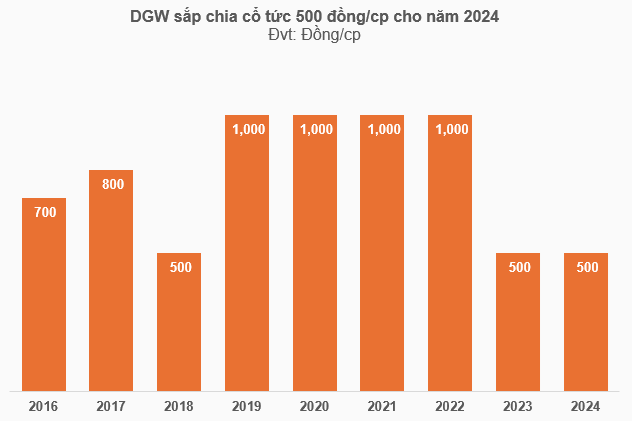

With over 219 million shares outstanding, DGW is set to spend approximately VND 110 billion on its upcoming dividend. This payout ratio is in line with the plan approved at the 2025 Annual General Meeting of Shareholders held not long ago. The dividend amount is also similar to that of 2023.

Source: VietstockFinance

|

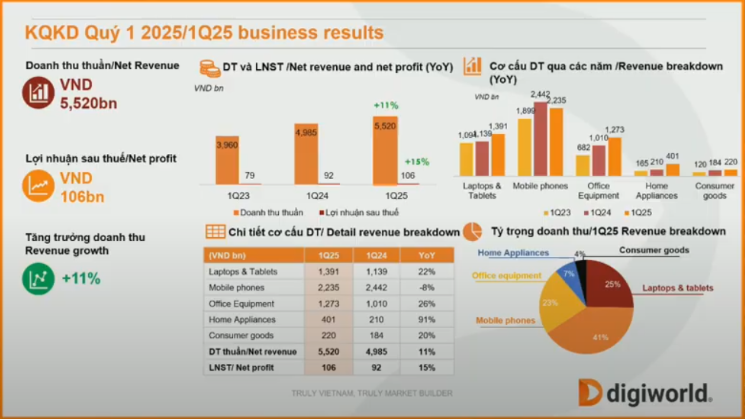

In addition to the 2024 dividend, the General Meeting also approved several notable agenda items, including the issuance of 2 million ESOP shares expected in Q2-Q3/2025 and the 2025 business plan with a revenue target of VND 25,450 billion and after-tax profit of VND 523 billion, representing 15% and 18% growth compared to 2024 performance.

In Q1 2025, DGW recorded VND 5,520 billion in revenue and VND 106 billion in after-tax profit, an increase of 11% and 15% respectively compared to the same period in 2024. Notably, the home appliance segment witnessed a remarkable 90% growth.

Source: Digiworld presentation at the 2025 Annual General Meeting of Shareholders on April 25, 2025

|

In the stock market, DGW shares are currently trading around VND 33,500/share, a significant drop since the beginning of April following news about the tax policies of the administration of US President Donald Trump.

Responding to a shareholder’s question about the impact of US tax policies on DGW, Chairman of the Board of Directors Doan Hong Viet affirmed that the company operates based on 100% domestic demand and thus remains unaffected. While higher tariffs may lead to economic recession and potentially decrease consumer demand, the likelihood of such a scenario is minimal.

| DGW Share Price Movement since the beginning of 2025 |

– 16:17 05/07/2025

“Record-Breaking Dividend Payout for Que Phong Hydropower: Doubling the Long-Standing Norm”

“The hydroelectric power company, Quế Phong Hydro-Electric Joint Stock Company, has announced a record-breaking cash dividend for 2024, amounting to 40% or VND 4,000 per share. This is a significant increase from the consistent 20% dividend rate maintained over the previous eight years, marking a new era for the company and its shareholders.”

“TCH Finalizes Plans to Issue Over 200 Million Shares, Focusing on Two Major Projects in Haiphong”

The Hoang Huy Finance Investment Joint Stock Company (HOSE: TCH) convened an extraordinary general meeting for the 2025 financial year to approve a plan to increase its charter capital to nearly VND 8,700 billion. This move aims to bolster the company’s resources for two key real estate projects in Hai Phong.

SIP Posts Highest Q1 Profit in 4 Years, Reaching Nearly 50% of Annual Target

Saigon VRG Joint Stock Company (HOSE: SIP) has announced its Q1 2025 financial results, reporting a net profit of over VND 351 billion, a remarkable 43% increase from the same period last year and the highest since Q1 2021. This achievement marks a strong start to the year, with the company already nearing 50% of its annual profit plan.