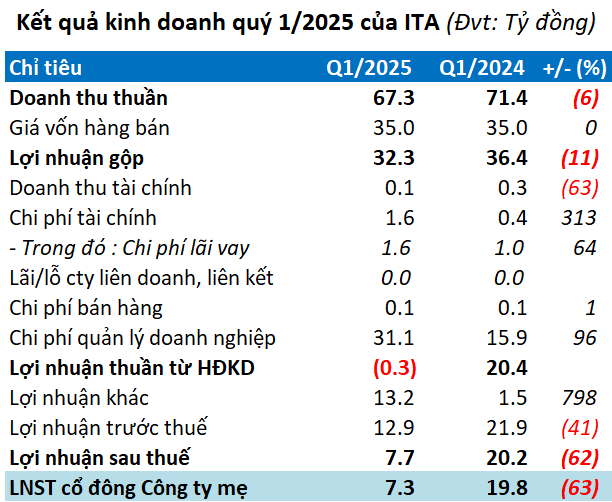

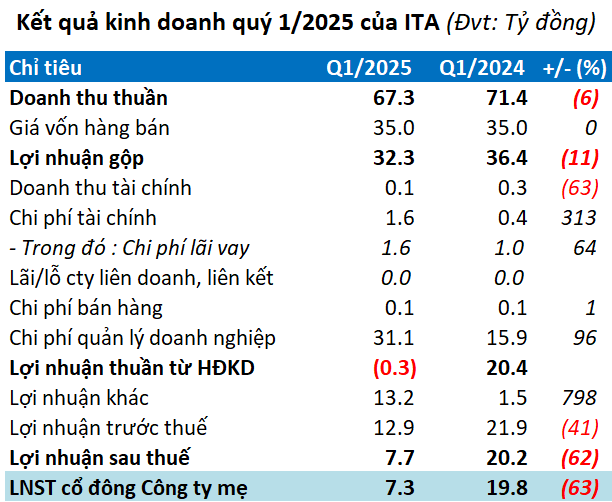

ITA had a challenging start to the year, with first-quarter revenue of over 67 billion VND, a 6% decrease from the previous year. The decline was attributed to a 24% drop in warehouse, factory, and land leasing, which totaled more than 28 billion VND.

Despite a 11% decrease in gross profit to over 32 billion VND, operating expenses soared to nearly 33 billion VND, double that of the previous year, primarily due to increased management costs. This resulted in a net loss of over 300 million VND for ITA.

The sole saving grace was other income, which totaled over 13 billion VND, a ninefold increase from the previous year and was not specifically explained. This helped the company avoid a quarterly loss, resulting in a net profit of over 7 billion VND, a 63% decrease.

Source: VietstockFinance

|

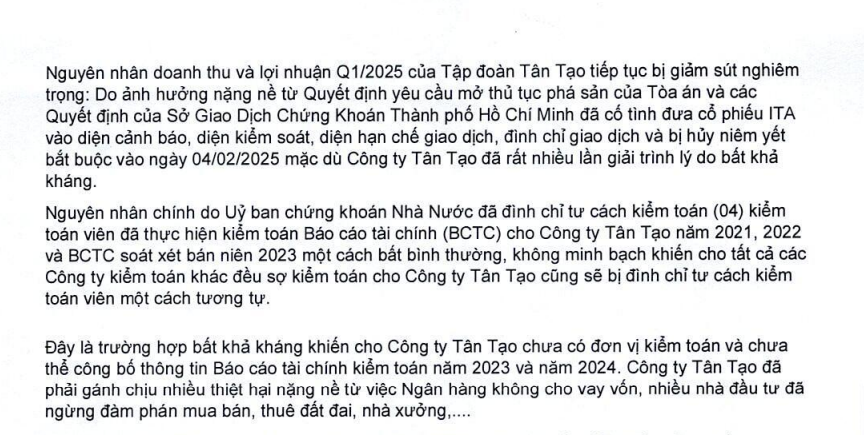

ITA attributed these results to the negative impact of the court’s decision to initiate bankruptcy proceedings and the Ho Chi Minh City Stock Exchange’s (HOSE) rulings, which deliberately placed ITA stock under warning, control, trading restrictions, suspension, and mandatory delisting on February 4, 2025, despite the company’s numerous explanations of force majeure.

The main reason for this was the State Securities Commission’s (SSC) suspension of four auditors who had previously audited the company, causing other firms to avoid potential similar risks. This led to a series of consequences, including banks refusing to provide loans and many investors halting negotiations for land, factory, and warehouse purchases or leases.

|

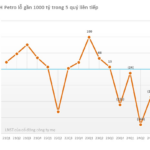

ITA set ambitious goals for 2025, targeting revenue of over 771 billion VND and a net profit of nearly 234 billion VND, double the previous year’s figure. However, with only 9% and 3% of these goals achieved in the first quarter, the company faces an uphill battle in the coming quarters.

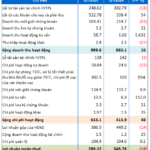

As of the end of the first quarter, ITA‘s total assets remained relatively unchanged from the beginning of the year at nearly 12,660 billion VND. Cash balances decreased by 37% to nearly 35 billion VND, while short-term receivables totaled over 2,021 billion VND, with a provision of nearly 1,025 billion VND for doubtful debts.

Inventories amounted to over 3,738 billion VND, a 1% increase, mainly in the E-City Tan Duc project (nearly 2,572 billion VND), Tan Tao Industrial Park (over 474 billion VND), and Tan Duc Industrial Park (344 billion VND). Additionally, long-term production and business expenses totaled over 3,269 billion VND, with the majority associated with the Kien Luong Thermal Power Project (nearly 2,363 billion VND).

Payables stood at over 1,965 billion VND, a slight increase of 1%, including construction costs for the E-City project of nearly 516 billion VND. Financial borrowings totaled nearly 143 billion VND, a 17% increase, representing 7% of total debt.

Regarding the Kien Luong Thermal Power Project, ITA‘s Chairman, Maya Dangelas (or Dang Thi Hoang Yen), stated that the case at the International Arbitration Center is in the decision-making phase.

Addressing shareholders’ concerns about stock liquidity, Ms. Dangelas assured that the company plans to repurchase shares or facilitate direct purchases by other investors from shareholders who wish to sell if the shares cannot be traded again. In the event of a legal victory, shareholders will also be compensated proportionally to their ownership.

ITA faces liquidity concerns, Chairman reassures with share repurchase plans

– 13:31 05/07/2025

Is FECON’s 200 Billion Profit Goal at Risk Due to Consecutive Losses in the First Quarter?

FECON Corporation (HOSE: FCN) reported a 34% increase in revenue for the first quarter of 2025, however, the company still incurred a loss of VND 7 billion, marking the second consecutive quarter of losses as financial expenses continue to weigh heavily. This puts the company’s target of VND 200 billion in profits for the year at a more challenging position.

The Oil Magnate’s Misfortunes: A Tale of Tax Troubles, Mounting Losses, and Bank Loans

For the year 2024, NSH Petro witnessed a staggering 89% decline in revenue, amounting to just over VND 678 billion, a significant drop from the previous year’s performance. The company reported a staggering loss of nearly VND 790 billion in after-tax profits for 2024, a stark contrast to the VND 47 billion profit achieved in 2023.

The Unforeseen Loss: Novaland’s Unexpected First-Year Report

Novaland (HOSE: NVL) ended 2024 with a net loss of over VND 6.4 trillion, marking the first time the real estate giant has reported a loss since its listing.

![[IR AWARDS] June 2025 Disclosure Calendar: Mark Your Dates](https://xe.today/wp-content/uploads/2025/06/HinhT6_01-218x150.png)