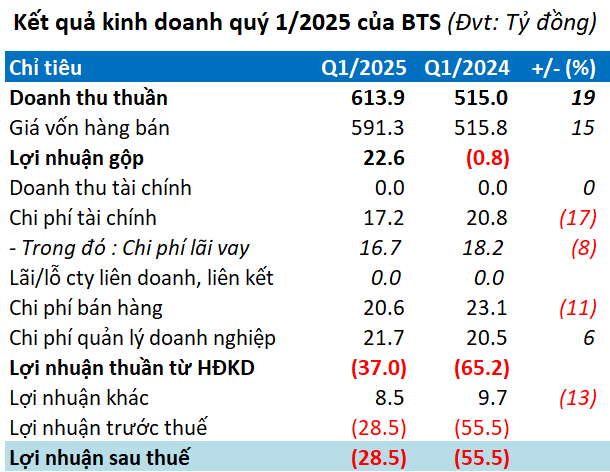

The results for the first quarter of 2025 indicate that the road to recovery is still fraught with obstacles, as the company posted a loss of nearly 29 billion VND, marking the tenth consecutive quarter of losses. Nonetheless, this figure represents a significant improvement compared to the loss of nearly 56 billion VND in the same period last year. The company last reported a profit in the third quarter of 2022, amounting to over 8 billion VND.

| BTS posts loss for the tenth consecutive quarter |

In terms of revenue, BTS recorded a 19% growth, reaching nearly 614 billion VND, equivalent to 22% of the annual revenue target. However, the company still has a long way to go to achieve its profit goals.

Source: VietstockFinance

|

As of the end of March, the company’s accumulated loss exceeded 320 billion VND. Total assets amounted to nearly 3,240 billion VND, a 5% increase from the beginning of the year, but cash holdings declined sharply by 41%, leaving only over 59 billion VND. Short-term receivables also surged to over 280 billion VND, triple the amount from the previous period.

Inventory stood at nearly 522 billion VND, a 9% increase. Construction work in progress increased by 15% to over 136 billion VND, focusing on key projects such as the Ba Sao clay mine, the Hòa Bình clay mine, and the waste heat power system.

BTS faces mounting financial pressure as its total liabilities climbed to nearly 2,202 billion VND, a 9% increase from the beginning of the year. Of this, financial borrowings accounted for 54%, equivalent to nearly 1,200 billion VND. To reduce operating costs, the company cut 10 employees in the first quarter.

After two years of losses, Xi măng VICEM Bút Sơn aims for profitability in 2025

– 08:00 01/05/2025

The Power of Persuasive Writing: Crafting Captivating Content for the Win

At the recent 2025 Annual General Meeting (for the 2024 financial year), held on the morning of April 29th, Gia Lai Electricity Joint Stock Company (HOSE: GEG) revealed ambitious growth plans. The company also announced its first-quarter financial statements for 2025, showcasing a significant improvement. This impressive performance is attributed to successful electricity price negotiations, with an astounding 89% of the annual profit plan achieved in just one quarter.

The Art of Crafting Profitable Headlines: “Unraveling the Mystery Behind Vinaconex’s Narrow Gross Profit Margin in Construction”

On the morning of April 21, Vinaconex, a leading Vietnamese construction and trading company listed on the Ho Chi Minh Stock Exchange (HOSE) under the ticker symbol VCG, held its annual general meeting for the year 2025. The key agenda items included discussing the company’s business plan, dividend distribution, capital increase, and the election of additional members to the board of directors.

The Brokerage Segment’s Thin Margins and Surging Provision Costs: A Look at FPTS’ 8% Drop in Q1 Net Profit

In Q1 2025, FPT Securities Joint Stock Company (FPTS, HOSE: FTS) recorded revenue and pre-tax profit of nearly VND 314 billion and over VND 100 billion, respectively, equivalent to 31% and 20% of the yearly plan. The profit showed a slight decrease compared to the same period last year due to modest profits in the brokerage segment and a significant increase in provision expenses.

MSB’s General Meeting: Q1 Profit Reaches VND 1,630 Billion, 2-3 Potential Buyers for the Finance Company

On April 21, 2025, the Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) held its annual general meeting to discuss and approve key business strategies for the upcoming year. The agenda included proposals for dividend distribution, plans to increase charter capital, and decisions regarding the divestment from TNEX Finance and the potential acquisition of a securities company.