The market experienced a surprising reaction during this afternoon’s session, sparked by a price push in FPT. The convincing development saw strong buying interest, with foreign investors also returning to strong net buying, reversing the morning’s trading position. The matched order volume of the two exchanges rose to nearly VND 19.3k billion, which is very positive.

However, it is worth noting that FPT and SHB, the two stocks with the most impressive price breakthroughs in the afternoon session, contributed the most to this high liquidity. These two stocks accounted for about 13% of the total trading volume of the two exchanges and, notably, 54% of the increased liquidity in the afternoon session.

Nevertheless, it is undeniable that there was a significant difference in the amount of money flowing into the market today compared to the sluggish post-holiday trading. Strong buying and robust price gains are always positive signals, as such price and liquidity effects stem from proactive price increases. Even excluding the exceptional trading of FPT and SHB, liquidity still showed a substantial improvement.

The largest-cap stocks in the market today were not all equally strong. While VIC hit the ceiling price, BID, TCB, FPT, and HPG showed strength, and GAS followed suit. In contrast, VCB, VHM, and CTG performed averagely or even weakly as most other stocks advanced. VIC’s movement is typically driven by its story rather than the broader market sentiment. FPT witnessed its first explosive session after a sluggish trading period since mid-April. The VN30 is now clearly recovering from the free fall due to the counterparty tax issue and is just 1.88% below its pre-tax level (compared to 3.64% for the VNI), mainly due to VIC and VHM.

According to statistics, only six stocks in the VN30 basket have recovered and surpassed their April 2nd prices (the day before the counterparty tax news) – VIC, VRE, VHM, SHB, MWG, and STB. Up to 20 codes are still 2-20% lower than this reference price.

Today’s positive development confirmed the market’s wait-and-see attitude and its potential to react if supportive information emerges. Tax negotiations remain the dominant information flow. The dissemination of information like today’s was unofficial and already available before the trading session, to which the market showed no response in the morning. Therefore, this afternoon’s unexpected developments need further validation.

Nonetheless, a stronger market is always a positive development, and good stock positions continue to be profitable. This exciting development indicates that the bottom-fishing price range in April was extremely safe, at least in the scenario where there are no worse outcomes from the negotiations. Thus, the strategy should remain to hold stocks and ignore short-term fluctuations until official information about the tax negotiations is released.

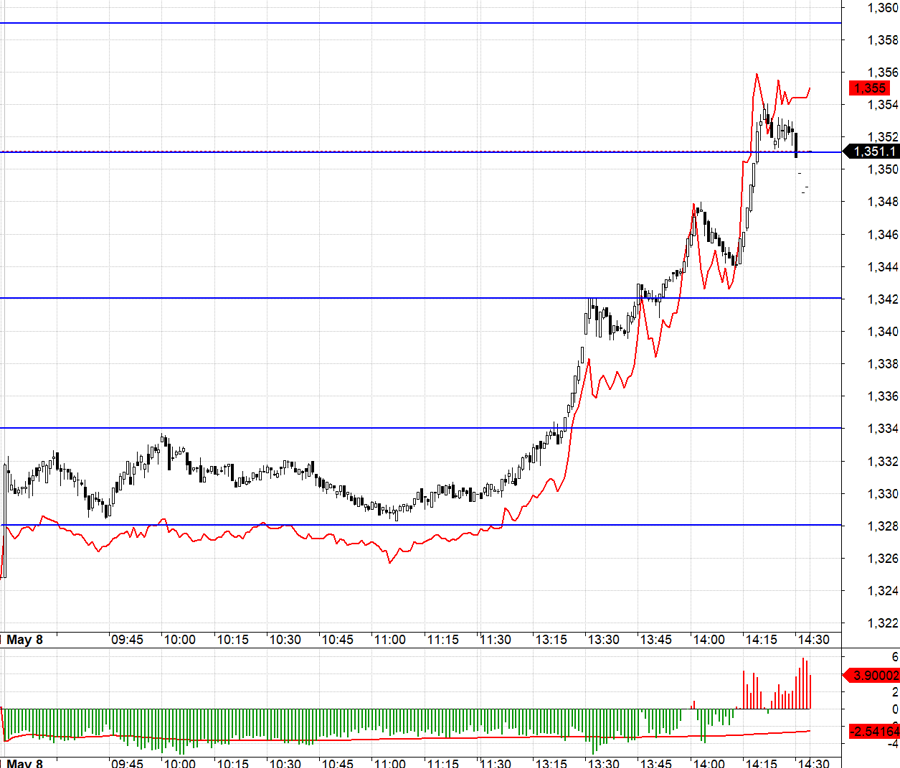

For most of today, the F1 futures contract accepted a discount, even though the VN30 remained green and fluctuated within a narrow range amid low liquidity. The main volatility zone effective in the morning was 1334.xx to 1328.xx. Things started to change in the afternoon session, and F1 showed a clear sign of basis cointegration. The Long point was good when the VN30 broke through 1334.xx for two reasons. First, all Short positions were wrong, and short-term trades would need adjustment once the VN30 surpassed the morning high, indicating a higher probability of further increases. Second, above 1334.xx is the VN30’s range expansion zone, with the nearest resistance at 1342.xx and then 1351.xx. While it was impossible to predict that FPT would be so strong and pull the entire VN30 basket up with high liquidity, trading is about taking calculated risks.

Today’s strong upward momentum was supported by money flow, but nothing is certain. Tomorrow will be a test to see if this sentiment persists. The strategy remains to hold stocks and flexibly Long/Short with derivatives.

VN30 closed at 1351.1, right at a milestone. The next resistance levels for tomorrow are 1361, 1368, 1376, 1384, 1389, and 1398. Supports are at 1343, 1334, 1329, 1321, and 1308.

“Blog Securities” reflects the personal perspective of the investor and does not represent the views of VnEconomy. The opinions and writing style belong to the investor, and VnEconomy respects this. VnEconomy and the author are not responsible for issues related to the investment opinions and perspectives presented in this blog.

The Market Tug-of-War: Heavyweight Stocks Hold the Line, Foreign Investors Surprise with Strong Buying

The VN-Index struggled to maintain its highs this morning as blue-chip stocks continued to diverge and weaken. Only 5 out of the top 10 largest capitalization codes increased, fortunately including VIC and GAS. Trading volume decreased by 10% compared to yesterday morning, with a balanced breadth confirming a tug-of-war state. A bright spot was that foreign investors unexpectedly net bought 367 billion VND after 16 consecutive net selling sessions.

The Ho Chi Minh Stock Exchange witnessed another day of net foreign buying, with VIC shares being the most accumulated.

The markets are buzzing with activity as intraday trading volume reaches a whopping 20.5 trillion VND. Foreign investors showed a keen interest, with a net buy of 246 billion VND, primarily accumulating VIC, MBB, HPG, MSN, DXG, CTG, and HCM stocks, while offloading VHM.

The Market Wary of Tariff Talks: Foreign Investors Turn Net Sellers

This morning, the market witnessed a significant cautious sentiment as preliminary and unofficial news regarding the first meeting on tariff issues was circulated. Despite an impressive surge in VIC, the second-largest market cap stock, the VN-Index fluctuated and posted a modest gain amid declining liquidity and a strong net sell-off by foreign investors.