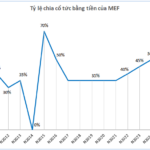

With over 30.2 million shares outstanding, D2D needs to spend more than VND 254 billion on dividend payments. This payout ratio corresponds to the plan approved by the 2025 Annual General Meeting of Shareholders not long ago, but it is still lower than the record dividend payout ratio of 87% in 2023.

In addition to the 2024 dividend, the meeting also passed several other important matters, including the 2025 business plan with a total revenue target of nearly VND 665 billion, a 90% increase from the previous year, and a net profit target of nearly VND 176 billion, double that of 2024.

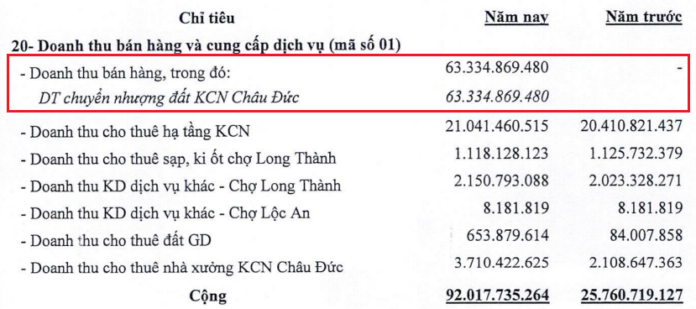

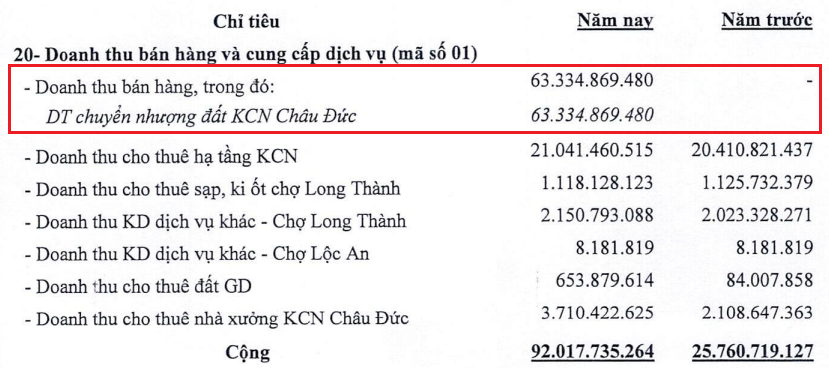

Wrapping up the first quarter of 2025, D2D reported a revenue of over VND 92 billion, 3.5 times higher than the same period last year, and a net profit of more than VND 8 billion, over 8 times higher. The company explained that the surge in profit was mainly due to revenue from the transfer of land in Chau Duc Industrial Park.

|

Breakdown of D2D‘s Q1 revenue structure

Source: D2D

|

However, against the high plan, the company has only achieved 14% and 5% of the full-year targets for revenue and net profit, respectively.

As of the end of the first quarter, D2D‘s total assets stood at nearly VND 1,641 billion, an increase of 8% from the beginning of the year. Notably, cash holdings surged to nearly VND 222 billion, 3.4 times higher. Inventories amounted to nearly VND 166 billion, an 11% decrease, comprising mainly of production and business costs for ongoing projects such as Loc An Residential Area with over VND 55 billion and Huu Phuoc Residential Area with nearly VND 57 billion, among others.

Total liabilities were nearly VND 886 billion, a 15% increase from the beginning of the year, mainly due to advances from customers and unearned revenue, which stood at nearly VND 791 billion, an increase of 27% and accounting for 89% of total liabilities. Notably, D2D did not record any financial debt.

| D2D‘s Financial Performance from Q1/2022 – Q1/2025 |

D2D Shareholders’ Meeting: Tax Uncertainties Affect Land Lease Contracts in Industrial Parks

D2D CEO: Land Lease Prices in Industrial Parks Continue to Rise Despite Tax-Related Uncertainties

– 16:13 08/05/2025

“Investors Express Interest in Long-Term Partnership with BIG Post-Annual General Meeting”

The 2025 Annual General Meeting of Big Invest Group JSC (UPCoM: BIG) was arguably the most memorable event for shareholders since its listing on the stock exchange in early 2022. Aside from record-breaking growth figures, BIG garnered expressions of long-term commitment from numerous professional investors.

A Confident Investor: CII Steps Up as a Key Project Investor in the Prime Thu Thiem Land Allocation

On May 7, Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company (HOSE: CII) shared its insights on Government Decree No. 91/2025/ND-CP, issued on April 24, 2025. The decree stipulates the timing of land price determination for land funds used for payment in build-transfer investment projects (BT projects) in the new urban area of Thu Thiem.

“Record-Breaking Dividend Payout for Que Phong Hydropower: Doubling the Long-Standing Norm”

“The hydroelectric power company, Quế Phong Hydro-Electric Joint Stock Company, has announced a record-breaking cash dividend for 2024, amounting to 40% or VND 4,000 per share. This is a significant increase from the consistent 20% dividend rate maintained over the previous eight years, marking a new era for the company and its shareholders.”