## Traphaco’s Q1 2025 Financial Results: A Comprehensive Overview

|

An insight into Traphaco’s performance in Q1 2025

Source: VietstockFinance

|

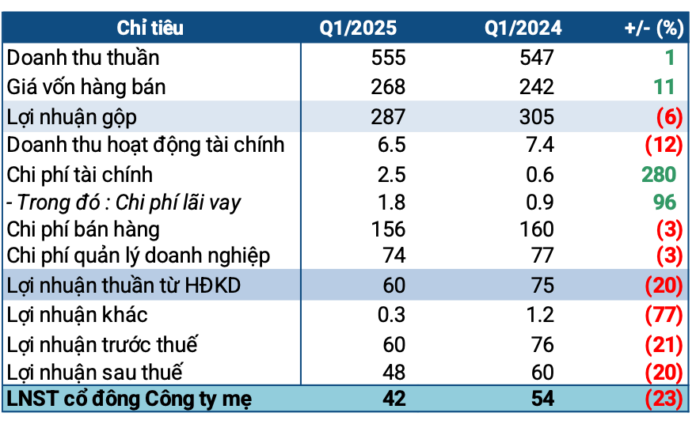

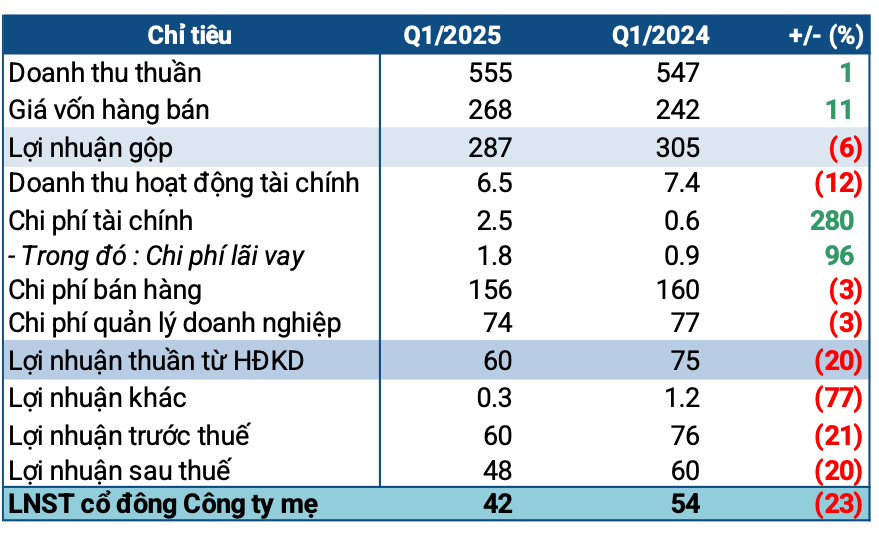

TRA recorded a modest increase in revenue for Q1, reaching VND 555 billion, while cost of goods sold rose by 11% to VND 268 billion. This resulted in a 6% decrease in gross profit, amounting to VND 287 billion.

A 12% decline in financial income, coupled with a significant surge in financial expenses to VND 2.5 billion, impacted the bottom line. Additionally, stagnant selling and administrative expenses played a role in shaping the final outcome. Ultimately, TRA’s net profit for the quarter stood at VND 42 billion, marking a 23% decrease.

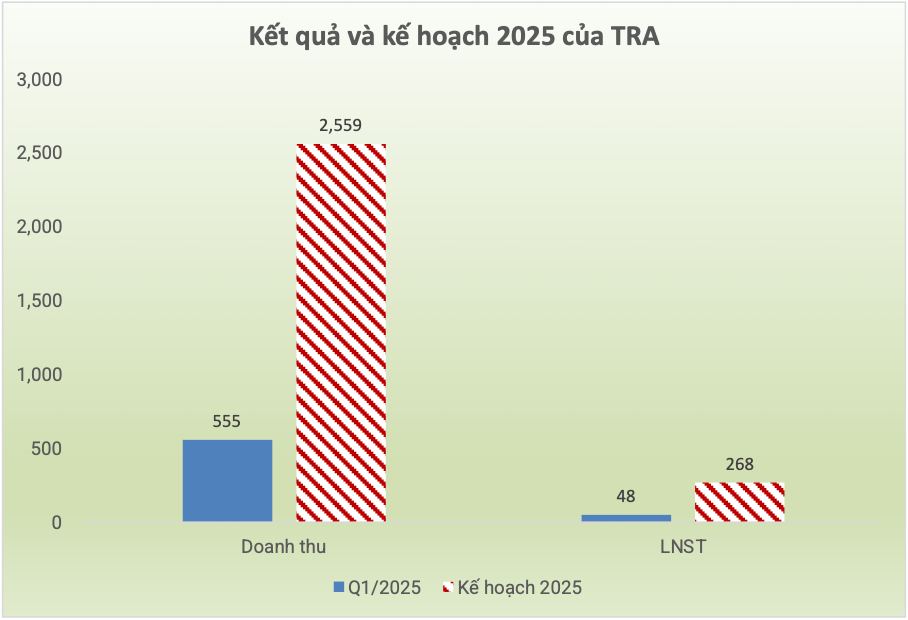

As per the 2025 Annual General Meeting minutes, TRA has set ambitious targets for the year, aiming for a 9% increase in revenue to VND 2,560 billion and a 4% rise in after-tax profit to VND 268 billion. With Q1 results, the company has achieved 22% of its revenue target and nearly 18% of its profit goal.

Source: VietstockFinance

|

TRA’s total assets as of Q1 end stood at VND 2,100 billion, a slight decrease from the beginning of the year, with VND 1,500 billion in short-term assets. Cash and cash equivalents dipped by 20%, settling at VND 574 billion, while inventory remained unchanged at VND 548 billion.

On the liabilities front, all of TRA’s payables were short-term, amounting to VND 609 billion. The company’s quick and current ratios exceeded 1, indicating a healthy position regarding debt obligations.

Short-term borrowings witnessed a 9% increase to VND 207 billion, solely comprised of bank loans.

Chau An

– 17:27 01/05/2025

Unveiling Vinhomes Wonder City: Vinhomes’ Q1 Net Profit Triples Year-on-Year

The launch of Vinhomes Wonder City in Hanoi’s west has seen Vinhomes Joint Stock Company (HOSE: VHM) kick off 2025 with a bang, posting a impressive net profit of nearly VND 2.7 trillion.

The Power of Persuasive Writing: Crafting Captivating Content for the Win

At the recent 2025 Annual General Meeting (for the 2024 financial year), held on the morning of April 29th, Gia Lai Electricity Joint Stock Company (HOSE: GEG) revealed ambitious growth plans. The company also announced its first-quarter financial statements for 2025, showcasing a significant improvement. This impressive performance is attributed to successful electricity price negotiations, with an astounding 89% of the annual profit plan achieved in just one quarter.

The Brokerage Segment’s Thin Margins and Surging Provision Costs: A Look at FPTS’ 8% Drop in Q1 Net Profit

In Q1 2025, FPT Securities Joint Stock Company (FPTS, HOSE: FTS) recorded revenue and pre-tax profit of nearly VND 314 billion and over VND 100 billion, respectively, equivalent to 31% and 20% of the yearly plan. The profit showed a slight decrease compared to the same period last year due to modest profits in the brokerage segment and a significant increase in provision expenses.