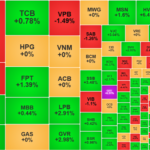

Today’s trading slowed down with liquidity declining and more stocks in the red. Yesterday’s enthusiastic uptrend persisted only in a few stocks, including FPT and LPB. These two stocks lack strong leadership, especially when other major stocks are also weakening.

This weakening trend is not necessarily negative; it merely confirms that enthusiasm unsupported by fundamentals is unlikely to be sustainable. With the primary information flow still centered around negotiation outcomes and other factors largely inconsequential, the market needs concrete data to alter its state. Otherwise, the oscillating range-bound situation persists.

While the VNI suggests a relatively robust market, the performance of individual stocks tells a different story. Numerous stocks are languishing after a swift recovery from the April sell-off. The strong stocks that surged early on are now plateauing at higher price levels. The index is just one reference point, and money flow is currently scattered. Even today’s best-performing stocks lack a distinct sectoral character.

The majority of stocks witnessed a sharp rise followed by weakness or a steep decline during the final trading session of the week. The highest prices were set in the first half of the session, mostly shortly after the market opened, but the momentum couldn’t be sustained, and weakness crept in. Apart from a few small-cap stocks that closed at the ceiling price with low liquidity, all other stocks slipped to some extent, including robust and high-liquidity stocks like FPT, CII, LPB, HSG, and VTP. Many stocks breached the reference price, indicating profit-taking and sellers’ willingness to lower prices, while low liquidity reflected buyers’ cautious attitude.

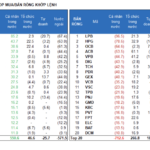

Yesterday’s liquidity surged to nearly 19.3k billion matched orders on the two exchanges, and today it dropped to nearly 16.7k billion, excluding negotiated trades. This is the average liquidity level for this period, and it’s not necessarily weak. The market is in a phase where there is no apparent upward momentum, but a significant downward move is also unlikely, so quick speculative opportunities are scarce. Long-term investors don’t perceive any significant risks that necessitate reducing their positions, either. Isolated speculative activities are unlikely to boost overall liquidity.

The market is currently in an information vacuum, with ‘antennae’ eagerly awaiting news on negotiation outcomes. This type of information is not easily disclosed or verified. The waiting game could extend for several more weeks. Hence, the plausible scenario remains range-bound oscillations with sporadic trading opportunities. Liquidity may continue to wane in the upcoming sessions.

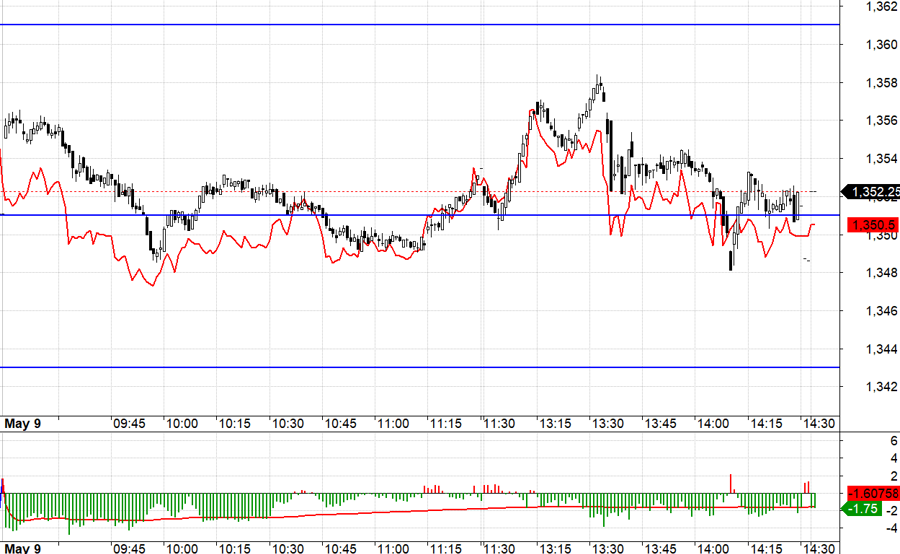

Today’s derivatives market was challenging due to the lack of prominent leading stocks and the tug-of-war among the major stocks, which neutralized momentum. When VIC, VHM, and banking stocks weakened, FPT and LPB’s strong performance had a limited impact. These two stocks’ afternoon surge was unexpected but failed to lift VN30 significantly. The index initially reacted positively to 1351.xx in the afternoon but rose only about seven points, excluding basis fluctuations. Their price retention time was brief, and other major stocks were weaker, resulting in VN30’s ambiguous oscillation. Long positions were ineffective, and short positions didn’t fare much better.

Given the current stagnant state, short-term opportunities in the spot market will diminish, and derivatives will become even more challenging unless there is intervention in the major stocks. There’s no need to force trades with unattractive risk/reward ratios.

VN30 closed today at 1352.25. The nearest resistance levels for the next session are 1361, 1371, 1377, 1384, and 1390. Support levels are 1351, 1343, 1335, 1330, 1321, 1317, and 1311.

“Blog chứng khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The views, interpretations, and opinions expressed herein are those of the individual author and do not necessarily reflect the views of VnEconomy or the author’s organization. VnEconomy and the author disclaim any responsibility for the consequences of decisions or commitments made based on the information or opinions contained herein.

Stock Market Blog: Navigating Low Liquidity

The market continued to exhibit small fluctuations today, and liquidity would have been low if not for the ETF restructuring. This is a positive sign as balance and low trading volumes indicate a healthy pause in the current phase.

What Was F88’s Business Model Before Going Public?

“F88, a familiar name in the industry, has officially become a public company and is preparing for its UPCoM listing. This significant move has sparked questions among investors and market observers alike: Is F88 truly ready for the stock market? With its transition into the public eye, F88 enters a new phase, inviting scrutiny and high expectations.”

“Stocks Slide as Selling Pressure Weakens, Blue-chips Rebound Ahead of Derivatives Expiry”

The market witnessed a positive shift in the afternoon session as selling pressure eased. Prices gradually climbed, especially after 2:15 pm when the VN30-Index calculations started influencing the final settlement prices. A steady ascent of blue-chip stocks propelled the VN-Index and VN30-Index to surpass the reference levels and close at their highest points for the day.

The Savvy Investor: When to Buckle Up and Ride the Profit Wave

Individual investors offloaded a net $9.4 million worth of stocks today, including $5 million in matched orders.