**State Bank of Vietnam (SBV) Decreases Midpoint Rate by 8 Dong**

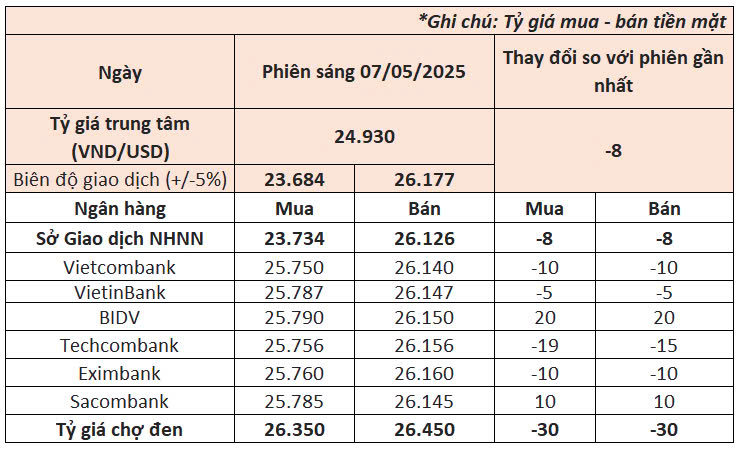

This morning (May 7), the State Bank of Vietnam set the daily reference exchange rate at 24,930 VND/USD, an 8-dong decrease from the previous day’s listing. This marks the third consecutive decrease since the holiday period, with a total reduction of 26 dong since the beginning of the week.

With a permitted fluctuation of 5% on either side of this midpoint, the trading band for commercial banks today is 23,684 – 26,177 VND/USD.

The State Bank of Vietnam’s trading arm also lowered its buying and selling rates by a corresponding amount to 23,734 – 26,126 VND/USD.

Commercial banks witnessed mixed movements in USD rates this morning, with a predominant downward trend.

Vietcombank, the lender with the largest market share in foreign currency term, listed the dollar at 25,750 – 26,140 VND/USD, a 10-dong decrease in both buying and selling rates compared to the previous day.

VietinBank followed suit with a 5-dong decrease in both rates, while BIDV increased its rates by 20 dong from the previous day.

Among private banks, Techcombank reduced its buying rate by 19 dong and selling rate by 15 dong. Eximbank lowered its rates by 10 dong on both sides, while Sacombank raised its buying and selling rates by 10 dong.

In the interbank market, the dollar stood at 25,962 VND/USD at the end of the May 6 session, a 9-dong increase from the previous close.

On the black market, the greenback was traded at 26,350 – 26,450 VND/USD as of 9:00 am this morning, with both buying and selling rates decreasing by 30 dong from the previous day.

Internationally, the US Dollar Index (DXY), which measures the greenback’s strength against a basket of major currencies, hovered around 99.5 points, slightly recovering from the previous day’s close.

The dollar weakened against major currencies amid market concerns over US trade deals and anticipation of the Fed’s monetary policy meeting outcomes.

Investors are awaiting details on trade agreements being negotiated by the Trump administration with various countries, including China.

Eugene Epstein, Head of Structured Products at Moneycorp, commented that the market seems anxious as the 90-day tariff extension deadline approaches without any significant announcements.

Meanwhile, newly released data showed that the US trade deficit hit a record high in March. According to the US Department of Commerce’s Economic Analysis Bureau, the trade deficit widened by 14% to $140.5 billion in March, surpassing market expectations of a $136.8 billion deficit. This marks the highest level on record.

**Gold Bar Prices Surge by 500,000 VND per Tael, Hovering Near All-Time High**

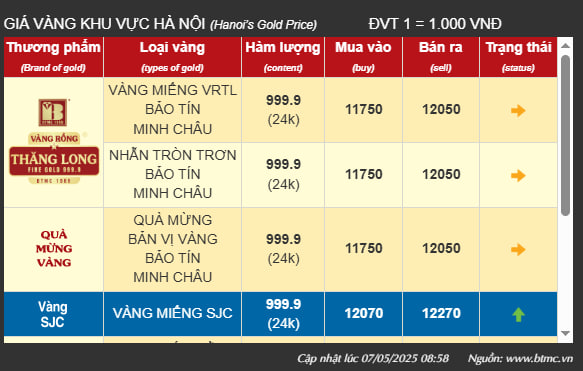

Gold bar prices at major domestic gold shops rose slightly this morning compared to the previous day’s close. Specifically, prices at Bao Tin Minh Chau, PNJ, SJC, and DOJI were adjusted to VND 120.7-122.7 million per tael (buying-selling), an increase of VND 500,000 per tael in both buying and selling rates from the previous session’s close. This rate is just VND 600,000 lower than the historical peak of VND 123.3 million per tael recorded yesterday.

Gold ring prices remained relatively stable. PNJ listed its gold rings at VND 115.5-118.1 million per tael, SJC at VND 116-118.5 million per tael, DOJI at VND 114.5-118 million per tael, and Bao Tin Minh Chau at VND 117.5-120.5 million per tael. These rates represent record highs for gold rings.

In the global market, gold prices retreated this morning after surging above $3,400 per ounce on May 6. This surge was attributed to renewed buying interest from Chinese investors following an extended holiday period and heightened concerns over new tariff policies from the Trump administration. Meanwhile, global investors are awaiting cues from the monetary policy meeting of the US Federal Reserve (Fed), with the decision expected to be announced early tomorrow morning Vietnam time.

The Price of Gold Plummets Following US-China Trade Deal

The positive trade developments have encouraged investors to shift their funds to riskier assets such as equities and commodities, diminishing gold’s safe-haven appeal.

“Global Markets Rally Ahead of Crucial US-China Trade Talks”

The global markets are abuzz with activity as oil, gold, rubber, and coffee prices, along with US agricultural products, surge ahead of the highly anticipated US-China tariff talks scheduled for later this week.

The Golden Opportunity: “Sharks” SPDR Gold Trust Show No Signs of Cooling Off

“The surge in gold prices to $3,500 per ounce happened too fast, and the market needs to take a step back to digest this rapid ascent and its implications. This sharp rally has caught many off guard, and a period of consolidation or even a modest pullback would be healthy to ensure the sustainability of this upward trend.”