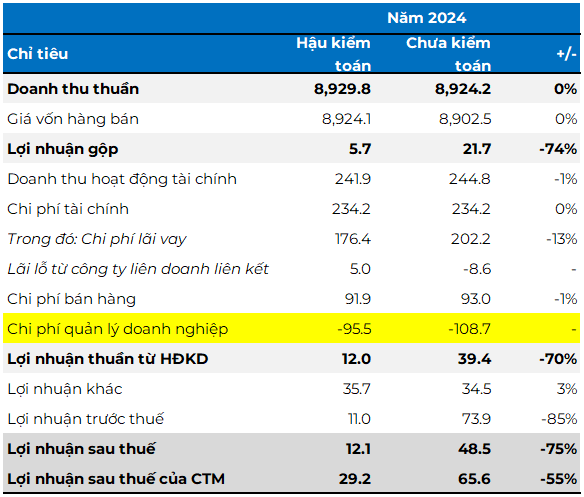

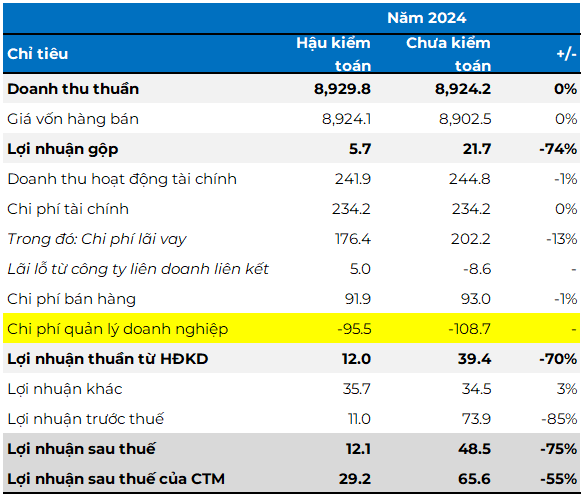

In the recently published audit report, SMC recorded a net profit of over 29 billion VND in 2024, a 55% decrease compared to the figure in the previously self-prepared report. This result comes after auditors from Moore Aisc made adjustments to several critical items, including gross profit, interest expenses, and management expenses.

Notably, management expenses were adjusted from negative 109 billion VND to negative 96 billion VND, mainly due to a change in the allowance reversal. It is also worth noting that the figure of negative 109 billion VND in SMC’s self-prepared report was also recently adjusted just a week ago.

SMC’s 2024 audited financial results

Unit: Billion VND

Source: VietstockFinance

|

Asset Purchase Agreement with Novagroup

The main factor contributing to SMC‘s profitability in 2024 was primarily due to an agreement with Novagroup.

“On December 20, 2024, SMC and Novagroup Joint Stock Company and its member companies signed a confirmation of debt and commitment to repay the debt. As of the date of this report, the Group and Novaland Group have signed several asset purchase contracts and agreements to ensure payment arrangements for the Group’s receivables.

These transactions occurred after December 31, 2024, and were determined by the Group’s Board of Directors as post-year-end events necessary for supplementary information and/or adjustments to existing year-end financial statements. As a result, the Group’s Board of Directors reviewed and assessed the recoverability, adjusting the allowance for related receivables as of December 31, 2024,” the Moore Aisc auditors stated.

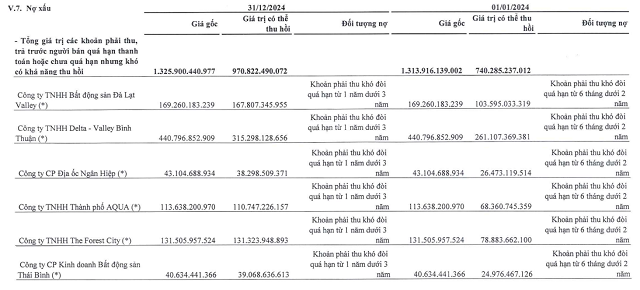

As a result of this agreement, SMC significantly reduced its allowance for doubtful accounts to 351 billion VND at the end of 2024, much lower than the 553 billion VND recognized at the beginning of the year. At the same time, the recoverable value of bad debts also increased significantly from 740 billion VND to 970 billion VND, mainly due to adjustments in companies related to Novagroup.

Source: SMC’s 2024 Audited Financial Statements

|

SMC explained that the allowance for doubtful accounts is based on the net realizable value, which is the amount of receivables after deducting the estimated value of collateral by the Board of Directors and the settlement of payables arising after the related real estate sales contracts and agreement.

Avoiding Delisting, but Still Facing Doubts About Continued Operations

With profitable financial results, SMC‘s stock has avoided the risk of delisting, as it has only incurred losses for two consecutive years. According to the regulations of HOSE, if a company reports losses for three consecutive years, its stock is subject to forced delisting.

However, despite overcoming this challenge, SMC still faces significant concerns. The core issue the company needs to address is how to restore its main business operations amid the growing challenges in the steel industry. A closer look at the audited report reveals that SMC only avoided losses due to allowance reversals and other income, while its core business shows no significant signs of recovery.

The auditors from Moore Aisc continue to emphasize SMC‘s ability to continue as a going concern, given its accumulated losses of 140 billion VND, negative cash flow from operating activities of over 500 billion VND, and short-term debt exceeding short-term assets by approximately 600 billion VND..

– 13:58 05/07/2025

“ACBS: Navigating Challenges in Q1 with a 31% Profit Dip: The Impact of Proprietary Trading, Brokerage, and Loan Provision Costs”

In Q1 of 2025, ACB Securities Joint Stock Company (ACBS) recorded a pre-tax profit of nearly VND 182 billion, a 31% decrease compared to the same period last year. This performance accounts for over 13% of the company’s full-year target of VND 1,350 billion. The decline can be attributed to a downturn in proprietary trading and brokerage, coupled with increased loan loss provisions.

Anticipating EVF’s 2024 Audit Results

Electricity Finance Corporation (EVNFinance – HOSE: EVF) is set to release its 2024 audited financial statements in late February 2025.