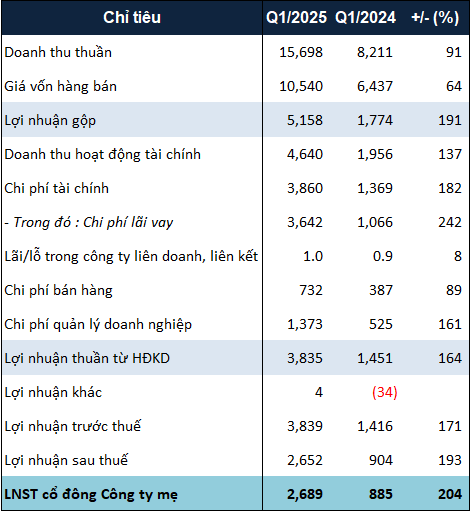

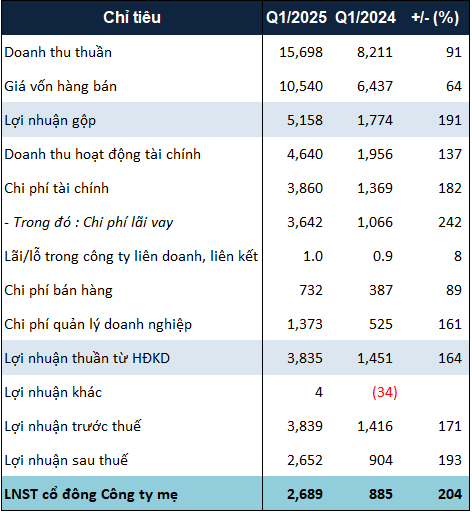

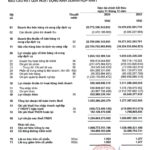

According to the consolidated financial statements for Q1 2025, Vinhomes reported consolidated net revenue of VND 15,698 billion, a more than 91% increase compared to the same period last year. Consolidated net revenue, including revenue from joint venture contracts and bulk sale transactions recorded in financial revenue, reached VND 19,269 billion, equivalent to 2.2 times. Net profit was nearly VND 2,689 billion, triple that of the previous year.

|

VHM’s Q1 2025 business results in VND billion

Source: VietstockFinance

|

The company attributed the strong results to the handover of units at Vinhomes Royal Island and Vinhomes Ocean Park 2-3 projects, which remained the main drivers for the period.

Sales revenue for Q1 2025 and unhanded over sales as of the end of the quarter reached VND 35 trillion and VND 120 trillion, respectively, representing a 2.2-fold increase and a 7% year-over-year growth. This outstanding performance was mainly driven by the positive business results from the mega-urban projects, particularly Vinhomes Wonder City in West Hanoi, which was launched in mid-March 2025. This lays a solid foundation for the company’s revenue and profit growth in the upcoming quarters.

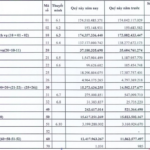

As of March 31, 2025, Vinhomes maintained a strong financial position with total assets and equity reaching VND 561.5 trillion and VND 223.4 trillion, respectively.

In terms of project development, in March 2025, Vinhomes launched the mega-urban project, Vinhomes Wonder City, with 92% of the Hung Dong subdivision sold out just four days after the launch, and 70% of the Binh Minh subdivision absorbed on the first day of its debut on March 23.

In Ho Chi Minh City, the super-project Vinhomes Green Paradise in Can Gio broke ground on April 19, 2025. With a scale of 2,870 ha and an expected population of 230,000, the project will set new standards for ESG urban models based on three pillars: green, smart, and ecological. Previously, on March 26, 2025, Vinhomes commenced construction on Vinhomes Green City in Hau Nghia, Duc Hoa, Long An (197.2 ha), marking a strategic step towards expanding to the northwest of Ho Chi Minh City and the Mekong Delta region.

Ha Le

– 08:19 05/01/2025

The Brokerage Segment’s Thin Margins and Surging Provision Costs: A Look at FPTS’ 8% Drop in Q1 Net Profit

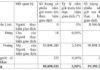

In Q1 2025, FPT Securities Joint Stock Company (FPTS, HOSE: FTS) recorded revenue and pre-tax profit of nearly VND 314 billion and over VND 100 billion, respectively, equivalent to 31% and 20% of the yearly plan. The profit showed a slight decrease compared to the same period last year due to modest profits in the brokerage segment and a significant increase in provision expenses.

The Power of Persuasive Writing: Crafting a Compelling Headline

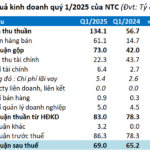

Unveiling the Secrets of a Profitable Quarter: VGC’s Impressive 56% Growth

Thanks to its robust land leasing segment and strong infrastructure development, Viglacera reported impressive earnings for the first quarter of 2025, with a profit of nearly VND 321 billion, a 56% increase compared to the same period last year. The company has successfully achieved 24% of its annual profit target.

The Tasty Transparency: Crunching Numbers for a Crispy Delight

In the first quarter, Safoco achieved 22.5% of its revenue target and almost 26% of its profit goal, marking a strong start to the year.