BIG’s Extraordinary General Meeting after 3 years of listing

On April 27, 2025, BIG held its annual General Meeting in Can Tho City, marking three years since the company went public. The meeting approved all 16 proposals, including a notable plan for 2025 with a revenue target of VND 480 billion and a net profit of nearly VND 10 billion. The dividend is expected to be 6% in shares.

BIG’s 2025 annual general meeting in Can Tho

|

In 2024, BIG achieved its highest-ever financial results with a revenue of VND 464 billion and a net profit of nearly VND 10 billion. However, BIG is not just about financial figures; it is entering a new phase of transforming its business model and expanding its investments into multiple fields.

Specifically, BIG plans to transition from a parent-subsidiary model to a holdings structure. This means BIG will hold shares in specialized subsidiaries focusing on various business areas such as trading (construction materials and agricultural products), hotel chains, technology, and M&A. The leadership team expects this specialization to enhance the company’s flexibility and mitigate risks in a volatile economic landscape.

In the real estate sector, BIG currently owns six hotels nationwide, with the latest acquisition being a property in the heart of Can Tho City in Q1 2025. Regarding this, Chairman of BIG, Vo Phi Nhat Huy, shared that there are two other ongoing projects. “BIG has acquired two plots of land totaling over 3,000 sq. m. in the center of Soc Trang City and 500 sq. m. near Can Tho Airport. These lands will be utilized for real estate development projects for lease, which are set to commence in 2025,” he stated.

BIG Group’s Can Tho Building

|

Attracting long-term professional investors

Besides business plans, capital raising, and utilization were among the shareholders’ key concerns. According to Mr. Vo Thuan Hoa, a member of the Board of Directors, BIG’s current chartered capital exceeds VND 150 billion, and the company intends to increase it through share issuance. Additionally, BIG representatives shared that the company has secured additional credit lines of VND 300 billion from several banks to finance its upcoming projects.

Notably, some professional investors at the meeting expressed their interest and desire to accompany the company in the long term. A long-term shareholder shared that they had held BIG shares since before its listing and appreciated the company’s continued focus on rental real estate despite its expansion into new sectors.

A representative from a securities company also acknowledged BIG’s relatively stable growth over the past few years, especially given the challenges faced by many businesses. However, they emphasized that diversified investments necessitate enhanced transparency in BIG’s capital allocation strategies.

While challenges remain, BIG assures that it will prioritize projects with low risks and high profitability. The management team acknowledges the positive signal of attracting long-term investors and is committed to enhancing transparency and governance to meet shareholders’ expectations.

Services

– 15:43 05/07/2025

A Confident Investor: CII Steps Up as a Key Project Investor in the Prime Thu Thiem Land Allocation

On May 7, Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company (HOSE: CII) shared its insights on Government Decree No. 91/2025/ND-CP, issued on April 24, 2025. The decree stipulates the timing of land price determination for land funds used for payment in build-transfer investment projects (BT projects) in the new urban area of Thu Thiem.

“Record-Breaking Dividend Payout for Que Phong Hydropower: Doubling the Long-Standing Norm”

“The hydroelectric power company, Quế Phong Hydro-Electric Joint Stock Company, has announced a record-breaking cash dividend for 2024, amounting to 40% or VND 4,000 per share. This is a significant increase from the consistent 20% dividend rate maintained over the previous eight years, marking a new era for the company and its shareholders.”

“TCH Finalizes Plans to Issue Over 200 Million Shares, Focusing on Two Major Projects in Haiphong”

The Hoang Huy Finance Investment Joint Stock Company (HOSE: TCH) convened an extraordinary general meeting for the 2025 financial year to approve a plan to increase its charter capital to nearly VND 8,700 billion. This move aims to bolster the company’s resources for two key real estate projects in Hai Phong.

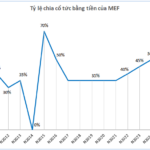

“Manufacturer of Pliers Pays 50% Cash Dividend”

Joint Stock Company MEINFA (UPCoM: MEF) has announced a dividend payout for the fiscal year 2024. Shareholders on the record date of May 15, 2025, will be eligible for a cash dividend of 50%, equivalent to VND 5,000 per share.