|

DVN’s Q1 2025 Business Results

Source: VietstockFinanance

|

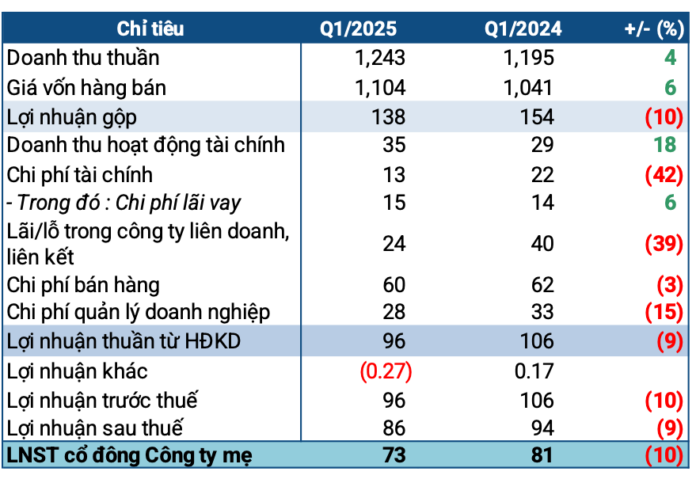

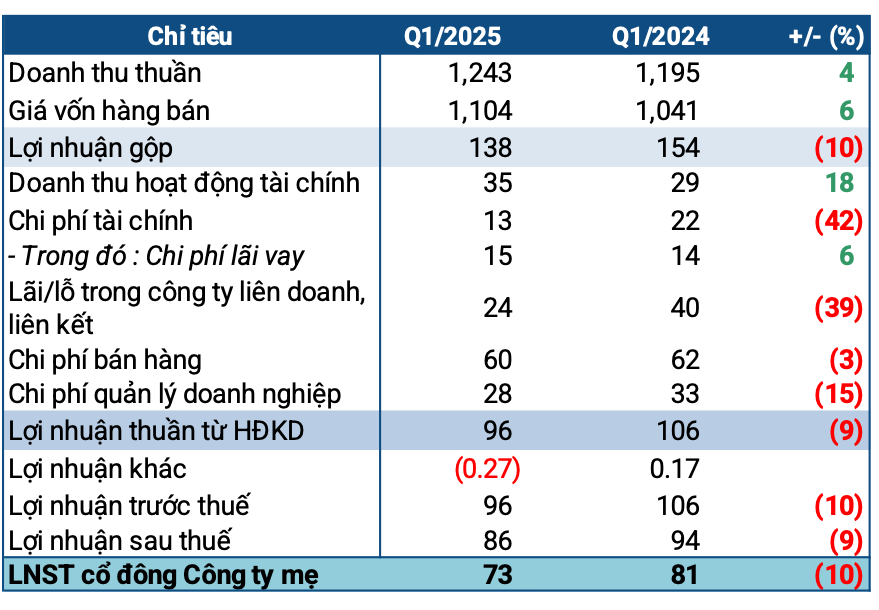

In Q1, DVN recorded over 1.2 trillion VND in net revenue, a 4% increase year-on-year. A 6% rise in cost of goods sold resulted in a 10% dip in gross profit, which stood at 138 billion VND.

Despite an 18% surge in financial income due to favorable exchange rate differences, coupled with a significant 42% reduction in financial expenses totaling 13 billion VND, profit from associates declined markedly by 39%, settling at 24 billion VND. Ultimately, the company posted a net profit of 73 billion VND, reflecting a 10% decrease from the previous year.

In the financial statements, the company disclosed a write-down in the value of its investment in Sanofi-Synthelabo Vietnam JSC, attributable to dividends received from profits generated before DVN’s transition to a joint-stock company. As of the consolidated financial statement date for Q1, DVN is collaborating with Sanofi-Synthelabo Vietnam (SVN) to undertake the necessary procedures for dissolving and closing down this associate as per prevailing regulations.

At the 2025 Annual General Meeting, the company shared that it is in the process of materializing and finalizing plans to increase its ownership stake in SVN. It is anticipated that the company will accomplish a rise in its ownership percentage to 30% in the second quarter of this year.

During the meeting, a shareholder raised concerns regarding SVN’s diminished stake in the healthcare segment of the newly established Opella company, potentially impacting the progress of the ownership increase. DVN reassured that the restructuring of business lines at SVN would not influence SVN’s commitments to facilitate DVN’s heightened ownership.

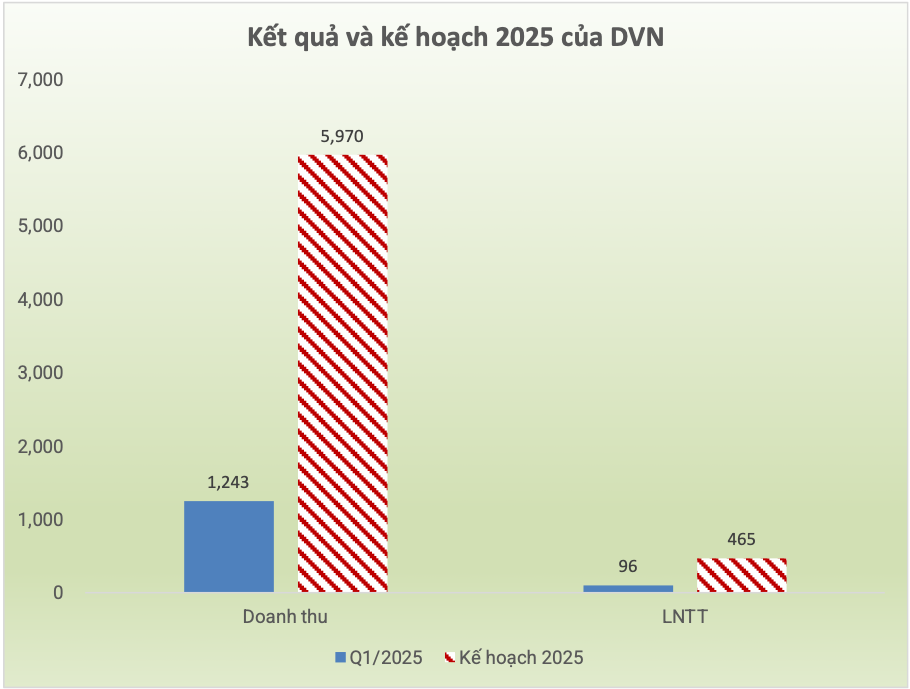

The Annual General Meeting approved a business plan for 2025, encompassing nearly 6 trillion VND in revenue and 465 billion VND in pre-tax profit. These figures represent a 3% increase and a 9% decrease, respectively, compared to the 2024 performance. Based on this plan, the company has achieved approximately 21% of both targets in Q1.

Source: VietstockFinance

|

As of the end of Q1/2025, DVN’s total assets exceeded 6.6 trillion VND, marking a 3% increase from the beginning of the year. Of this, over 4.6 trillion VND comprised short-term assets, signifying a 5% rise. Cash and cash equivalents held were approximately 1.03 trillion VND, a slight decrease. Inventory stood at nearly 1.67 trillion VND, remaining relatively unchanged.

On the capital side, short-term debt constituted almost the entirety of total debt, inching up to over 3 trillion VND. Within this, debt exceeding 1.24 trillion VND remained largely unchanged. Both the quick and current ratios exceeded 1, indicating the company’s unquestionable ability to meet its short-term obligations.

– 10:53 05/03/2025

The Brokerage Segment’s Thin Margins and Surging Provision Costs: A Look at FPTS’ 8% Drop in Q1 Net Profit

In Q1 2025, FPT Securities Joint Stock Company (FPTS, HOSE: FTS) recorded revenue and pre-tax profit of nearly VND 314 billion and over VND 100 billion, respectively, equivalent to 31% and 20% of the yearly plan. The profit showed a slight decrease compared to the same period last year due to modest profits in the brokerage segment and a significant increase in provision expenses.

The Business Slump: Everest Securities Plans a Major Overhaul

In the face of challenging business conditions, with net profits declining by 48% in 2024 compared to 2023, and a broader downward trend since 2021, the Board of Directors of Everest Securities Joint Stock Company (HNX: EVS) has recently passed a series of resolutions aimed at a robust corporate restructuring.

“TV3 Recalibrates: Scaling Down 2024 Profit Target by 21%”

Assuming that it would be challenging to achieve the business plan targets for 2024 as assigned by the General Meeting of Shareholders, Construction Electricity Consultancy Joint Stock Company (HNX: TV3) is seeking to adjust its business plan by lowering the targets.