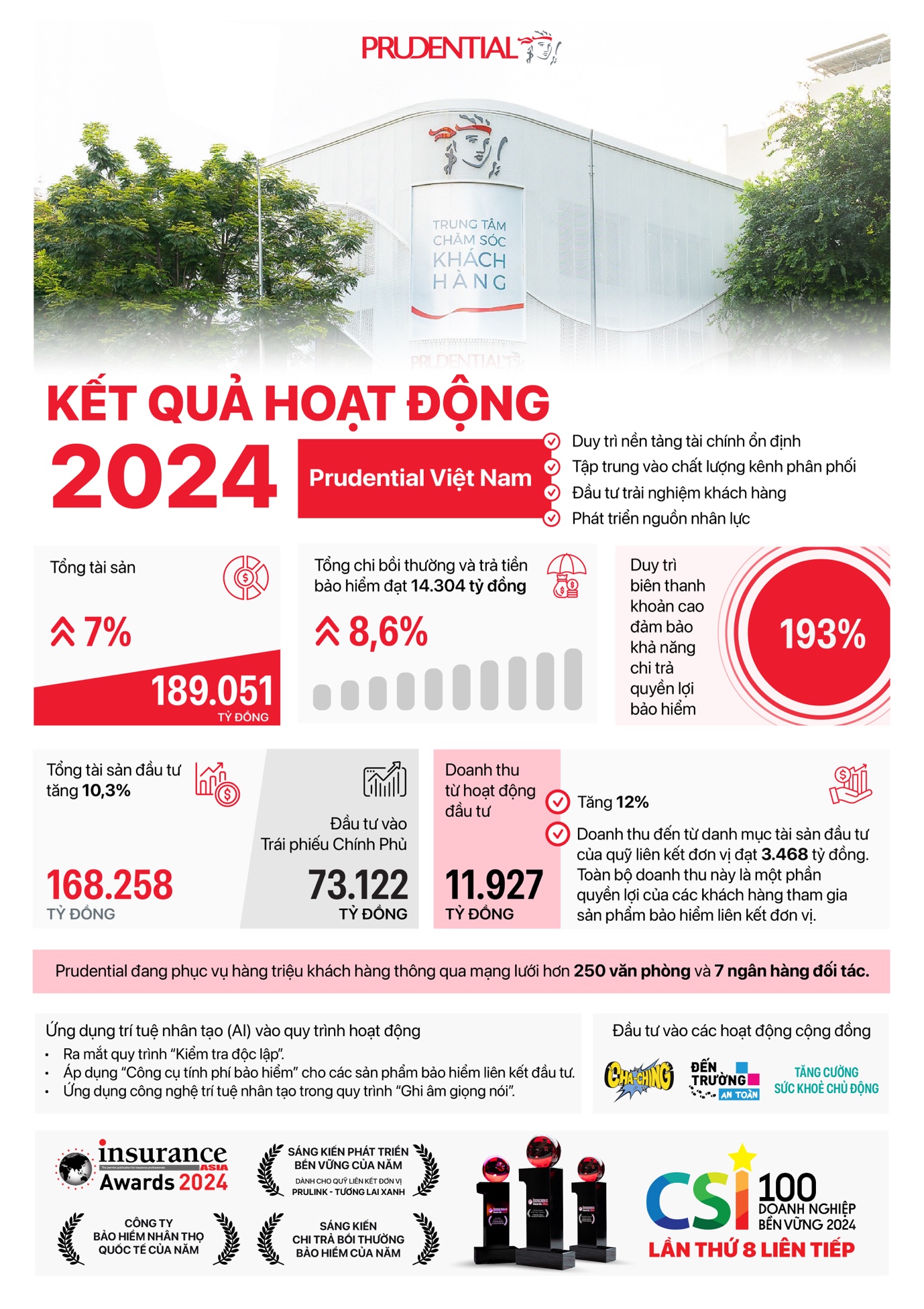

On April 8, 2025, in Ho Chi Minh City, Prudential Vietnam Life Insurance Company Limited (Prudential Vietnam) announced its 2024 annual financial report.

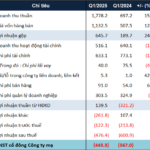

At the end of the 2024 financial year, Prudential Vietnam recorded the following notable results:

Total assets reached VND 189,051 billion, a 7% increase.

Total investment assets amounted to VND 168,258 billion, a 10.3% increase. Of this, VND 73,122 billion was contributed to the economy through investments in government bonds.

2024 was another year of effective investing, with investment income reaching VND 11,927 billion, a 12% increase. Of this, VND 3,468 billion came from the investment portfolio of unit-linked funds. This income forms part of the benefits for customers participating in unit-linked insurance products.

Total insurance business revenue reached VND 23,251 billion. New business annualized premium equivalent (APE) revenue was VND 3,043 billion.

Pre-tax profit stood at VND 3,339 billion.

Total claims and benefit payments amounted to VND 14,304 billion, an 8.6% increase.

Mr. Conor Martin O’Neill, Deputy CEO and Chief Financial Officer of Prudential Vietnam, commented:

“In 2024, Prudential Vietnam made solid progress in strengthening its operating capabilities and enhancing customer experience amidst a dynamic market environment. While economic fluctuations influenced customers’ financial planning habits and decisions, the demand for long-term financial protection and accumulation remains strong in Vietnam.”

“Prudential Vietnam is focused on driving sales quality, ensuring our products not only meet customer needs but also comply with the new Insurance Business Law. We are preparing to launch new life insurance solutions, committed to keeping customers at the heart of our development.”

“Additionally, in 2024, our flagship financial education program, Cha-Ching, reached over 32,000 Vietnamese students, bringing the total number of students in Cha-Ching schools to over 111,000. This is a meaningful contribution to fostering a generation with stronger financial knowledge.”

“With a high liquidity ratio of 193%, Prudential Vietnam is well-positioned to fulfill our insurance benefit payment commitments and ensure financial security for our customers. Through continuous innovation and a focus on sustainable growth, we are committed to accompanying our customers on their journey of protecting their hard-earned financial achievements.”

In 2024, with the official implementation of the Insurance Business Law, Prudential Vietnam continued to put customers at the heart of its business operations.

Through the application of technology, 87% of insurance claim requests were submitted online via the official Zalo page and the PRUOnline customer portal during the past year.

Prudential Vietnam remains committed to investing in technology-based innovations, including the utilization of artificial intelligence (AI) to optimize operations and enhance service efficiency, as evidenced by the following initiatives:

The ‘Independent Verification’ process was introduced to authenticate customers’ personal information and needs when purchasing insurance.

The ‘Insurance Pricing Tool’ was launched to help prospective customers choose protection plans that align with their financial capabilities.

The ‘Voice Recording’ process, integrated with AI generative technology, was implemented during the consultation process for all new customers to ensure alignment between their actual needs and the recommended protection solutions.

In 2024, Prudential Vietnam continued to initiate various initiatives to enhance the capabilities of its workforce by fostering a high-performance culture. Focused learning and development programs delivered 5,160 training hours to over 1,500 employees. The “Development Day” initiative was conducted with 7,980 self-study hours, including 4,567 hours of online self-study on the Udemy platform.

Regarding the Group’s business performance, Prudential made strides in executing its strategy to improve operational capabilities and drive growth in 2024. The Group recorded an 11% increase in new business profits and generated the expected $26.42 million in allocated surplus from operations. For 2025 and beyond, Prudential aims to continue building capabilities and strengthening its position for outstanding growth. Looking further ahead, by focusing on new business quality, effectively managing the in-force portfolio, and improving operational variables, Prudential is confident in achieving its financial and strategic goals by 2027 while creating sustainable value for shareholders and stakeholders across its Asia and Africa markets.

About Prudential Vietnam

Prudential Vietnam Life Insurance Company Limited (“Prudential Vietnam”) is a member of Prudential plc, which provides life insurance, health, and asset management solutions in 24 markets across Asia and Africa. Prudential is dedicated to being the most trusted and reliable partner and protector for today’s and future generations, offering accessible and simple financial and health solutions.

As of December 2024, Prudential had a charter capital of VND 7,698 billion and operated all types of life insurance businesses, serving millions of Vietnamese customers. The company has an extensive distribution and office network with over 250 offices and customer service centers nationwide, along with partnerships with seven banks.

With a strong commitment to innovation, digital transformation, and customer centricity, Prudential Vietnam continuously drives sustainable growth, enhances financial literacy through its exclusive financial education program, Cha-Ching, and provides diverse life insurance solutions to meet customer needs.

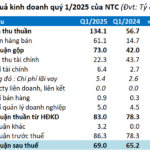

SIP Posts Highest Q1 Profit in 4 Years, Almost 50% of Annual Target

Saigon VRG Joint Stock Company (HOSE: SIP) has announced its Q1 2025 financial results, reporting a net profit of over VND 351 billion, a remarkable 43% increase from the same period last year and the highest since Q1 2021. This impressive performance marks a strong start to the year, with the company already nearing 50% of its annual profit plan.