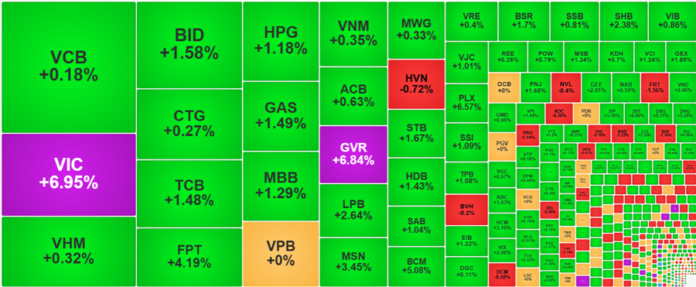

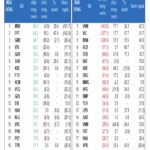

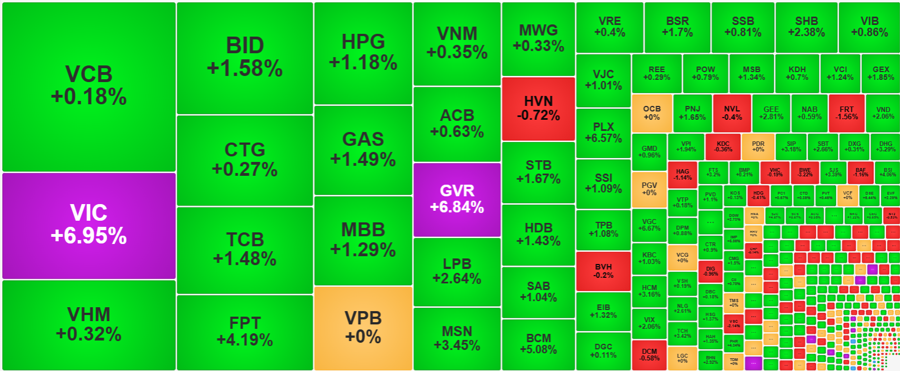

The lethargic morning trading session suddenly transformed just 15 minutes into the afternoon session. Several large-cap stocks, notably FPT, experienced a dramatic surge in volatility, triggering a frenzied wave of trading. HoSE’s trading volume soared by 66% compared to the morning session, resulting in VN-Index’s strongest gain in 16 sessions.

FPT’s market capitalization had significantly diminished after a decline of over 28% since the beginning of 2025, yet it still maintained its position within the Top 10 in the market (ranked 7th). FPT concluded the morning session with a 0.64% dip, but within the first 45 minutes of the afternoon session, it rebounded spectacularly, surging 4.47%. The stock ultimately closed 4.19% higher, contributing approximately 1.62 points to the VN-Index.

Remarkably, this rapid and robust ascent of FPT was propelled by a formidable influx of capital. The afternoon trading volume for FPT reached VND 1,170.6 billion, bringing the daily transaction value to VND 1,417.7 billion, the highest in the market. The majority of FPT’s matched orders today were from domestic investors, while foreign investors primarily engaged in negotiated trades, with a negligible net balance.

SHB, another prominent blue-chip stock, garnered attention despite exhibiting a less pronounced range compared to FPT. SHB concluded the morning session with a 0.79% loss but subsequently experienced a burst of activity, albeit at a slower pace than FPT. SHB peaked at 2:02 PM (FPT peaked at 1:45 PM), surging 3.97% above the reference price. However, it concluded the session slightly lower, ending 2.38% higher. Nevertheless, SHB’s trading volume was exceptionally impressive in the afternoon, reaching approximately VND 1,026.7 billion and bringing the daily transaction value to VND 1,142.8 billion.

The trend of surging alongside FPT was evident in several other stocks. Overall, the VN30 index exhibited a robust performance in the afternoon, with the majority of stocks registering gains. Only VPB witnessed a slight dip, retreating to the reference price. Aside from FPT and SHB, which made a striking impression, PLX also witnessed a substantial increase of 5.31% compared to the morning session, ultimately closing 6.57% higher. BCM, MSN, MWG, and VJC were other stocks that witnessed gains of over 2% in the afternoon session compared to the morning.

The VN30-Index concluded the day with a 1.99% gain, comprising 26 advancing stocks and only 1 declining stock. This marked a stark contrast to the lackluster morning session, which saw the index rise by merely 0.39% with 14 advancing stocks and 12 declining stocks. Among the VN30 constituents, 19 stocks witnessed gains of 1% or more, with VIC and GVR reaching their upper limits. The trading volume of the VN30 index in the afternoon session surged by 130% compared to the morning, confirming the robust inflow of capital that propelled the price ascent.

Expanding our perspective to the entire HoSE market, capital inflows were not confined to a few stocks like FPT and SHB. These two stocks accounted for only about half of the VN30 index’s trading value increase. The breadth of the index at the close was markedly different, with 219 advancing stocks and 89 declining stocks (compared to 158 advancing and 128 declining stocks at the morning close). The number of stocks advancing by over 1% skyrocketed to 132, compared to 70 in the morning session. The trading volume of this top-performing group accounted for 65.2% of the entire HoSE market.

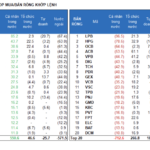

Naturally, blue-chip stocks dominated the list of stocks with the highest trading volume and gains exceeding 1%. Several mid-cap stocks also displayed robust performance: HCM rose 3.16% with a trading volume of VND 368 billion; VIX climbed 2.06% with VND 318.4 billion; GEX increased by 1.85% with VND 307.9 billion; KBC rose 1.03% with VND 237.2 billion; VCI advanced 1.24% with VND 215.9 billion; and TCH surged 3.42% with VND 213.6 billion…

Foreign investors also actively participated in the afternoon trading frenzy. Their total new buying value on HoSE skyrocketed by 147% compared to the morning session, reaching VND 2,111.8 billion. On the selling side, there was a modest increase of less than 5%, amounting to VND 1,390.1 billion, resulting in a net buy value of VND 721.7 billion. In contrast, during the morning session, foreign investors were net sellers, offloading VND 475.4 billion.

Notable stocks that witnessed substantial net buying included VIC (+VND 145.1 billion), MBB (+VND 119.6 billion), HPG (+VND 102.8 billion), MSN (+VND 72.4 billion), DXG (+VND 65.5 billion), CTG (+VND 64.5 billion), HCM (+VND 64 billion), and STB (+VND 53.1 billion). On the net selling side, VHM (-VND 282.7 billion), VCB (-VND 60.1 billion), SSI (-VND 51.8 billion), VRE (-VND 48.5 billion), and VPB (-VND 48.2 billion) stood out.

Today’s gain of 19.43 points propelled the VN-Index back above the 1269.8-point level. Prior to the market collapse triggered by the countervailing tax news, the index stood at 1317.83 points. Consequently, the gap has narrowed to just 48 points or 3.64%. This deficit is not insurmountable, considering the market’s resilient recovery efforts in the first four sessions of April, which recouped nearly 224 points.

“Stocks Slide as Selling Pressure Weakens, Blue-chips Rebound Ahead of Derivatives Expiry”

The market witnessed a positive shift in the afternoon session as selling pressure eased. Prices gradually climbed, especially after 2:15 pm when the VN30-Index calculations started influencing the final settlement prices. A steady ascent of blue-chip stocks propelled the VN-Index and VN30-Index to surpass the reference levels and close at their highest points for the day.

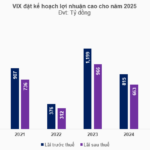

The Ultimate Guide to VIX’s Ambitious Plans: Targeting Billion-Dollar Profits with a Massive Share Offering of 73 Million.

The upcoming 2025 Annual General Meeting of VIX Securities Joint Stock Company (HOSE: VIX) is set to take place on the morning of May 23, 2025, with a packed agenda. Notably, the company plans to present its ambitious pre-tax profit target of VND 1,500 billion and a post-tax profit of VND 1,200 billion. Additionally, they will propose the issuance of nearly 73 million shares as dividends for the year 2024 and seek approval for changes to the board of directors, including the exemption and election of a new member.

Trade Tax Talks Begin, Markets Await News With Bated Breath

The Vietnamese market cautiously welcomed the news of Vietnam initiating negotiations with the US on the evening of April 23rd. While it was expected that this would happen and the “scheduling” is a positive step, the market is essentially waiting for results. The balanced tug-of-war between buyers and sellers, coupled with a significant drop in liquidity, indicates that both sides are mostly observing for now.