The past two years have witnessed significant turbulence in the Vietnamese banking industry, as the impact of the US Federal Reserve’s monetary tightening policies reverberated widely. The Fed’s consecutive interest rate hikes prompted capital outflows from emerging markets, including Vietnam. This not only exerted pressure on liquidity but also increased funding costs for domestic banks. In this context, banks had to implement flexible solutions to stabilize capital sources, with the issuance of securities being a crucial option.

Another significant challenge for the banking industry is that a large portion of mobilized capital is short-term. This makes it difficult for banks to maintain financial safety ratios such as the ratio of short-term capital for medium and long-term loans and the loan-to-deposit ratio (LDR). As banks accelerated credit growth to meet the post-pandemic economic recovery demands, maintaining a balance between credit growth and capital structure became a complex equation. To address this issue, banks had to intensify long-term capital mobilization through the issuance of securities.

Banks ramped up the issuance of securities

Since the second half of 2022, total outstanding loans in the economy surpassed total mobilization for the first time. This trend continued into 2023, with a gap of nearly VND 800 trillion as of August. Limited capital in the context of rising credit growth pushed the industry-wide LDR upward in recent years. According to data, the industry LDR increased from 74.35% at the end of 2022 to 78.25% by mid-2024. State-owned commercial banks and joint-stock commercial banks were the two groups with the most significant LDR increases, as they were also the main drivers of credit growth in the system.

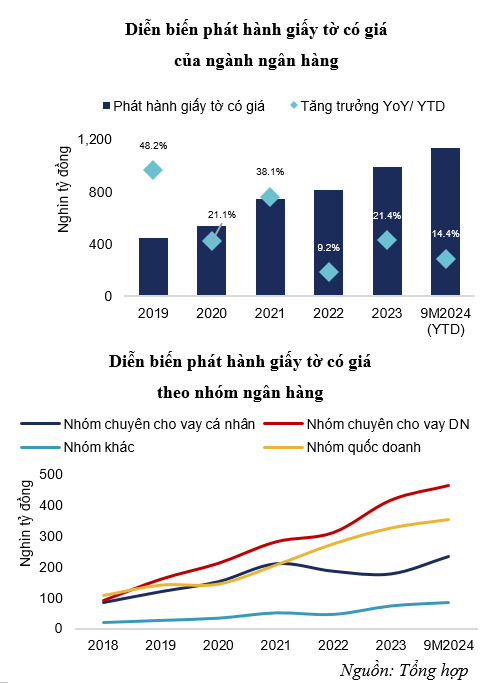

Faced with capital structure pressures, banks intensified the issuance of long-term securities, including bonds and certificates of deposit. Financial reports from 27 listed banks showed that the total value of securities issued by the banking industry grew by approximately 21% in 2023, and by 14.4% year-to-date in 2024 compared to the previous year-end. In 2023 alone, the value of bank bond issuance reached nearly VND 175 trillion, accounting for a large proportion of total long-term mobilized capital. As of Q3 2024, the cumulative increase reached VND 142.5 trillion, bringing the total value of securities issued by the banking industry to VND 1,130 trillion. According to VBMA, as of late October, banks issued nearly VND 240 trillion in bonds, accounting for 72% of the total new issuance value in 2024. If banks maintain the same issuance pace in Q4 as in the previous three quarters, the cumulative increase for the year is expected to reach nearly VND 190 trillion, equivalent to a 45% year-over-year increase—the highest growth rate in the last five years.

|

Chart 1: Trends in Securities Issuance by the Banking Industry

|

Overall, the trend in securities issuance has been upward across most bank groups. The group specializing in corporate lending demonstrated a more substantial increase in the past two years. In 2023, this group increased its securities issuance by VND 105,120 billion, equivalent to a 33.8% rise compared to the end of 2022. In 2024, the cumulative additional issuance value for the first three quarters reached VND 47,275 billion, representing an 11.4% increase over the previous year-end. This development occurred against the backdrop of this group achieving the highest system-wide LDR increase, indicating the approach these banks are taking to maintain prudent lending ratios and supplement capital in the face of slow customer deposit growth, which increased cumulatively by 8.9% this year compared to a 14.6% rise in credit.

The group of banks specializing in personal lending recorded the highest securities issuance from the beginning of the year to date. The situation where credit growth outpaced deposit growth was also a reason for banks to strengthen capital supplementation through securities issuance. Despite a slight decline in 2023 compared to 2022, this group of banks showed a VND 56,952 billion increase in securities issuance in just the first nine months of 2024, equivalent to a 32% cumulative increase. The state-owned bank group and the “other banks” group recorded cumulative growth rates of 8.4% and 15.2%, respectively. Compared to the two private bank groups mentioned earlier, these two groups had lower deposit growth rates and significantly higher LDRs.

Securities Issuance Activities of Banks

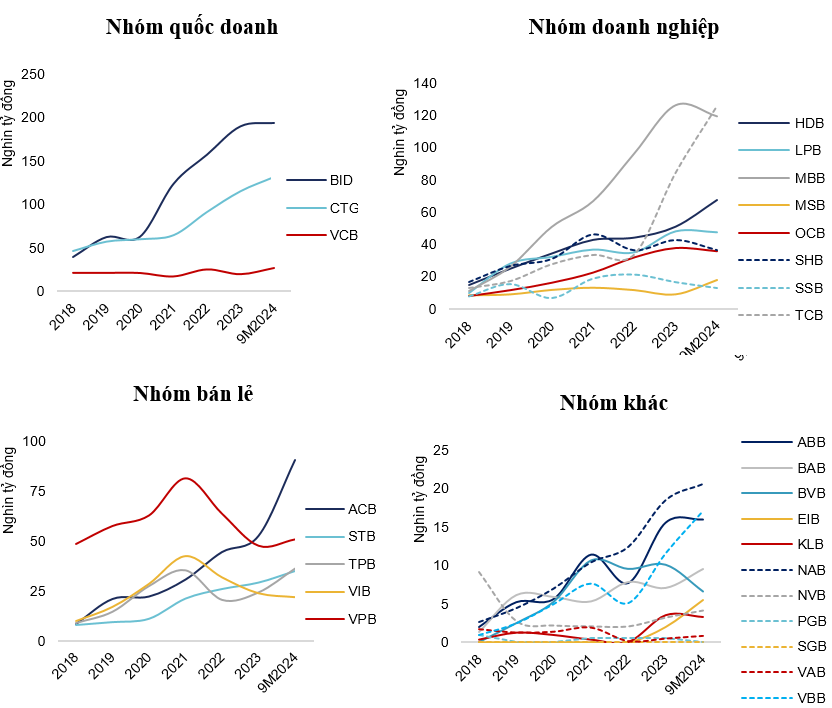

The widening gap between credit growth and deposit growth rates underscores the necessity of securities issuance to meet capital adequacy requirements. In the state-owned bank group, BID and CTG substantially increased capital supplementation through securities issuance in 2023, with increments of VND 32,435 billion and VND 24,000 billion, respectively, equivalent to growth rates of 20-25%. In 2024, their securities issuance remained relatively stable. Conversely, VCB’s securities issuance scale was more consistent in previous years but showed signs of acceleration this year. Specifically, as of Q3 2024, VCB issued nearly VND 7 trillion, a 35% increase over the previous year-end. According to VBMA, VCB approved a plan to privately place green bonds in 2024, with a maximum total value of VND 2 trillion, a face value of VND 1 billion per bond, and a two-year term.

|

Chart 2: Securities Issuance by Banks

|

In the group of banks specializing in corporate lending, MBB and TCB demonstrated significant increases in the scale of securities issuance. In 2023, MBB issued 12 bond lots, mobilizing VND 3,449 billion. Additionally, the MBB Board of Directors approved a plan in October to issue additional Tier 2 capital-raising bonds in 2024-2025 through private placement. The plan includes issuing 30,000 bonds in up to 50 tranches, equivalent to a total issuance value of VND 3,000 billion, with bond maturities ranging from five to ten years. Alongside MBB, TCB also recorded a substantial increase in the scale of securities issuance, equivalent to a rise of more than VND 41 trillion as of Q3 2024. Accordingly, in late September, TCB issued a total of five bond lots to the market, with a total value of VND 9,700 billion and maturities of two to three years, intending to supplement capital for lending to customers.

The group specializing in personal lending exhibited some differentiation. The trend of increasing securities issuance this year was more prominent among banks experiencing high credit growth. ACB, for instance, expanded its securities issuance by 72.4% compared to the beginning of the year, equivalent to an additional VND 37,956 billion. This issuance reflects ACB’s urgent capital supplementation pressure, as its customer lending exceeded deposits by approximately VND 42,700 billion. These securities were primarily bonds with maturities ranging from two to five years. TPBank also conducted several bond issuance tranches this year, most recently issuing bonds worth VND 38.4 billion on November 19.

Finally, in the “other banks” group, there was differentiation in bond issuance among banks, depending on their growth rates. NAB and VBB, which accelerated credit growth in the past period, were among the banks that expedited bond issuance. Meanwhile, EIB and VAB focused on strengthening equity capital as credit growth improved this year. EIB has a plan to privately place bonds in Q4 2024, with a maximum total value of VND 3 trillion and a three-year term.

As credit growth remains robust, the banking industry strives to balance credit growth and long-term capital mobilization. Securities issuance has helped banks alleviate liquidity pressure and maintain financial safety ratios. However, rapid capital strengthening in the short term can exert pressure on funding costs and compress NIMs. With the banking sector’s substantial capital requirements, absorption through securities issuance is not straightforward, necessitating more flexible strategies to ensure stability and sustainable development in the future.

The Capital Injection Conundrum: Why Are Businesses Still Struggling to Secure Loans Despite Banks’ Efforts?

The banking sector injected nearly VND 200,000 billion into the economy in the first few months of the year, yet businesses still cry out for easier access to this capital. Experts assert that directing this bank funding towards businesses requires a harmonious interplay between governing policies, strategic banking initiatives, and proactive enterprise from businesses themselves.

The Central Bank Injects an Additional 164 Trillion VND into the Economy Since the Lunar New Year of 2025

According to estimates released by the State Bank of Vietnam, the credit scale of the entire banking system as of March 12 reached VND 15,810 trillion, an increase of nearly VND 194 trillion compared to the end of 2024, and a further VND 164 trillion surge since the Lunar New Year.

The Latest Credit Growth Figures: Unveiling the Banking System’s Performance

“The banking sector is off to a strong start this year, with credit growth outpacing that of the previous year. According to Vice Governor of the State Bank of Vietnam, Pham Thanh Ha, as of March 12, credit growth in the banking system had increased by 1.24% compared to the end of 2024, indicating a significant improvement.”