In the domestic market, the Company proactively restructured its distribution and business system, launching and re-launching nearly 20 products. Currently, Vinamilk operates a system of more than 600 stores and expects to have 800 stores by Q2 2025. Plant-based milk, Green Farm fresh milk, and powdered milk for children achieved double-digit growth. From the beginning of April 2025, domestic revenue growth is expected to improve with a double-digit increase compared to the same period last year.

The international market maintained positive growth for the seventh consecutive quarter, with a 11.8% increase over the same period, thanks to positive export results. The company has expanded into two new export markets, bringing the total number of export markets to 65.

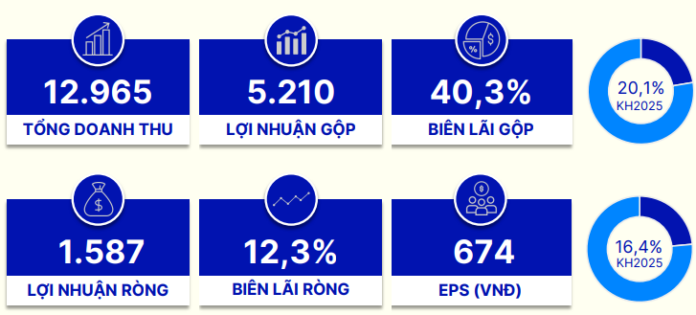

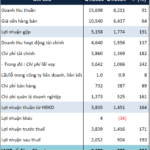

Consolidated pre-tax profit reached VND 1,951 billion, fulfilling 16% of the yearly plan. Net profit was VND 1,587 billion, down 28% compared to the previous year; net profit margin was 12.3%, compared to 15.7% in the same period last year.

|

Key business indicators of Vinamilk in Q1/2025

|

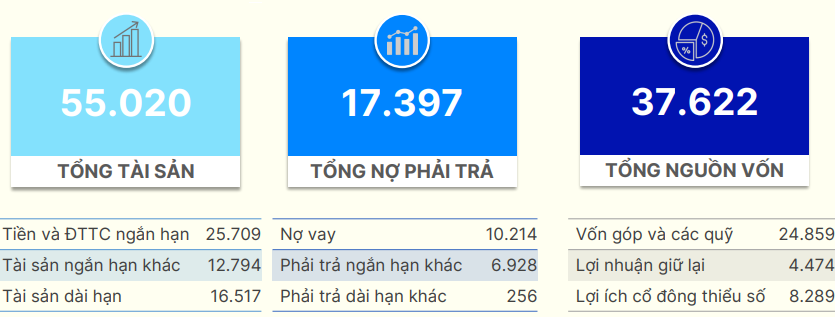

As of March 31, 2025, total assets exceeded VND 55,000 billion. The company maintained high liquidity, with cash and cash equivalents accounting for 46.7% of total assets. In addition, inventories were nearly VND 7,000 billion, up 23% from the beginning of the year. Short-term receivables decreased by 12% to less than VND 2,500 billion.

Total liabilities were nearly VND 17,000 billion, down 8% from the beginning of the period. Short-term borrowings accounted for the majority of this, at approximately VND 10,000 billion.

|

Financial indicators of Vinamilk as of March 31, 2025

|

Regarding the risk of global trade wars, the Company is closely monitoring the situation and believes that while there is no direct impact on its business, there may be indirect effects due to more cautious consumer sentiment. However, the Company is confident that the situation will stabilize once the trade conflicts are resolved.

Sharing in the Q1/2025 investor newsletter, Mai Kiều Liên, Member of the Board of Directors and General Director of Vinamilk, said: “The macroeconomic situation in 2025 is witnessing significant fluctuations. Vinamilk will strive to adapt quickly and provide timely support to customers and consumers to achieve the revenue, profit, and dividend plans that the General Meeting has approved. The basis for this is that Vinamilk completed the fundamental steps in its comprehensive renewal strategy in 2024. Notably, this includes products, services, customer approach, management methods, business digital transformation, and investment in technology and people for future projects.”

– 19:35 05/01/2025

The Elite PYN Elite Fund is No Longer a Major Shareholder of TPB

As of September 30, 2024, the Fund increased its holdings to over 104 million shares, representing a 4.7% stake in TPB.

The Brokerage Segment’s Thin Margins and Surging Provision Costs: A Look at FPTS’ 8% Drop in Q1 Net Profit

In Q1 2025, FPT Securities Joint Stock Company (FPTS, HOSE: FTS) recorded revenue and pre-tax profit of nearly VND 314 billion and over VND 100 billion, respectively, equivalent to 31% and 20% of the yearly plan. The profit showed a slight decrease compared to the same period last year due to modest profits in the brokerage segment and a significant increase in provision expenses.

Unlocking Steady Growth and Unlocking Strong Returns: ACB’s 2025 Vision

Asia Commercial Bank has unveiled ambitious plans for the next five years, targeting VND23,000 billion in pre-tax profits and an impressive 16% credit growth by 2025. With a sharp focus on sustainable expansion and digital innovation, the bank aims to deliver consistent returns to its shareholders. This new strategy underscores the bank’s commitment to dynamic growth and positions it for a promising future in Vietnam’s evolving financial landscape.