Extraordinary General Meeting of TCH for FY 2025 was held on the morning of May 9th

|

Issuing nearly 200.5 million shares, 45% lower than market price

The Extraordinary General Meeting of TCH for FY 2025 has approved the plan to offer nearly 200.5 million shares to existing shareholders at a ratio of 10:3 (for every 10 shares held, shareholders are entitled to purchase 3 new shares) at a price of VND 10,000/share, which is 45% lower than the market closing price on May 8th, which stood at VND 18,150/share.

If successful, TCH‘s chartered capital will increase from over VND 6,682 billion to nearly VND 8,687 billion, equivalent to nearly 868.7 million shares. The issuance is expected to take place in 2025, after obtaining approval from the State Securities Commission.

Shareholders are allowed to transfer their purchase rights once during the specified period. The offered shares are not subject to transfer restrictions.

The expected proceeds from this offering amount to nearly VND 2,005 billion, which TCH plans to utilize as follows: VND 1.2 trillion will be prioritized for investment in the Hoang Huy Green River project, and the remaining amount of nearly VND 805 billion will be allocated to the Hoang Huy Commerce – H2 Tower project.

The Hoang Huy Green River new urban area project spans over 32.5 ha in Hoa Dong ward, Thuy Nguyen district, with a total investment of more than VND 4,050 billion. It comprises 780 landed houses, 447 social housing units, and other urban utilities. The project’s infrastructure has been substantially completed, and the first phase, consisting of 282 units that have been constructed up to the third floor, is expected to generate revenue from late 2025.

Regarding the Hoang Huy Commerce – H2 Tower project, it is located in Le Chan district and covers an area of nearly 1 ha. The project includes a 36-story apartment building with a total investment of nearly VND 2,200 billion. Currently, the construction has reached the first floor, and the company plans to launch sales within the next 1-2 months. The project is expected to be completed within 20 months, starting to generate revenue from 2026.

Mr. Do Huu Hung, Member of the Board of Directors and Vice President of TCH, affirmed that this capital increase has a reasonable allocation, accounting for approximately 30% of the total investment in the two projects, and will bring about high efficiency.

Accelerating Investments in Hai Phong

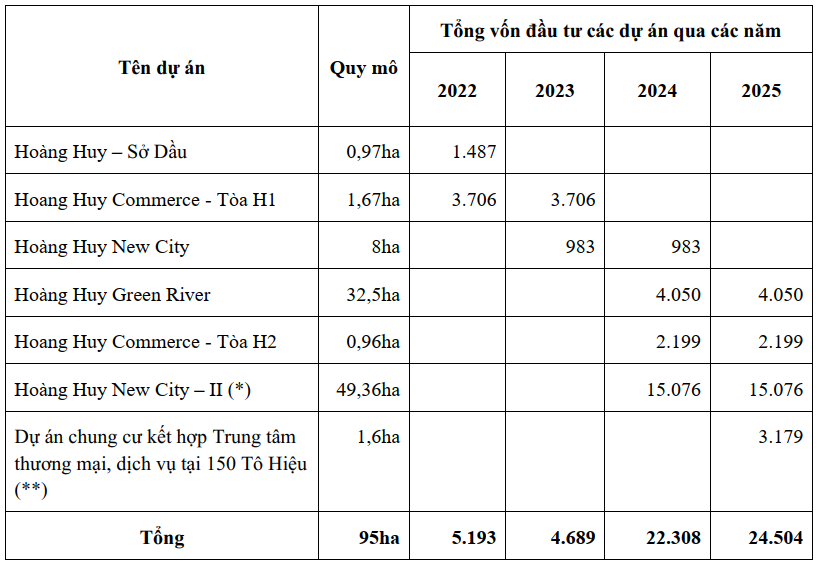

In addition to the aforementioned projects, TCH is simultaneously developing several large-scale projects in Hai Phong in 2025, with a total investment portfolio of approximately VND 24.5 trillion, nearly five times higher than in 2022.

Notably, the Hoang Huy New City phase 2 project, covering an area of nearly 49.4 ha, has a total investment of over VND 15,076 billion. It includes low-rise, villa, and high-rise apartment components. The company plans to launch sales for the low-rise segment this year, while the high-rise segment will be developed later due to its longer construction period. The first phase of New City (covering an area of 8 ha) has already been completed and handed over by TCH.

TCH is also working on a project that combines apartments with a commercial and service center at 150 To Hieu, covering an area of 1.6 ha. This project includes a 40-story building and 11 adjacent houses, with a total investment of VND 3,179 billion.

|

Summary of TCH‘s projects to be deployed in 2025

Source: TCH

|

Ms. Hoang Thi Huyen, General Director of TCH, stated that the capital needs during this peak investment period are significant. Meanwhile, the company’s chartered capital and owner’s equity have not increased proportionally with the scale of project development, making it necessary to mobilize additional financial resources to ensure the progress and efficiency of investments.

US Tariffs Have Minimal Impact on the Company

Regarding the impact of US tax policies, the General Director of TCH shared that the US’s increased import tariffs on certain products might affect businesses in the short term, but the impact on TCH is insignificant. This is because the company currently focuses on the domestic real estate sector.

Concerning automobile imports, Ms. Huyen stated that the company has experience in navigating exchange rate fluctuations during various periods. If the import tax from the US is reduced to 0% in the future, it will be advantageous for the company to increase profits in the automobile business segment.

Although the official business plan for FY 2025 has not been announced, Mr. Do Huu Hung revealed that revenue is expected to exceed VND 4 trillion, with after-tax profits ranging from VND 1.6 to 2 trillion.

“The company has ensured a growth rate of over 30% in revenue and profits for the next five years. With a 30% increase in capital, the company will still guarantee efficiency gains, so shareholders can rest assured and confident,” said Mr. Hung.

– 14:41 09/05/2025

The Green Urban Oasis in the Heart of Hong Bang District (Hai Phong)

Him Lam Central Park, an exquisite green urban development, made its highly anticipated debut on March 11th, 2025. With its entrance into the market, it has invigorated the real estate landscape of Hai Phong, setting the tone for an exciting year ahead.

“Proposed Discount Shopping Center in Ho Chi Minh City to Lure Tourists”

“Red tape is a significant hindrance to the growth and prosperity of Vietnam’s business community. This is according to the Chairman of the Business Association in Ho Chi Minh City, who highlights the cumbersome administrative procedures as a key issue facing enterprises today. The current bureaucratic red tape is stifling the dynamic and innovative spirit of businesses, hindering their ability to adapt, grow, and contribute to the country’s economic development.”

The Dark Horse of Real Estate: Novaland’s Unexpected Loss in the First Quarter

According to its Q1 2025 consolidated financial statements, Novaland Group (Novaland, HOSE: NVL) recorded a consolidated revenue of over VND 1,778 billion, 2.5 times higher than the same period last year.