The Federal Reserve (Fed) on May 7 decided to keep interest rates unchanged, stating that the risks of rising inflation and unemployment have increased. The Fed’s assessment highlights the dilemma faced by policymakers in dealing with the uncertain US economic outlook due to President Donald Trump’s tariffs.

At a press conference following the two-day monetary policy meeting, Fed Chairman Jerome Powell stated that it is currently unclear whether the economy will continue to grow or weaken under the pressure of heightened uncertainty and the potential for a sharp rise in inflation.

FED “STANDS STILL” DUE TO UNCERTAINTY

“The scope, magnitude, and persistence of these uncertainties are quite, very difficult to assess,” Mr. Powell said at the press conference. “There is no clarity at all about what monetary policy should be doing at this point. We don’t know what to do. I don’t think we can say where things will go from here.”

Analysts interpreted these statements as Mr. Powell’s way of conveying that the Fed – as a crucial force in shaping the US economy – will “stand still” until Trump’s agenda of significant policy changes takes full effect.

In its statement following the meeting, the Fed said that since its recent meeting in March, “uncertainty about the economic outlook has increased,” with heightened risks of rising inflation and unemployment.

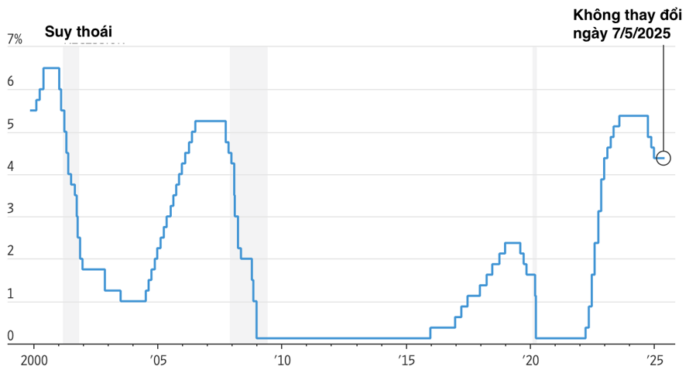

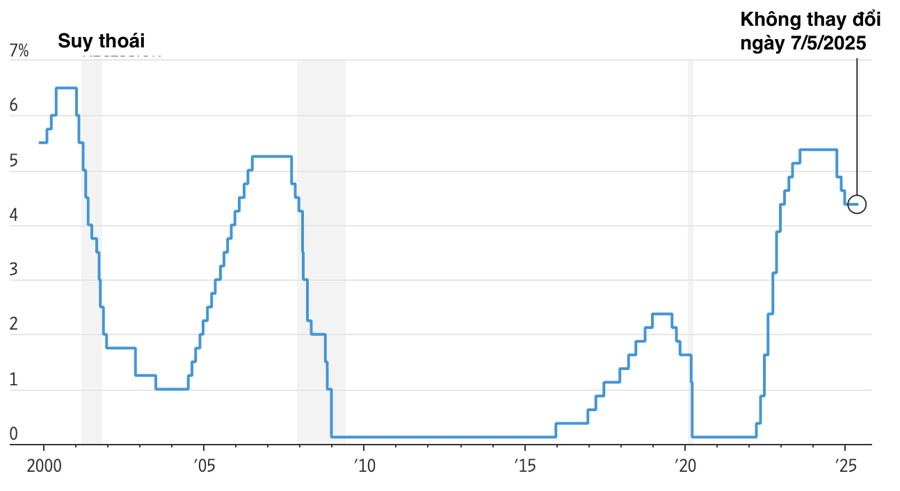

This time, the Fed kept the overnight lending rate unchanged at 4.25-4.5%, a decision that was anticipated by the market. This rate has been maintained by the FOMC since last December after three consecutive cuts totaling a full percentage point.

Thomas Simons, Chief US Economist at investment bank Jefferies, said that the language in the Fed’s statement “downplayed” the volatility since the central bank’s March 18-19 meeting, as well as the increased uncertainty of the economic outlook since then.

Following the announcement of the retaliatory tariff plans and subsequent unpredictable tariff moves, “the increased pessimism in business and consumer surveys has made it difficult for the Fed to accurately gauge the economic outlook and the shift in risks,” Simons wrote in a report. He also noted that Powell conveyed a “non-committal” stance on monetary policy, which was expected.

The Fed’s statement and Powell’s remarks at the press conference painted a picture of a resilient US economy with continued job growth. When asked about the decline in US gross domestic product (GDP) in the first quarter, Powell attributed it to increased imports as businesses and consumers rushed to buy goods before tariffs took effect. He added that measures of domestic demand remained robust.

Analysts said the Fed is in a dilemma.

“They are in a difficult position. If I were in the Fed meeting, I would also propose that they do nothing at this point,” said William English, a former senior adviser to the Fed, to the Wall Street Journal.

COULD THE FED CUT RATES IN JUNE?

Some economists worry that if the Fed cuts rates, it could make inflation worse. Lower rates stabilize the economy and support steady income growth, but they can also cause businesses and consumers to accept higher prices. Fed officials believe that these expectations could lead to a self-reinforcing upward spiral. On the other hand, if consumers and businesses expect inflation to remain low and stable over time, this “anchored” inflation expectation can play a crucial role in ensuring that inflation does not continue to escalate.

“Businesses and consumers are worried and postponing various economic decisions. If this continues and nothing is done to alleviate these concerns, it will be reflected in the economic data,” Powell said at the press conference.

However, the Fed cannot react until the economy shows a clear direction, and the Fed accurately assesses the risks to its two goals of keeping inflation at 2% and maintaining maximum employment.

“Our current policy stance puts us in a good position to respond to developments as they unfold,” Powell said, reiterating the “wait-and-see” stance maintained since Trump returned to the White House.

The Fed’s path will depend on how the risks related to inflation and employment evolve, or worse, whether inflation and unemployment rise together, putting the Fed in a difficult position. A weak job market is typically a reason to cut rates, while rising inflation calls for tighter monetary policy.

“The Fed is standing still until things become clearer,” said Ashish Shah, investment director at Goldman Sachs Asseet Management. He added that “the better-than-expected US jobs data recently supports this Fed view, and the question is whether the job market will deteriorate enough to warrant a continuation of the easing cycle.”

Investors currently expect the Fed to cut rates later this year. A rate cut at the Fed’s next meeting, expected on June 17-18, would not be a surprise if the economy slows significantly, according to English. However, he also noted that a rate cut in June “would require more clarity about the economic outlook than I expect.”

The Unavoidable Excise Tax on Gasoline

“According to the Minister of Finance, continuously encouraging and exempting gasoline from taxation will make it very challenging to alter behavioral patterns.”

The New Economic Frontier: Leading the Charge in Ho Chi Minh City’s Renaissance

Half a century has passed since the country’s reunification, and it has been a transformative journey for Ho Chi Minh City. The metropolis has always been vibrant and dynamic, witnessing and driving spectacular changes. Overcoming the challenges of the post-war era, the city has rapidly emerged as a major economic hub, solidifying its position as the nation’s leader.

The Golden Rush: Soaring Prices of Gold Rings and SJC Gold

Late in the afternoon of April 8th, domestic gold prices rebounded, surging back above the 100 million VND per tael mark after a sharp decline earlier in the day. This dramatic turnaround saw the price of gold jewelry and SJC gold reclaim their lofty perch, offering a glimmer of hope to investors and enthusiasts alike.