The market saw a more positive session in the afternoon as selling pressure eased. Prices gradually rose, especially after 2:15 PM when the VN30-Index started to be calculated into the final settlement price. A string of blue-chip stocks continuously climbed, helping the VN-Index and VN30-Index turn positive and close at the session’s high.

Statistics showed that 26 out of 30 VN30 stocks rose in the afternoon compared to the morning session, with only four declining. VIC and VHM witnessed a rather impressive surge in the last 15 minutes of continuous trading. At 2:15 PM, VHM was even down 2.3% from the reference price, but it quickly rebounded to close 0.53% higher. VIC, at the same time, was up 1.62% but ended the day 4.57% higher.

Not only that, but other large-cap stocks also rallied simultaneously with the aforementioned two. For instance, FPT, which started the day flat, steadily climbed to close 1.39% higher. LPB also had an impressive performance, ending 2.91% higher, with a 2.6% gain in the last 15 minutes alone. If we consider the peak price in the final minutes of continuous trading, the gain was even more impressive at 5.67% compared to the reference price.

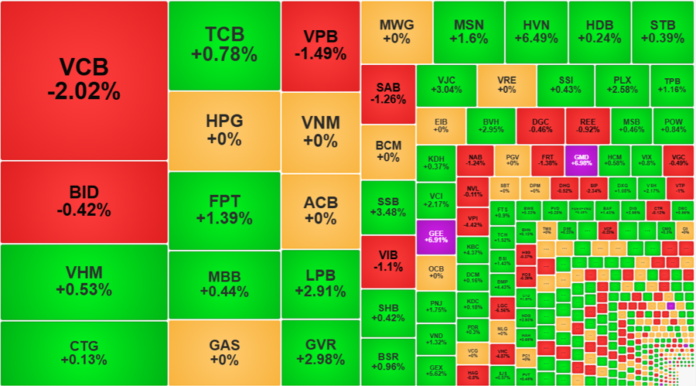

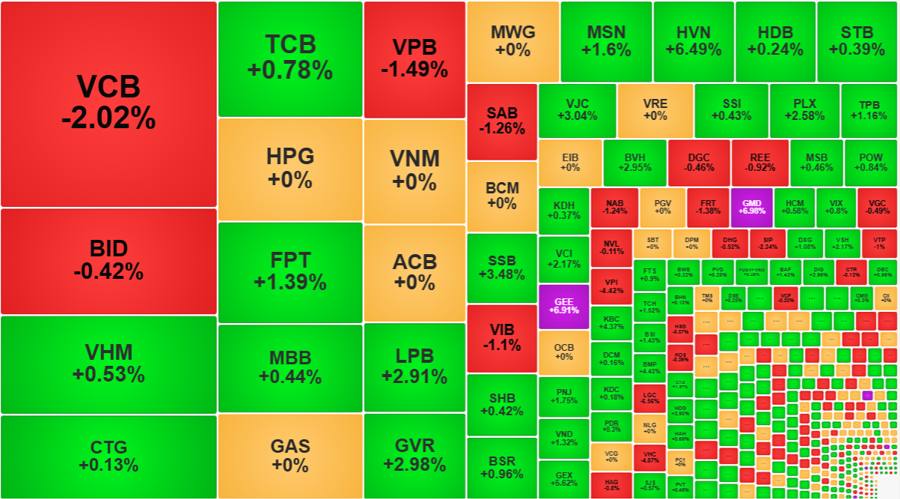

The VN30-Index closed at the session’s high, up 0.76% with 18 gainers and five losers. Compared to the morning session, the afternoon saw a higher price level (10 gainers and 19 losers). Ten stocks within the basket rose more than 1%, with seven of them gaining over 2%. Among the decliners, VCB fell 2.02%, VPB dropped 1.49%, SAB decreased by 1.26%, VIB lost 1.1%, and BID slipped 0.42%. VCB and VPB are among the top ten stocks by market capitalization in the VN-Index. VCB had a disappointing afternoon session, falling an additional 0.85% from its morning closing price. This stock, the largest by market capitalization in the market, dragged down the VN-Index by more than 1.6 points. If there had been better consensus among the large-cap stocks, the recovery momentum would have been even more impressive.

Nevertheless, thanks to the upward pull of the blue-chip stocks, most other stocks also improved. At its low around 2:15 PM, the VN-Index had 156 gainers and 285 losers, but by the close, there were 261 gainers and 174 losers. The fact that hundreds of stocks reversed their trends and turned positive indicates that the index’s rise was not solely due to a few large-cap stocks but also the participation of the majority.

As many as 110 stocks in the VN-Index ended the day more than 1% higher compared to the reference price, clearly showing the improved price level (there were only 43 such stocks in the morning session). Twenty of these stocks recorded trading volumes exceeding 100 billion VND, notably GMD and GEE, which hit the daily limit-up. In addition to strong blue-chips like FPT, VIC, and MSN, GEX stood out with a 5.62% gain, followed by VCI (+2.17%), KBC (+4.37%), DIG (+2.96%), HVN (+6.49%), and HHS (+6.19%).

It is also worth noting that liquidity did not improve significantly in the afternoon session. The HoSE floor only matched an additional 8,010 billion VND, a mere 3.7% increase compared to the morning session. The modest increase in liquidity, coupled with the rise in stock prices, suggests that selling pressure eased. Although investors raised their buying prices (hence the gradual price increase), they did not match many orders (resulting in low liquidity). Although this afternoon marked the expiration of derivatives contracts, which could have influenced blue-chip stocks, the low sell-side liquidity is still a positive sign.

On the downside, the effect of reduced selling pressure was also evident. Very few stocks witnessed deep declines with high liquidity. Trading was mainly concentrated in about 13 stocks with liquidity of over 10 billion VND and price declines of more than 1%. VPB, VCB, VIB, and VPI were the most actively sold, with trading volumes of hundreds of billion VND. However, other stocks had moderate to low liquidity and were not representative of the overall market.

Foreign investors recorded a sudden net selling in VIC in the afternoon, with a total net value of -4,446.3 billion VND. In the morning session, they had net bought VIC by about 53.3 billion VND. The total net selling value of foreign investors in the afternoon alone reached 4,410.5 billion VND. Thus, excluding the VIC transaction, foreign investors were relatively balanced.

The Ultimate Guide to VIX’s Ambitious Plans: Targeting Billion-Dollar Profits with a Massive Share Offering of 73 Million.

The upcoming 2025 Annual General Meeting of VIX Securities Joint Stock Company (HOSE: VIX) is set to take place on the morning of May 23, 2025, with a packed agenda. Notably, the company plans to present its ambitious pre-tax profit target of VND 1,500 billion and a post-tax profit of VND 1,200 billion. Additionally, they will propose the issuance of nearly 73 million shares as dividends for the year 2024 and seek approval for changes to the board of directors, including the exemption and election of a new member.

Trade Tax Talks Begin, Markets Await News With Bated Breath

The Vietnamese market cautiously welcomed the news of Vietnam initiating negotiations with the US on the evening of April 23rd. While it was expected that this would happen and the “scheduling” is a positive step, the market is essentially waiting for results. The balanced tug-of-war between buyers and sellers, coupled with a significant drop in liquidity, indicates that both sides are mostly observing for now.

“The Super Pillar” Returns: VN-Index Surges Past 1220 Points as Foreign Investors Turn Net Buyers

The morning’s trading conundrum continued for a few minutes into the afternoon session, culminating in an explosive surge. VIC and VHM, the prominent large-cap stocks, led the charge, propelling a host of other blue-chips to significant gains. The VN-Index closed above the crucial 1220-point mark, as foreign investors also unexpectedly ramped up their buying activity.

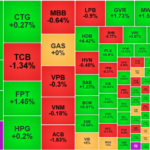

The Red Hot Electric Board: VN-Index Plunges Below the 1200-Point Mark, Foreigners Sell Off in the Highest 7 Sessions

The significant weakening of pillars, coupled with unfavorable developments in the international market, sent Vietnamese stocks into a sharp decline this morning. Investors tried to offload their positions, and while it didn’t quite turn into a panic sell-off, it still resulted in hundreds of stocks plunging. The VN-Index tumbled to 1,189.07 points…