As is customary every year, towards the end of Q1 2025, many businesses enter the peak period of preparation for the annual general meeting season. This is not only an occasion to summarize the 2024 business operations but also to discuss and decide on important plans and goals for 2025 and even outline a medium-term vision for the next 3-5 years.

Among the listed companies on the stock market, the group of bank stocks always attracts the attention of investors and has started to announce the schedule of the 2025 general meeting of shareholders. Of which, Nam A Bank (code NAB) is one of the pioneer banks in organizing the early congress to present to the General Meeting of Shareholders for consideration and approval of important contents and new orientations in 2025.

Customers doing transactions at Nam A Bank

|

Revealing a 25% dividend plan

Nam A Bank has finalized the list of shareholders on February 24 and plans to hold the 2025 Annual General Meeting of Shareholders on March 28 at Dalat Palace Heritage Hotel (Da Lat City, Lam Dong Province). All related documents have been publicly disclosed on the bank’s website.

In 2024, Nam A Bank continued to record positive business results, specifically: consolidated pre-tax profit reached VND 4,545 billion (up 38% over the same period, exceeding 14% of the year plan), along with total assets of more than VND 245,000 billion and customer capital mobilization reaching VND 178,341 billion (completing 100% of the set target).

Entering 2025, with the orientation of maintaining the growth target but associating with the responsibility of sharing difficulties with businesses and customers as called by the Government. Therefore, Nam A Bank sets a pre-tax profit plan for 2025 of VND 5,000 billion, up 10% over the previous year. Total assets are expected to reach more than VND 270,000 billion, up more than 10% compared to the end of 2024. Loan balance for customers is about VND 194,000 billion, up 16% equivalent to the credit growth limit aimed by the banking industry in 2025. At the same time, the bank also aims to continue controlling the bad debt ratio at below 2.5%.

Especially, one of the contents that investors are particularly interested in is the plan to pay stock dividends. Accordingly, Nam A Bank will submit to the General Meeting of Shareholders for approval the plan to issue 343 million bonus shares (equivalent to a ratio of 25%) from the source of owner’s equity.

Sustainable development orientations in 2025: Increasing financial buffers and aiming for digitization and greening goals

Continue to increase financial buffers to enhance financial capacity towards meeting the requirements of the Basel II Advanced Approach roadmap and promote the application of green and digital standards in the bank’s business portfolio.

OneBank digital transaction point – One of Nam A Bank’s technology highlights

|

In 2024, Nam A Bank increased its charter capital from VND 10,580 billion to VND 13,725 billion through bonus share issuance and ESOP. In 2025, the bank continues to plan to increase its charter capital to over VND 18,000 billion and submit to shareholders many important proposals: Issuance of convertible bonds to private placement, capital contribution to buy shares, participate in the restructuring of people’s credit funds…

The proactive construction of contingency plans and risk management scenarios, especially in the case of “early intervention” of the bank, shows a well-managed and strictly compliant management orientation with the State Bank’s regulations.

In addition, Nam A Bank is gradually building an investment portfolio towards digitization and greening, aiming for sustainable development and differentiation in the financial market.

Expanding into the international market and targeting new potential customers

Nam A Bank has continuously expanded its business network in the past time

|

In 2024, the bank opened 5 new branches and 3 transaction offices, bringing the total number of traditional transaction points to 148. In addition, the Onebank digital transaction point was also expanded with 114 points, bringing the total number of business points to 262, covering all key economic regions of the country.

The plan to expand activities in the international market will also continue to be submitted to shareholders for approval in 2025, aiming to access global financial institutions and potential customer segments such as overseas Vietnamese and FDI enterprises.

At the same time, Nam A Bank promotes its digital transformation strategy, upgrades technology infrastructure, restructures traditional distribution channels, and gradually forms strategic alliances with securities, finance, insurance, and retail chains… to expand the potential customer base.

In addition, the bank is researching and deploying a ‘financial supermarket’ tool to provide customers with a multi-functional experience.

NAB has been included in the investment portfolios of many foreign funds

In the stock market, NAB stock continuously attracts investors, liquidity increases sharply with tens of millions of shares matched per session. Not only attracting domestic investors, NAB also caught the attention of foreign investors with many sessions being bought in large quantities.

In the Q1/2025 review period, MarketVector Indexes added NAB to the portfolio of MarketVector Vietnam Local Index – the reference index of VanEck Vector Vietnam ETF (VNM ETF). NAB is also the code expected to be bought the most with nearly 5.9 million USD, equivalent to about 9 million shares bought according to the closing price session on March 14 – before the portfolio announcement date (VND 17,600/share).

Founded in 1955, VanEck has grown into one of the most powerful investment empires in the world. As of the end of 2024, VanEck managed assets of up to 113.8 billion USD. This company has affirmed its leading position in the global financial market through a diverse investment portfolio. With a macro investment philosophy, being in the eyes of this fund has made NAB stock a ‘hot’ bank stock in the eyes of investors recently.

Previously, in the Q3/2024 restructuring, NAB was also included in the investment portfolio of Fubon FTSE Vietnam ETF. This fund bought about 10 million NAB shares.

In addition to VanEck and Fubon FTSE Vietnam ETF funds, there are also ETF funds from Singapore, Taiwan, Hong Kong, the US, and domestic ETFs such as DCVFMVN Mid Cap ETF, Vina Capital VN 100 ETP… investing in NAB stock.

– 08:31 27/03/2025

“Transforming Tu Son into a Heritage City: A Fusion of Tradition and Modernity”

If the melody of the music video Bắc Bling struck a chord with you, then delve deeper into this vibrant young city – a unique blend of modern and traditional, steeped in rich cultural heritage and brimming with potential. Known as the “Village in the City, City in the Village”, it boasts a distinct charm and a promising future.

The Ultimate Guide to VIX’s Ambitious Plans: Targeting Billion-Dollar Profits with a Massive Share Offering of 73 Million.

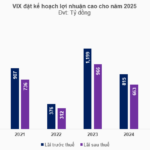

The upcoming 2025 Annual General Meeting of VIX Securities Joint Stock Company (HOSE: VIX) is set to take place on the morning of May 23, 2025, with a packed agenda. Notably, the company plans to present its ambitious pre-tax profit target of VND 1,500 billion and a post-tax profit of VND 1,200 billion. Additionally, they will propose the issuance of nearly 73 million shares as dividends for the year 2024 and seek approval for changes to the board of directors, including the exemption and election of a new member.

The Power of Persuasive Writing: Crafting Captivating Content for the Win

At the recent 2025 Annual General Meeting (for the 2024 financial year), held on the morning of April 29th, Gia Lai Electricity Joint Stock Company (HOSE: GEG) revealed ambitious growth plans. The company also announced its first-quarter financial statements for 2025, showcasing a significant improvement. This impressive performance is attributed to successful electricity price negotiations, with an astounding 89% of the annual profit plan achieved in just one quarter.