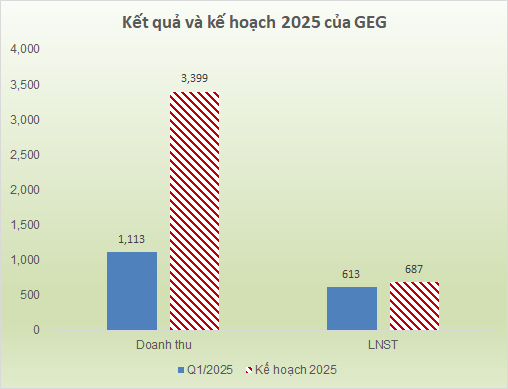

The Shareholders’ Meeting approved a plan for total revenue of nearly VND 3.4 trillion, up 43% from the 2024 performance, and a pre-tax profit target of VND 777 billion, representing a growth of nearly 330%. This profit target stems from GEG’s core business operations and the retroactive value realization at the Tan Phu Dong 1 (TPD1) wind power project from its commercial operation until the signing of the official PPA Appendix (excluding VAT), amounting to VND 443 billion.

It is known that since the commercial operation date (May 31, 2023), the electricity selling price at TPD1 has been calculated based on the provisional price set by the Ministry of Industry and Trade (50% of the ceiling price). The company revealed that on March 26, 2025, GEG officially signed the Power Purchase Agreement (PPA) Appendix under the transitional price mechanism for TPD1, with the new price set at VND 1,813 per kWh (7.8 cents).

2025 Annual General Meeting of GEG

|

For the direction of 2025, GEG stated that it would continue to optimize the operation of its existing plants, develop and expand its core energy business from the portfolio of current and potential energy projects that have been developed over the past time.

The company will also implement phase 2 of the developed renewable energy projects, in line with the orientation of the adjusted Power Development Plan 8 (PDP8), while completing the legal procedures for the projects it owns. Additionally, GEG will participate in investment promotion programs for new renewable energy projects.

Regarding the profit distribution plan, the meeting approved a dividend payout of 6% multiplied by the adjustment ratio for 2025 to shareholders holding preferred shares convertible to common shares. Furthermore, the meeting approved a plan to repurchase the preferred shares convertible to common shares issued in 2022 (64.2 million shares), with an expected repurchase volume of more than 7.7 million shares. The maximum repurchase price was determined to be VND 10,936 per share.

Continue to Develop Renewable Energy

Sharing at the meeting, General Director Nguyen Thai Ha said that GEG has been focusing on searching for and surveying favorable locations to develop renewable energy projects. In 2025 and beyond, the company will implement several important projects.

The first is the Ea Tih Small Hydro Power Plant with a capacity of 10 MW, for which the Board of Directors has already passed a resolution on construction. The second is the Duc Hue 2 Solar Power Project, which was previously developed by GEG but encountered some legal issues. Now, it has been included in the adjusted Power Development Plan 8 (PDP8), and the company is in the process of completing the procedures for the investment approval extension in Long An province. “Once completed, the project will be submitted to the Board of Directors for reconsideration, with the goal of achieving commercial operation as soon as possible,” said the General Director of GEG.

The third project is the VPL2 wind power project with a capacity of 30 MW, which is already equipped with the necessary infrastructure and elements, located near the operating VPL1 wind power cluster. Ms. Thai Ha shared that in 2025, GEG will carry out the relevant procedures to submit to the Board of Directors for approval to implement a group of projects (Ea Tih, VPL2, Duc Hue 2) with a total capacity of about 100 MW.

In addition, Ms. Ha revealed that GEG also has a potential project portfolio in the adjusted PDP8, including pumped-storage hydropower, wind, solar, and energy storage projects, with a total capacity of over 1 GW.

“However, according to new regulations, these projects will be transferred by the Ministry of Industry and Trade to the provinces to conduct bidding and select investors. Therefore, this portfolio is subject to the following legal procedures and the specific names of the projects cannot be disclosed at this time. All projects in this portfolio have been directly pursued and developed by GEG.”

Divesting from Truong Phu Hydropower to Focus on Controlling Projects

Despite its active development of renewable energy projects, GEG recently divested from the Truong Phu Hydropower Project. Regarding this decision, Ms. Ha explained that GEG only held a 25% stake in Truong Phu, which is a non-controlling ratio.

“As a professional energy development company, divesting from Truong Phu allows the company to concentrate its resources on projects where it has a controlling stake. Additionally, this move helps to recover resources to serve as equity for the development of new and diverse potential projects that are prioritized according to a set order. The proceeds from the divestment can also be used to restructure financial activities.”

According to Ms. Ha, GEG expects to receive a cash flow of more than VND 200 billion from the divestment from Truong Phu. The divestment process is being actively carried out, and detailed information will be announced as soon as possible.

Change of Representatives from Major Shareholder Jera on the Board of Directors

Regarding personnel matters, the meeting approved the discharge and reappointment of two Board members whose terms had expired: Mr. Tan Xuan Hien (Chairman of the Board) and Ms. Pham Thi Khue (Independent Board Member).

Additionally, the meeting approved the resignation of two current Board members, Mr. Simon Mark Wilson and Mr. Toshihiro Oki, who were representatives of the major shareholder Jera Co., and elected two other representatives from Jera to the Board of Directors: Mr. Eiji Hagio and Mr. Mark Houghton Scott Leslie.

According to the information disclosed, Mr. Eijji Hagio (born in 1975) is Japanese, holds a Master of Laws, and is a lawyer; Mr. Leslie (born in 1971) is an American citizen, holds a Master of Advanced Management and a Master of Business Administration, and is proficient in Chinese. Both individuals are representatives of the major shareholder Jera Co.

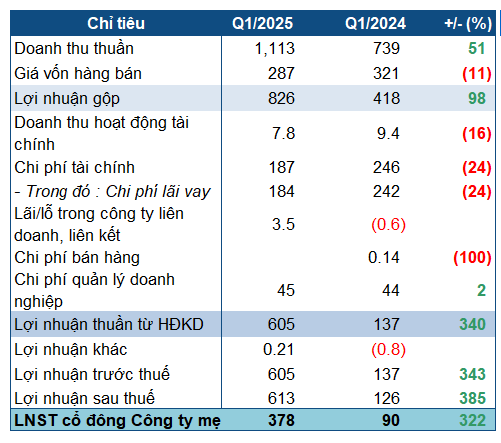

Profitable First Quarter, Nearly Completing Annual Plan

GEG recently published its first-quarter consolidated financial statements for 2025. Accordingly, revenue reached over VND 1,100 billion, up 50% from the same period last year, with electricity sales accounting for 99%. Gross profit increased significantly to VND 826 billion due to the recognition of revenue from the TPD1 project. The gross profit margin improved considerably from 57% to over 74%.

In particular, the electricity output of the entire system reached 329 million kWh, generating revenue of nearly VND 1,100 billion, an increase of almost 50% compared to the same period last year. Electricity sales revenue recorded a nearly 50% increase as the Tan Phu Dong 1 wind power plant recognized the official selling price.

|

GEG’s Business Results for the First Quarter of 2025

Source: VietstockFinance

|

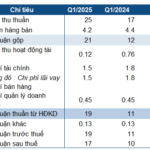

In terms of revenue structure, wind power contributed nearly 206 million kWh, corresponding to VND 822 billion in revenue, accounting for 62% of output and 75% of electricity sales revenue. Solar power recorded an output of nearly 92 million kWh and revenue of VND 210 billion, representing 28% and 19%, respectively. Hydropower provided 32 million kWh of output, equivalent to VND 61 billion in revenue, accounting for 7% of output and 8% of electricity sales revenue.

Another positive aspect was the significant reduction in financial expenses by 24%, amounting to VND 187 billion, mainly due to interest expenses. Finally, the company achieved after-tax profit and net profit of VND 613 billion and VND 378 billion, respectively, more than four times higher than the previous year. Compared to the plan approved by the Shareholders’ Meeting, GEG has accomplished 89% of the after-tax profit target.

Source: VietstockFinance

|

As of the end of March, GEG’s total assets amounted to over VND 15,700 billion, a decrease of 3% from the beginning of the year, of which nearly VND 1,900 billion was short-term assets, representing a 38% increase. Cash and cash equivalents held stood at VND 408 billion, a slight increase.

On the capital side, total liabilities were recorded at over VND 9,300 billion, a decrease of 9% from the beginning of the year, mainly comprising loan debt. However, only VND 830 billion was short-term debt, a 6% increase. The debt service coverage ratio improved significantly to 2.1 times, ensuring the company’s ability to service interest.

Chau An

– 09:00, April 30, 2025

“Fostering Green Energy Collaboration: Vietnam, ASEAN, and China”

In pursuit of sustainable energy sources to meet the ambitious target of double-digit economic growth for the period of 2026–2030, Vietnam not only needs to invest in its domestic capabilities but also forge stronger connections with its ASEAN counterparts and China.

The Art of Crafting Profitable Headlines: “Unraveling the Mystery Behind Vinaconex’s Narrow Gross Profit Margin in Construction”

On the morning of April 21, Vinaconex, a leading Vietnamese construction and trading company listed on the Ho Chi Minh Stock Exchange (HOSE) under the ticker symbol VCG, held its annual general meeting for the year 2025. The key agenda items included discussing the company’s business plan, dividend distribution, capital increase, and the election of additional members to the board of directors.

The Brokerage Segment’s Thin Margins and Surging Provision Costs: A Look at FPTS’ 8% Drop in Q1 Net Profit

In Q1 2025, FPT Securities Joint Stock Company (FPTS, HOSE: FTS) recorded revenue and pre-tax profit of nearly VND 314 billion and over VND 100 billion, respectively, equivalent to 31% and 20% of the yearly plan. The profit showed a slight decrease compared to the same period last year due to modest profits in the brokerage segment and a significant increase in provision expenses.

The Power of Words: Crafting a Compelling Title

“The SC5 Shareholder’s Meeting: Vice-Chairman’s Ambition to Increase Ownership and Cancel 2024 Dividends”

Mr. Nguyen Dinh Dung, Vice Chairman of the Board of Directors and CEO of Construction Joint Stock Company No. 5 (HOSE: SC5), shared that the construction industry continues to face challenges due to volatile and unstable material prices, which drive up costs. Despite these difficulties, the Company ensures a sufficient backlog of work to cushion its plans for the coming years.