Source: SCID

|

This is a project with a total investment of over 448 million USD, including over VND 198 billion from public issuance of shares – a plan implemented by SCID since 2013.

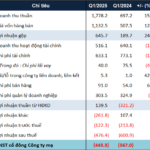

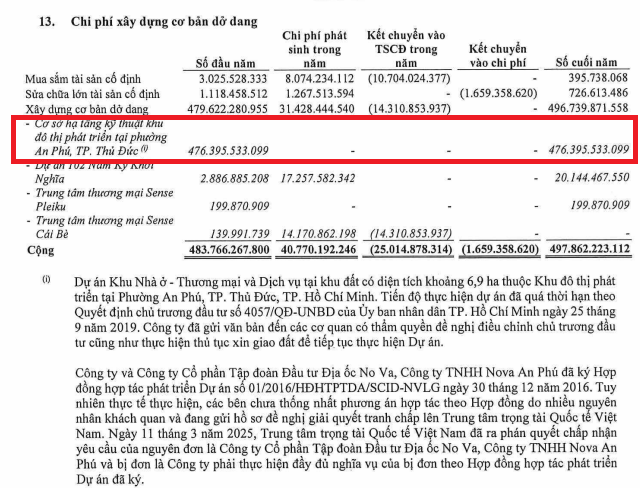

As of the end of Q1/2025, the Company recorded construction in progress of over VND 476 billion at this project.

SCID stated that the An Phu project covers an area of approximately 6.9 hectares in the urban development area of An Phu Ward, Thu Duc City, Ho Chi Minh City. The progress has exceeded the deadline according to the Decision on Investment Policy of Ho Chi Minh City People’s Committee dated September 25, 2019. SCID has sent documents to competent authorities requesting adjustments to the investment policy as well as land allocation to continue implementing the project.

SCID and Novaland (HOSE: NVL), and Nova An Phu Co., Ltd. (a subsidiary of Novaland) signed a project development cooperation contract on December 30, 2016. However, the parties have not yet agreed on the cooperation plan under the contract, which SCID explained was due to many objective reasons.

On March 11, 2025, the Vietnam International Arbitration Center (VIAC) issued a ruling accepting the request of the claimants, Novaland and Nova An Phu, and the respondent, SCID. Accordingly, the Company must fulfill the obligations of the respondent under the signed project development cooperation contract.

Source: SCID’s 2024 Consolidated Audited Financial Statements

|

Saigon Co.op An Phu Project in Thu Duc City

|

Out of 3 projects, only 1 remains, but it is still incomplete

In fact, the Company has prepared for the issuance of 25 million shares to the public in 2013, raising VND 255 billion to invest in 3 projects, including An Phu – Saigon Co.op Commercial Services and Housing with nearly VND 196 billion, Co.opmart in Cat Bi, Hai Phong with nearly VND 44 billion, and Co.opmart Supermarket in Vinh city with nearly VND 16 billion.

At the 2014 Annual General Meeting of Shareholders, SCID shareholders approved the transfer of investment capital in the linked companies investing in Saigon Co.op retail activities to the Saigon Cooperative Alliance. Accordingly, SCID transferred its investment capital in the Co.opmart Cat Bi project to Saigon Co.op, thus no longer investing in this project and transferring all remaining investment capital (disbursed nearly VND 41 billion and undisbursed nearly VND 3 billion) to invest in the large and key An Phu project.

At the 2016 Annual General Meeting of Shareholders, SCID shareholders approved the plan to use capital from the issuance for only 2 projects, namely An Phu with over VND 198 billion and Co.opmart Supermarket in Vinh city with nearly VND 16 billion.

However, for the Co.opmart Supermarket project in Vinh city, the partner who signed the cooperation contract with SCID to implement the project, BMC Trading and Construction Materials Company Limited, encountered legal obstacles in land procedures locally, so it could not hand over the site as scheduled. In 2022, SCID sued BMC and in 2023, the court approved the termination agreement, forcing BMC to pay principal and interest on late payment.

At the 2024 Annual General Meeting of Shareholders, the SCID Board of Directors submitted to the shareholders the content of not continuing to invest in this project, and the result was approved. Since then, the Company has only invested in the An Phu project based on the proceeds from the issuance.

However, since the last report on capital use progress in November 2023, SCID has not disbursed any additional funds for the project.

In the stock market, SID stock has attracted attention in recent sessions with strong price fluctuations. Most recently, in the session on May 7, the price of this stock fell to the floor price of 15% with only 500 matched orders, despite the previous session’s increase of more than 11%. Since the beginning of 2025, SID’s market price has increased by 18%.

SID plunged to the floor in the session on May 7, 2025 with only 500 matched orders – Source: VietstockFinance

|

Huy Khai

– 14:28 05/07/2025

The Dark Horse of Real Estate: Novaland’s Unexpected Loss in the First Quarter

According to its Q1 2025 consolidated financial statements, Novaland Group (Novaland, HOSE: NVL) recorded a consolidated revenue of over VND 1,778 billion, 2.5 times higher than the same period last year.

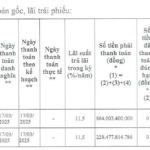

The Novaland Bond Debacle: Clarifying the Unpaid Bond Instalments Totalling VND 1,200 Billion

Two Novaland bond lots, with a total outstanding balance of over VND 1,200 billion, have defaulted on their payments. These bonds are secured by NVL shares, which have experienced a significant decline in value, impacting the bondholders’ ability to recover their investments. The situation has raised concerns among investors and highlights the risks associated with investing in high-yield bonds, particularly those backed by volatile assets.

What Proportion of Novaland’s Shares Are Held by the Group of Shareholders Related to Chairman Bui Thanh Nhon?

As of the end of 2024, the group of shareholders related to Chairman Bui Thanh Nhon held over 750 million NVL shares, equivalent to a 38.65% stake in Novaland. This significant ownership showcases a strong commitment to the company’s growth and a belief in its long-term success. With such a substantial stake, the group has a vested interest in ensuring Novaland’s prosperity and a bright future ahead.

The Heir Apparent’s New Move

“In a recent development, Bui Cao Nhat Quan, the son of Novaland’s Chairman Bui Thanh Nhon, has registered to sell over 2.9 million NVL shares for personal reasons. This news comes as Novaland faces the task of repaying two bond batches, totaling over VND 1,200 billion in principal and interest. As the company navigates these financial obligations, the sale of a significant number of shares by a key insider has sparked interest within the investment community.”

Unleashing the Potential: NVL Skyrockets as Obstacles Cleared for Ben Van Don Project

The shares of No Va Real Estate Investment Group (Novaland, HOSE: NVL) soared to the ceiling during the February 20th session, following the National Assembly’s issuance of a resolution on special mechanisms to address obstacles at the project located at 39-39B Ben Van Don, Ward 12, District 4, Ho Chi Minh City.