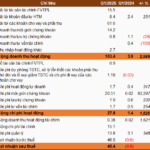

SSI Research reports that for profits, the proportion of enterprises planning for higher profits in 2025 compared to 2024 stands at 67%, with a 13.3% increase in planned profits. Notably, privately-owned enterprises are optimistic, with a 22.4% planned profit increase year-on-year.

State-owned enterprises, as is often the case, have adopted a more cautious approach in their planning, with a 21.4% decrease in planned profits compared to their 2024 performance. However, when compared to their 2024 plans, they still project a 20-100% increase.

In terms of industry sectors, real estate, banking, non-essential consumer goods, information technology, basic resources, and construction & building materials are expected to experience profit growth in 2025. This is due to a focus on the domestic market and supportive policies.

The majority of enterprises set their plans before the US announced its tax policy towards other countries, including Vietnam. However, not many businesses have adjusted their plans as of now.

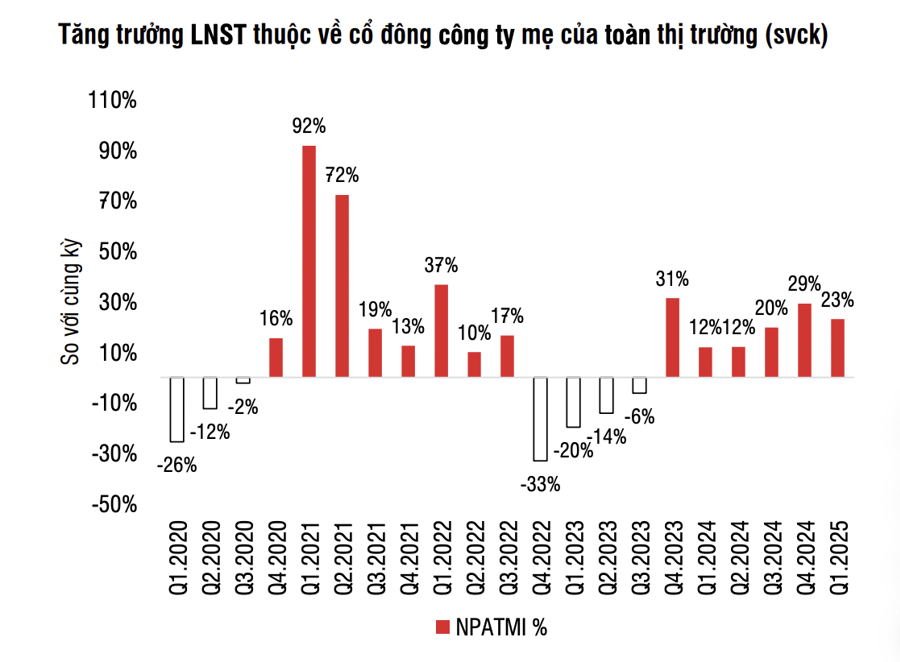

Currently, 989 listed companies, representing 97% of the market capitalization, have published their Q1/2025 financial statements.

The market’s after-tax profit attributed to the parent company’s shareholders continued to grow in Q1/2025, increasing by 23% year-on-year and 6.1% compared to the previous quarter. This marks the sixth consecutive quarter of profit growth, pushing profits to their highest level since 2018, at VND 146.6 thousand billion for the whole market.

The overall profit growth of the market was driven by the real estate sector, which saw a significant 139% surge in profits year-on-year, contributing 63% to the market’s profit increase.

Notably, Vingroup-affiliated stocks like VIC, VHM, VEF, and VRE collectively achieved a 157% profit growth year-on-year, contributing 87% to the sector’s profit increase. Other real estate stocks, such as BCM (+203% year-on-year), KDH (+92% year-on-year), KBC, and NLG, also turned profitable compared to their losses in the previous year.

Excluding the Vingroup stocks, the after-tax profit attributed to the parent company’s shareholders in Q1/2025 grew by 10.8% year-on-year.

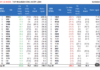

Banks remain the largest contributors to profits, accounting for approximately 45% of the market’s total profits. However, their growth has slowed compared to Q4/2024, with a 14% year-on-year increase. Credit growth for the companies analyzed by SSI Research was relatively positive, reaching 3.4% since the beginning of the year (19.3% year-on-year) in Q1.

Net interest margins (NIMs) remain under pressure due to intense competition as banks maintain attractive lending rates to retain customers. Additionally, asset quality has slightly deteriorated, with the non-performing loan ratio increasing to 2.02% (+29 basis points compared to the previous quarter), partly due to seasonal factors.

Joint-Stock Commercial Banks led the growth in after-tax minority interest profit – NPATMI in the quarter, with SSB at 190%, MBB at 45%, HDB at 36%, and STB at 37% year-on-year. Meanwhile, State-owned Commercial Banks like CTG (+9.3% year-on-year), VCB (+1.4% year-on-year), BID (+0.5% year-on-year), and some large banks like TCB (-4.4% year-on-year) and ACB (-5.8% year-on-year) saw lower-than-expected growth.

Some smaller banks, starting from low or loss-making positions in Q1/2024, achieved outstanding growth, such as NVB (turning around to make a profit of VND 151 billion), ABB (+116%), and VBB (+245%). Additionally, other sectors recorded robust growth, including utilities (+44.5%), chemicals (41%), and retail (+74%). In contrast, the telecommunications and oil & gas sectors experienced declines of 47% and 58%, respectively.

The Big Money Rush: Stocks Soar as VN-Index Recovers from Tariff Trauma

The lethargic morning trading pace took an unexpected turn within the first 15 minutes of the afternoon session. Leading stocks, notably FPT, witnessed a dramatic surge in volume, swiftly triggering a frenzied buying spree. HoSE’s afternoon matching volume skyrocketed by 66% compared to the morning session, with the VN-Index closing at its strongest gain in 16 sessions.

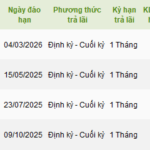

The VDS Issuance of Corporate Bonds: An Exclusive Offering of 800 Billion VND

The Board of Directors of Rong Viet Securities Corporation (VDSC, HOSE: VDS) approved a plan to issue the second tranche of bonds worth VND 800 billion to professional investors on May 7th, 2025. This move aims to restructure the company’s debt and strengthen its financial position. With this new issuance, VDSC demonstrates its commitment to optimizing its capital structure and ensuring long-term financial stability.

“LPBS Announces Impressive Q1 Results: Net Profit Surpasses VND 40 Billion, with an 81% Increase in Asset Size Since the Start of the Year”

Joint Stock Commercial Bank for Foreign Trade of Vietnam, or LPBank, announced that its securities arm, LPBS, recorded a net profit of over VND 40 billion in the first quarter of 2025. This impressive performance was driven by robust earnings from proprietary trading and lending activities, which successfully offset losses incurred in the brokerage division. As a result, LPBS’ total assets surged to a remarkable VND 9,175 billion, largely attributed to increased borrowing from its parent company, LPBank.

The Power of Persuasive Writing: Crafting a Compelling Headline

Unveiling the Secrets of a Profitable Quarter: VGC’s Impressive 56% Growth

Thanks to its robust land leasing segment and strong infrastructure development, Viglacera reported impressive earnings for the first quarter of 2025, with a profit of nearly VND 321 billion, a 56% increase compared to the same period last year. The company has successfully achieved 24% of its annual profit target.