With nearly 4.1 million shares outstanding, MEF plans to spend over VND 20 billion on dividend payments, starting May 26.

Source: VietstockFinance

|

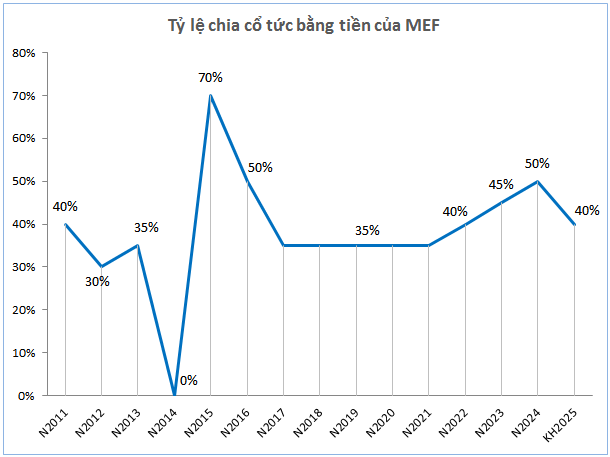

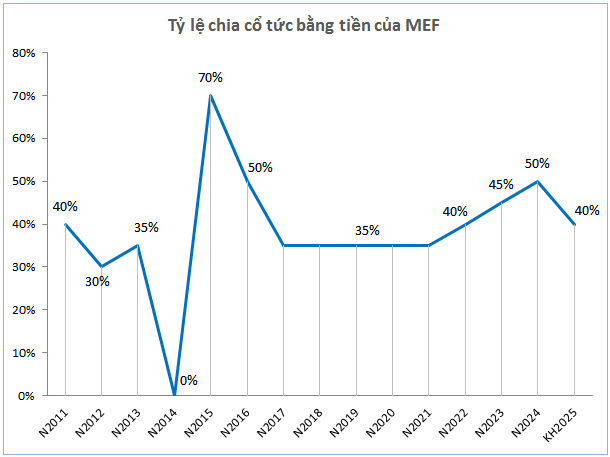

2024 marked the second time MEF paid dividends at a rate of 50%, after the first time in 2016. Previously, the Company did not pay dividends in 2014, but the following year (2015) raised the rate to the highest level of 70%. From 2011 up to now, MEF has maintained a stable cash dividend policy at 30-45%.

2024 was also MEF’s most vibrant year in business, with net revenue reaching VND 380 billion and net profit reaching VND 44 billion, up 17% and 26%, respectively, compared to 2023.

In 2025, MEF targets a slight increase in total revenue to over VND 600 billion, but net profit is expected to decrease by 19% to nearly VND 36 billion. The planned dividend rate is also adjusted down to 40%.

According to MEF, 2025 profit is affected by high input material prices such as copper and aluminum, while selling prices are not adjusted due to competitive pressure. In addition, labor costs and the risk of rising electricity prices also put pressure on profits.

Source: VietstockFinance

|

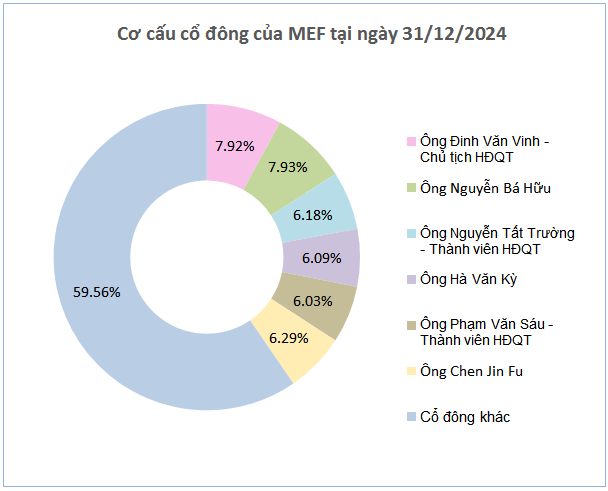

As of the end of 2024, MEF’s major shareholders were all individual investors. Among them, Mr. Dinh Van Vinh, Chairman of the Board of Directors, holds 7.92% of capital and is expected to receive nearly VND 2 billion in dividends from this payment.

|

MEINFA, formerly known as Medical Equipment Factory 2, was established on July 19, 1975, according to Decision No. 519/CL-CB of the Minister of Mechanical Metallurgy. On November 30, 2001, the Company officially operated as a Joint Stock Company. The main business lines are manufacturing and trading of mechanical products and equipment serving the medical industry; manufacturing of metal products, general-use machines… One of the most familiar products of this enterprise is pliers. |

– 14:09 07/05/2025

SIP Posts Highest Q1 Profit in 4 Years, Reaching Nearly 50% of Annual Target

Saigon VRG Joint Stock Company (HOSE: SIP) has announced its Q1 2025 financial results, reporting a net profit of over VND 351 billion, a remarkable 43% increase from the same period last year and the highest since Q1 2021. This achievement marks a strong start to the year, with the company already nearing 50% of its annual profit plan.

Coteccons Bags 250 Billion VND Profit in 9 Months of FY 2025, Secures 23 Trillion VND in Contracts

Impacted by the global economic fluctuations, Coteccons Construction Joint Stock Company (HOSE: CTD) witnessed a 46% decline in its profit for the third quarter of the financial year 2025. However, for the first nine months, Coteccons posted a profit of VND 255 billion, a 6% increase compared to the same period last year.

The Rising Cost of Raw Materials: Traphaco’s First Quarter Setback

For the first quarter of 2025, JSC Traphaco (HOSE: TRA) experienced a regressive business period, primarily due to elevated cost of goods sold.