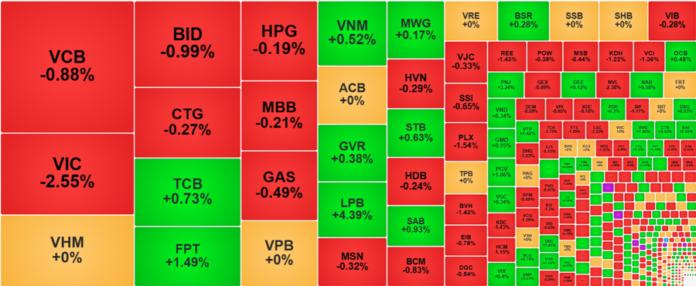

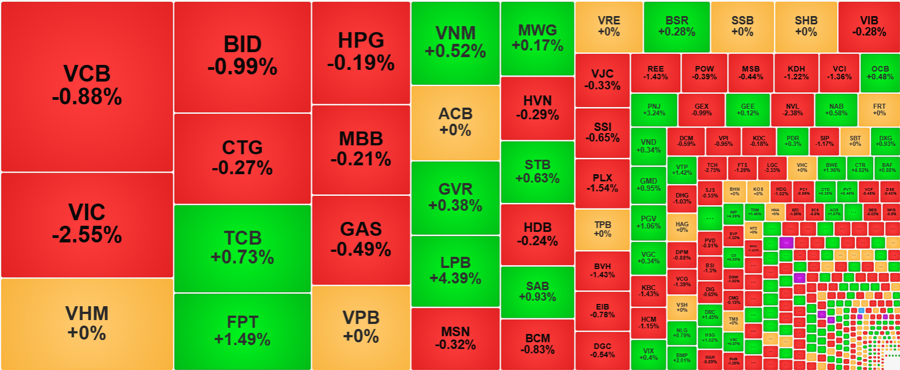

The VN-Index witnessed a sharp decline today, with VIC’s reversal dealing a blow to yesterday’s enthusiasm. While FPT and LPB emerged as notable performers, with LPB displaying considerable strength, its limited market capitalization meant it couldn’t serve as a pillar of support for the index. Additionally, investor sentiment turned notably cautious, as the market breadth tilted towards decliners and trading volume dropped by 13%.

The VN-Index managed to stay in positive territory during the early minutes of the trading session, with gains peaking at approximately 5.8 points. This coincided with VIC’s strong performance, as the stock reached its intraday high within the first two minutes of trading, surging by 3.06% compared to the previous close. However, the remainder of the session saw VIC undergo a significant correction, eventually closing 2.55% lower. This marked the most substantial adjustment in a recent string of nine consecutive gains, during which VIC had rallied by nearly 34%.

FPT and LPB attempted to counterbalance the decline in VIC. Both stocks staged a robust recovery during the afternoon session, moving in the opposite direction of VIC’s downward spiral. LPB stood out with its impressive performance, surging by 4.44% within a 20-minute period starting at 1:15 PM and ultimately closing 4.39% higher. LPB’s trading volume was also the highest in seven sessions, reaching nearly VND 170.1 billion. However, due to LPB’s relatively small market capitalization in the VN-Index, its impact on the index was limited to just over one point. FPT, on the other hand, experienced a strong upward momentum during the first 20 minutes of the afternoon session as well, erasing its 0.44% loss from the morning session and climbing 1.84% by 1:20 PM. It closed the day 1.7% higher than the previous close. Given that FPT’s market capitalization is one and a half times larger than LPB’s, its contribution to the VN-Index was approximately 0.6 points, despite its less impressive percentage gain.

Despite the strong showing from FPT and LPB, they stood alone in their efforts. Out of the 30 stocks in the VN30 basket, only eight managed to close in positive territory, while 15 finished in the red. Among the decliners were prominent stocks such as VIC, VCB, BID, CTG, HPG, MBB, and GAS. Within the top 10 stocks by market capitalization on the HoSE, only two—FPT and TCB—managed to stay in the green, while seven ended in the red.

The performance of FPT and LPB was reflected in the VN30-Index, which managed to eke out a gain of 1.15 points despite the extremely narrow market breadth. However, the afternoon session witnessed an increase in selling pressure within the VN30 basket, as the trading value rose by 45% compared to the morning session, but 15 stocks suffered declines, while only nine advanced. Throughout the session, all stocks in the basket experienced downward pressure, with half of them (15 stocks) falling by more than 1% from their intraday highs.

A broader look at the HoSE also revealed a weakening in buying sentiment, while sellers were more eager to offload their holdings. The market breadth at the end of the day stood at 130 decliners versus 173 advancers. The real estate and securities sectors bore the brunt of the selling pressure, with numerous stocks experiencing sharp declines alongside high trading volumes. Notable examples include VIC, which fell by 2.55% with a trading volume of VND 548.7 billion; NVL, down 2.38% with a volume of 299.2 billion; TCH, declining by 2.75% with a volume of 276.6 billion; VCG, dropping by 1.39% with a volume of 250.4 billion; VCI, slipping by 1.36% with a volume of 192.1 billion; HCM, down 1.15% with a volume of 187.5 billion; KBC, falling by 1.43% with a volume of 122.9 billion; and HHV, declining by 1.23% with a volume of 98.5 billion…

On the flip side, while there were several strong gainers, they lacked sector-specific characteristics. It appeared that money flowed independently and individually rather than following sector trends. Notable stocks that attracted substantial buying interest and rose by more than 1% include FPT, up 1.49% with a trading volume of VND 998 billion; CII, climbing by 3.08% with a volume of 344.5 billion; DBC, advancing by 1.45% with a volume of 203 billion; PNJ, surging by 3.24% with a volume of 154.8 billion; CTR, rising by 4.82% with a volume of 121.5 billion; and HSG, ticking up by 1.02% with a volume of 100.5 billion.

The market witnessed a pullback in liquidity, with the matched trading volume on the two exchanges falling by 13.4% compared to the previous day, reaching VND 16,690 billion. This cautious sentiment could be attributed to the circulation of information refuting the preliminary negotiation content that had been disseminated the day before. Moreover, many stocks, including pillar stocks like VIC, had already witnessed substantial gains over the short term, prompting profit-taking activities and making buyers more hesitant to step in.

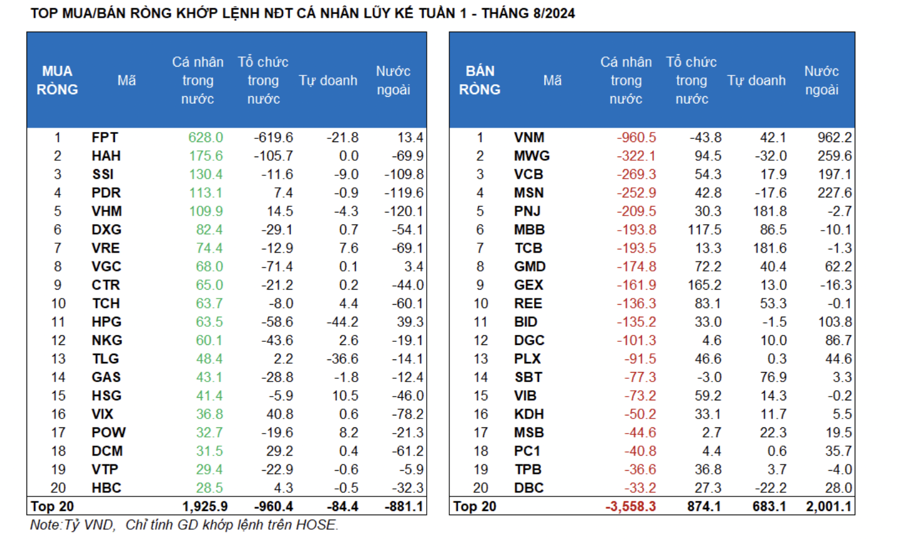

Foreign investors recorded a slight net sell position on the HoSE today, amounting to VND 88 billion. However, their buying activities improved during the afternoon session, resulting in a net buy position of VND 249.6 billion, compared to a net sell position of VND 337.8 billion in the morning session. The stocks that witnessed the largest net sell positions were VCB, with VND 184.5 billion; VHM, with VND 133.7 billion; NVL, with VND 90.4 billion; SSI, with VND 67.1 billion; VCG, with VND 67 billion; VPB, with VND 57.3 billion; VCI, with VND 32.4 billion; and VNM, with VND 32 billion. On the other hand, the stocks that attracted the largest net buy positions were FPT, with VND 70.1 billion; MBB, with VND 64.1 billion; HPG, with VND 62.1 billion; PNJ, with VND 60.5 billion; DXG, with VND 59.6 billion; MSN, with VND 49.7 billion; and NLG, with VND 48 billion.

Stock Market Insights: Unleashing the Power Within

The market witnessed a surprising turnaround in the afternoon session, triggered by a price surge in FPT. Convincingly, the session saw strong buying power and a significant reversal in foreign investors’ net buying position compared to the morning session. The matched liquidity of the two floors rose to a healthy VND 19.3k billion.

The Market Tug-of-War: Heavyweight Stocks Hold the Line, Foreign Investors Surprise with Strong Buying

The VN-Index struggled to maintain its highs this morning as blue-chip stocks continued to diverge and weaken. Only 5 out of the top 10 largest capitalization codes increased, fortunately including VIC and GAS. Trading volume decreased by 10% compared to yesterday morning, with a balanced breadth confirming a tug-of-war state. A bright spot was that foreign investors unexpectedly net bought 367 billion VND after 16 consecutive net selling sessions.

The Market Wary of Tariff Talks: Foreign Investors Turn Net Sellers

This morning, the market witnessed a significant cautious sentiment as preliminary and unofficial news regarding the first meeting on tariff issues was circulated. Despite an impressive surge in VIC, the second-largest market cap stock, the VN-Index fluctuated and posted a modest gain amid declining liquidity and a strong net sell-off by foreign investors.

The Big Money Rush: Stocks Soar as VN-Index Recovers from Tariff Trauma

The lethargic morning trading pace took an unexpected turn within the first 15 minutes of the afternoon session. Leading stocks, notably FPT, witnessed a dramatic surge in volume, swiftly triggering a frenzied buying spree. HoSE’s afternoon matching volume skyrocketed by 66% compared to the morning session, with the VN-Index closing at its strongest gain in 16 sessions.

“Stocks Slide as Selling Pressure Weakens, Blue-chips Rebound Ahead of Derivatives Expiry”

The market witnessed a positive shift in the afternoon session as selling pressure eased. Prices gradually climbed, especially after 2:15 pm when the VN30-Index calculations started influencing the final settlement prices. A steady ascent of blue-chip stocks propelled the VN-Index and VN30-Index to surpass the reference levels and close at their highest points for the day.